- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Share CFDs

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Share CFDs

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & Analysis

- Forex

- Asian Open FX Analysis – EUR, JPY, AUD, USD

News & AnalysisDespite runaway US treasury yields which saw 10-year yields hit their highest level since 2007, the USD was flat in Monday’s session as it seems improved risk sentiment and a technically overbought Dollar Index (DXY)held it in check. DXY traded within a tight range with a low of 103.13 and a high of 103.50, where it was again rejected at the major resistance set at the July and August to date highs. USD traders focus today will be on FedSpeak from Bowman, Goolsbee, and Barkin whose comments will be closely watched ahead of Jackson Hole later in the week.

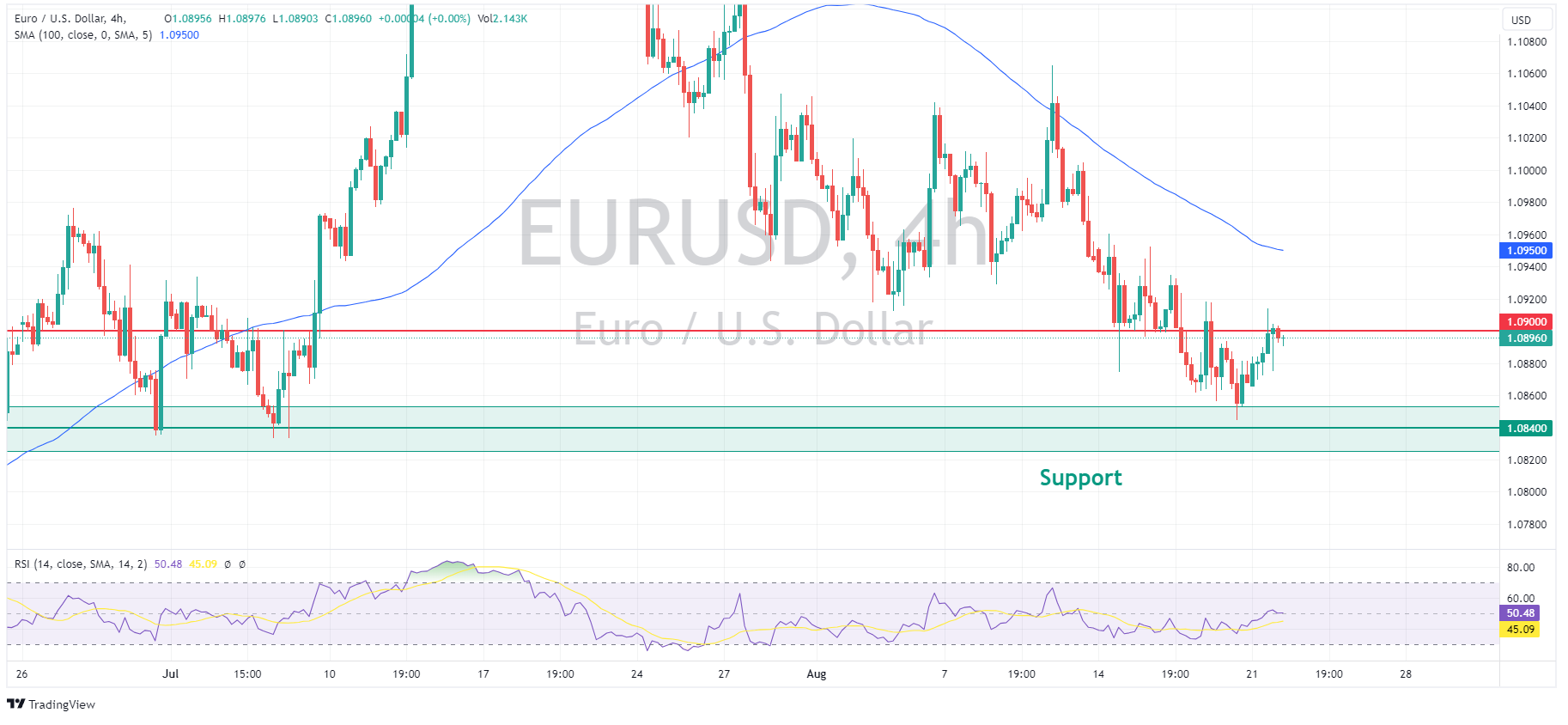

EUR was the outperforming major currency, with EURUSD pushing hard to reclaim the psychological 1.09 level but failing to hold convincingly above. Another headline to hit the wires was HSBC giving a bullish take on the EUR “in part built on the idea of upside for the EUR from overly dovish rate expectations for the ECB”. They noted that while headline inflation figures are cooling, core inflation is proving stickier.

JPY resumed its march lower on Monday, reversing its 2-day rally from late last week. The jump higher in US yields saw carry traders back in action taking the USDJPY back above 146.00 from lows of 145.15. A note from JP Morgan stated that they believe the MoF will not intervene in the FX market at around 145 level as they did previously, with JPM analysts believing the threshold level for BoJ intervention being around 150 level.

AUD and NZD saw marginal gains vs the USD with the Kiwi the lagging vs the Aussie after New Zealand trade figures showed a deficit of 1.1bln in July, vs the prior surplus of 9mln. AUDUSD reclaimed the big figure at 0.6400, AUDNZD holding above the key 1.0800 level. A quiet calendar ahead today for both AUD and NZD, with general market sentiment likely to be the main drivers in price action for the rest of the week.

Ready to start trading?

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice.

Next Article

FX analysis – Euro lower ahead of PMIs – AUD, JPY and Gold stumble higher

USD was mostly firmer in Tuesday’s session as a mixed equity markets saw some slight risk-off conditions. Also support USD was rates markets shifting hawkishly (September meeting now pricing a 16% chance of a hike) ahead of Jackson Hole and Fed Chair Powell speaking on Friday. Fed member Barkin spoke but added little new, as he noted consumer spe...

August 23, 2023Read More >Previous Article

Entries for longer-term stock investment approaches can be based on either long-term technical trends or more commonly, fundamental data related to a ...

August 21, 2023Read More >Please share your location to continue.

Check our help guide for more info.