FX analysis – Euro lower ahead of PMIs – AUD, JPY and Gold stumble higher

23 August 2023USD was mostly firmer in Tuesday’s session as a mixed equity markets saw some slight risk-off conditions. Also support USD was rates markets shifting hawkishly (September meeting now pricing a 16% chance of a hike) ahead of Jackson Hole and Fed Chair Powell speaking on Friday. Fed member Barkin spoke but added little new, as he noted consumer spending and economic strength make it possible the US economy could reaccelerate before inflation cools. DXY hit a high of 103.710, pushing slightly above July and last week’s high and resistance area after testing support at 103.00 earlier in the session.

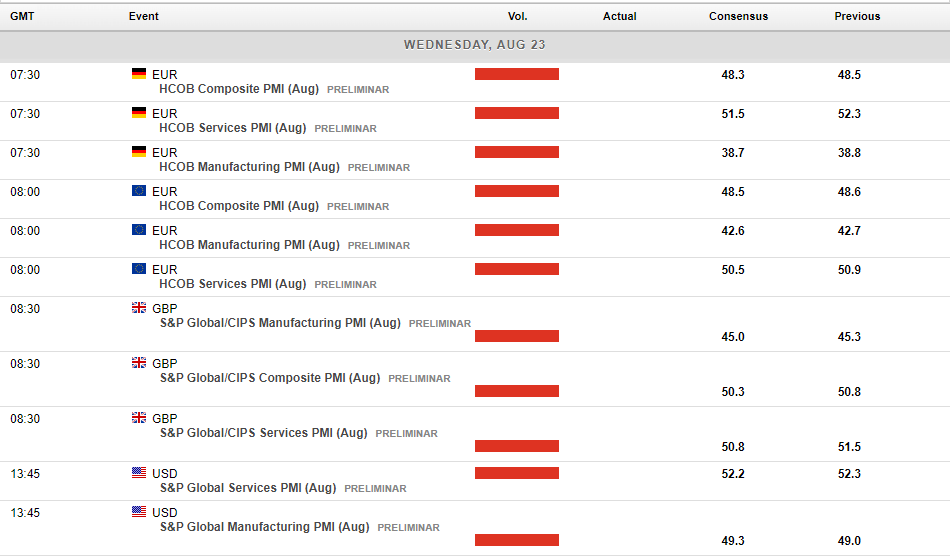

EUR and GBP were both lower against the USD to varying degrees, EUR was the G10 underperformer with EURUSD hitting a low of 1.0834 and EURGBP testing the bottom of its recent range and major support at 0.8500. Both EUR and GBP traders have key PMI figures to navigate today, with readings in manufacturing and services for both currencies.

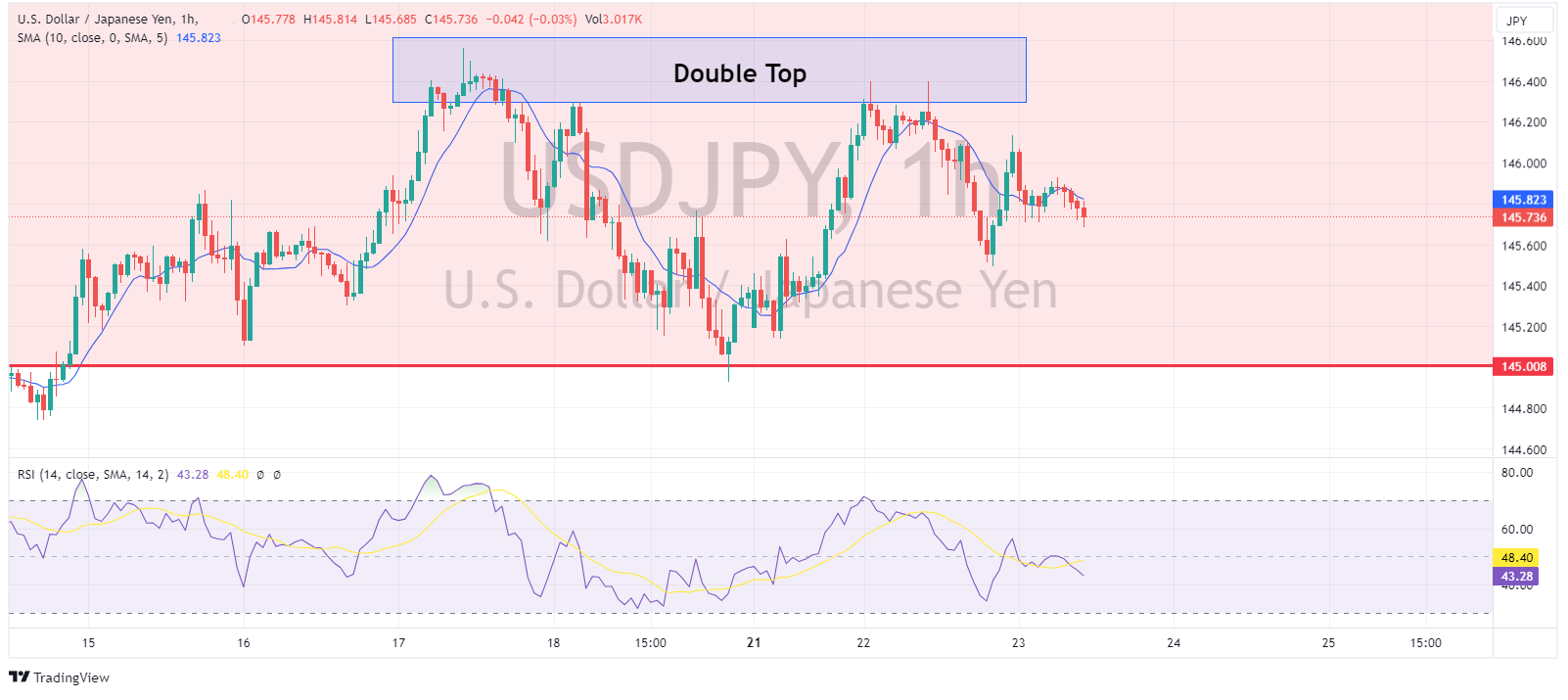

AUD, NZD and JPY were all firmer against the USD, with NZD outperforming, seeing AUDNZD dip below the psychological 1.0800 level briefly. Both NZDUSD and AUDUSD managed to hold their major support levels at 0.5900 and 0.6400 respectively. With Kiwi and Aussie traders having NZ retail sales and Australian flash PMIs to look forward to today. USDJPY dropped 146.00, trading in a range between 146.39-145.50 ahead of Japan’s preliminary PMIs, JPY supported by a double top and forming in USDJPY.

Despite overall USD strength, with some help from a soured risk sentiment, XAUUSD attempted to retake the 1902 resistance/support level. The move however was strongly rebuked as sellers entered the market at that key level, holding XAUUSD in its 2-week range.

Todays Calendar:

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice.

Next Article

EURUSD tests near term support

After reaching the high of 1.1250, last tested in 2022, the EURUSD has been trading steadily lower and currently sits along the 1.0850 support level, formed by the 61.8% Fibonacci retracement level and the previous swing low from early July. Looking at the technical aspects, the Ichimoku cloud indicates continued bearish pressures, with the top ...

Previous Article

Asian Open FX Analysis – EUR, JPY, AUD, USD

Despite runaway US treasury yields which saw 10-year yields hit their highest level since 2007, the USD was flat in Monday’s session as it seems imp...