EURUSD tests near term support

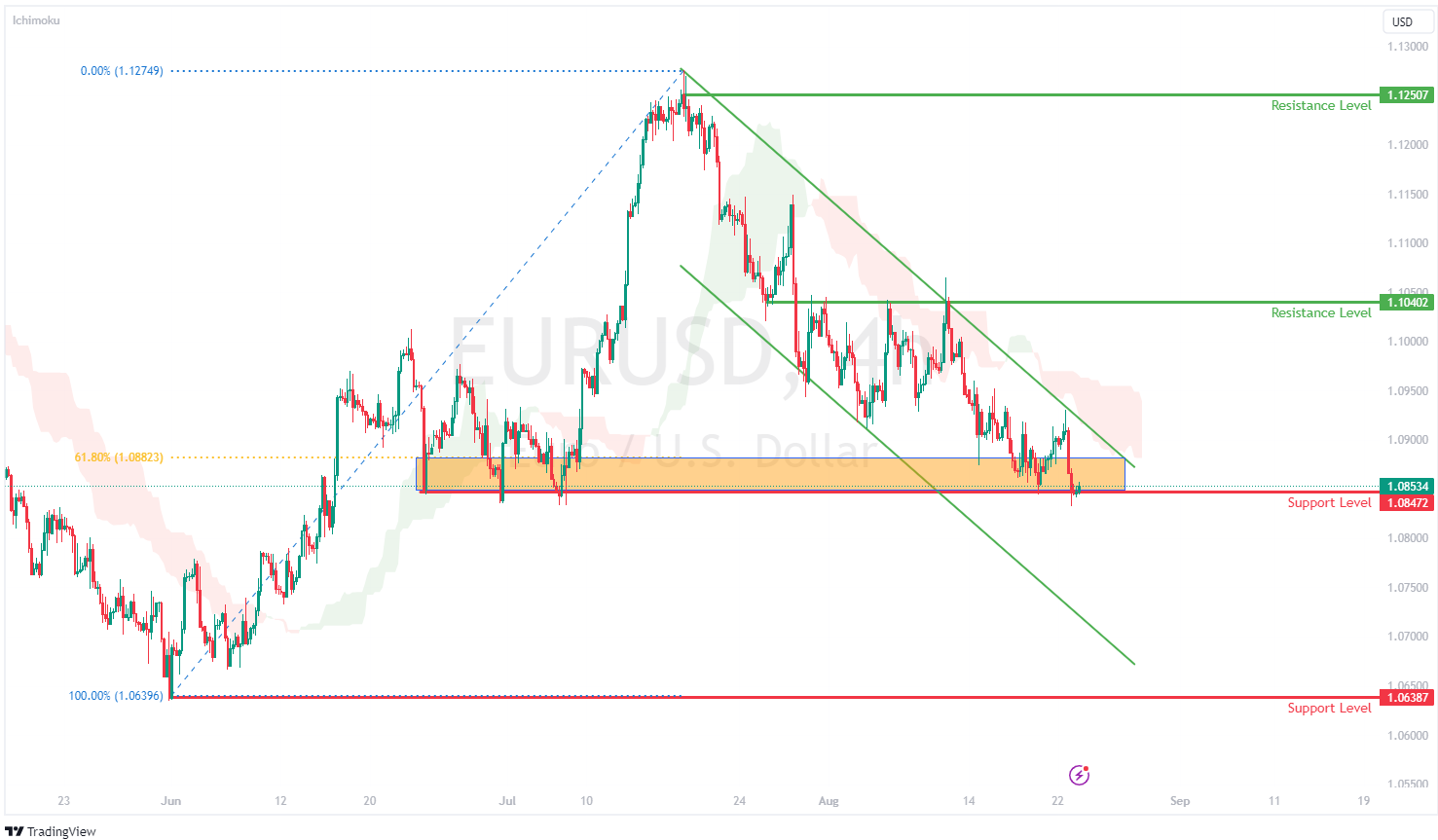

23 August 2023After reaching the high of 1.1250, last tested in 2022, the EURUSD has been trading steadily lower and currently sits along the 1.0850 support level, formed by the 61.8% Fibonacci retracement level and the previous swing low from early July.

Looking at the technical aspects, the Ichimoku cloud indicates continued bearish pressures, with the top of the channel providing dynamic resistance, highlighting further downside potential for the EURUSD.

The current downtrend on the EURUSD has been driven by the European Central Bank’s (ECB) comments in July that there was no clear bias in favour of hiking or holding rates for the upcoming meeting in September. Coupled with the increasing likelihood of another rate hike to come from the US FOMC in September, as the Fed continues to fight inflation, strength in the DXY has led to the EURUSD trading lower.

While a brief retracement could be likely to retest the upper bound of the channel, look for the EURUSD to maintain within the bearish channel. If the price breaks below the support level of 1.0850, this could signal a confirmation of further downside, with the next key support level at the previous swing low, along the 1.0650 price level.

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice.

Next Article

FX analysis – USD drops, Gold pops on soft data, falling yields

A raging US equity market fuelled by soft data, a drop in treasury yields and blowout earnings from NVDA (which saw its stock price hit an all-time high) saw risk-on trading through Wednesdays session. USD was choppy on Wednesday with an initial rally in DXY, which saw it briefly pierce the major resistance at 103.60, dramatically reversing cour...

Previous Article

FX analysis – Euro lower ahead of PMIs – AUD, JPY and Gold stumble higher

USD was mostly firmer in Tuesday’s session as a mixed equity markets saw some slight risk-off conditions. Also support USD was rates markets shiftin...