The week ahead – NFP and European inflation figures in the spotlight.

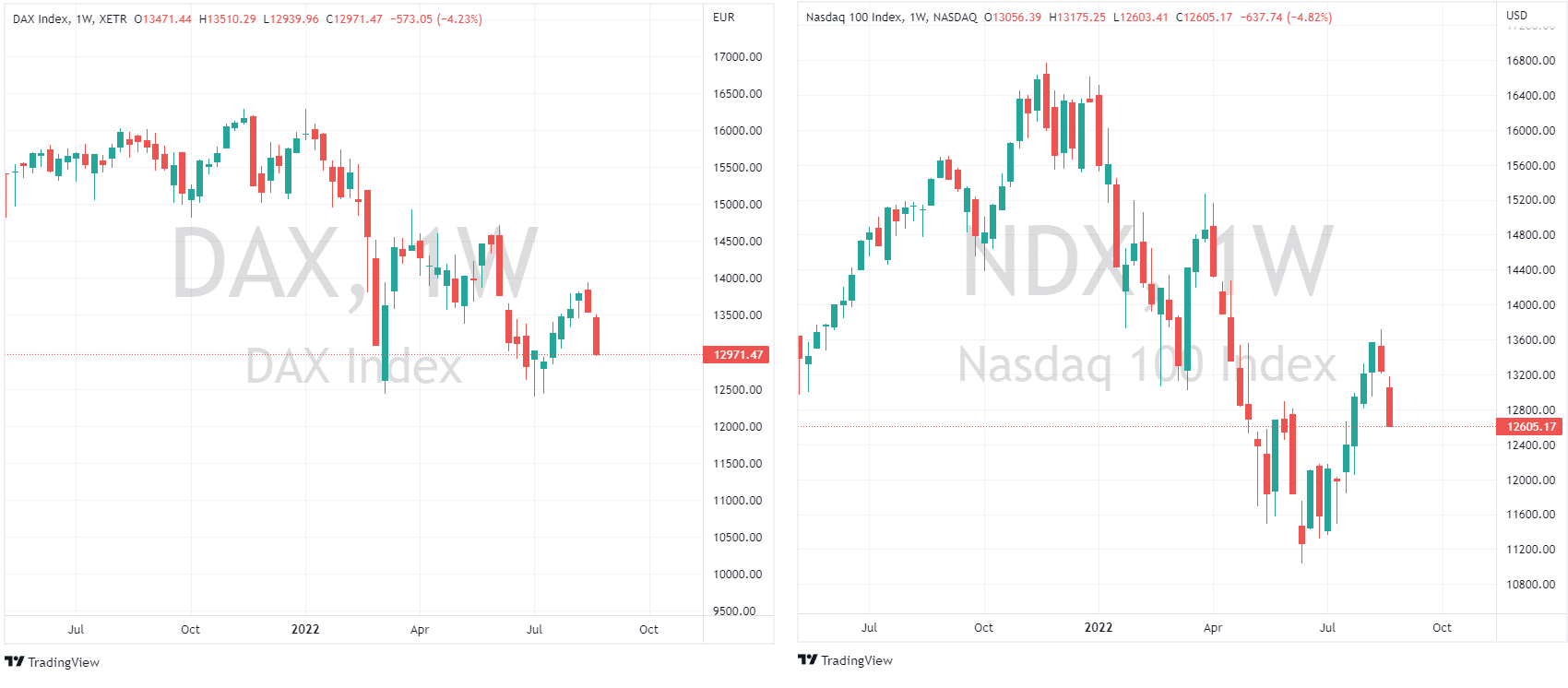

29 August 2022Global equities took a battering last week, most of it in Fridays session after Fed Chair Jerome Powell re-iterated the Feds number one priority is taming inflation in a hawkish speech at the Jackson Hole symposium. This saw the Feds rate hike trajectory reprice sharply higher and seeing risk assets take a significant leg lower, the Nasdaq was hammered nearly 4% lower and the Vix index spiking over 17% for the week.

European markets didn’t fare any better with the added headwind of the energy crunch weighing on markets in the Eurozone, the German Dax index fell over 4% for the week.

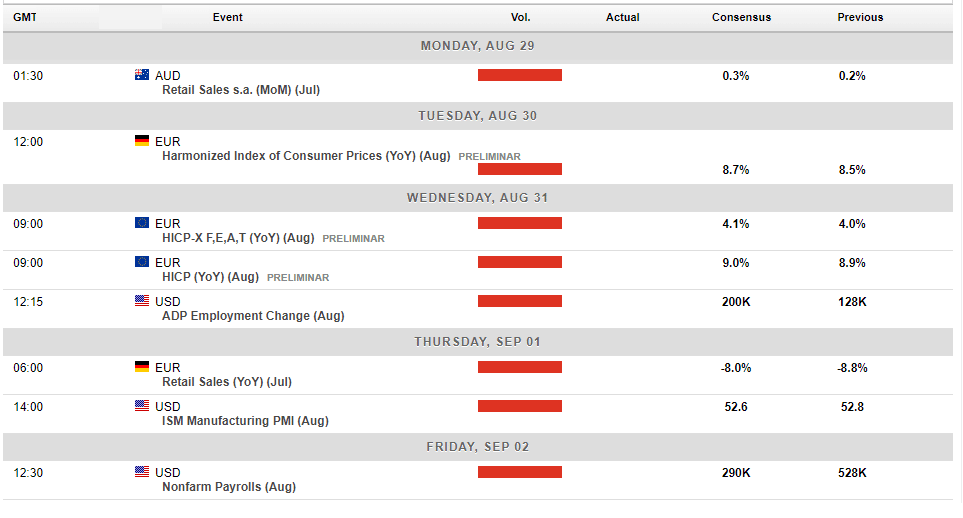

With the odds of 75bp hike at the next Fed meeting spiking to over 60% from a 50-50 bet at the start of the week and a fast approaching ECB meeting this week the figures to watch will be the US Non-Farm payrolls and a smorgasbord of European inflation figures, both set to be major drivers of FX and equities in the near term.

The US August job report is expected to come in at +295k , a drop from last month’s blockbuster +528k nevertheless a respectable figure that shows the resilience of the US labour market, despite being in a technical recession for the first half of the year. You would expect anything over 250k to keep the Fed in hiking mode, a figure over 350k would almost certainly see a 75bp hike in the September meeting be repriced as a certainty, with USD rallying and equities taking another hit.

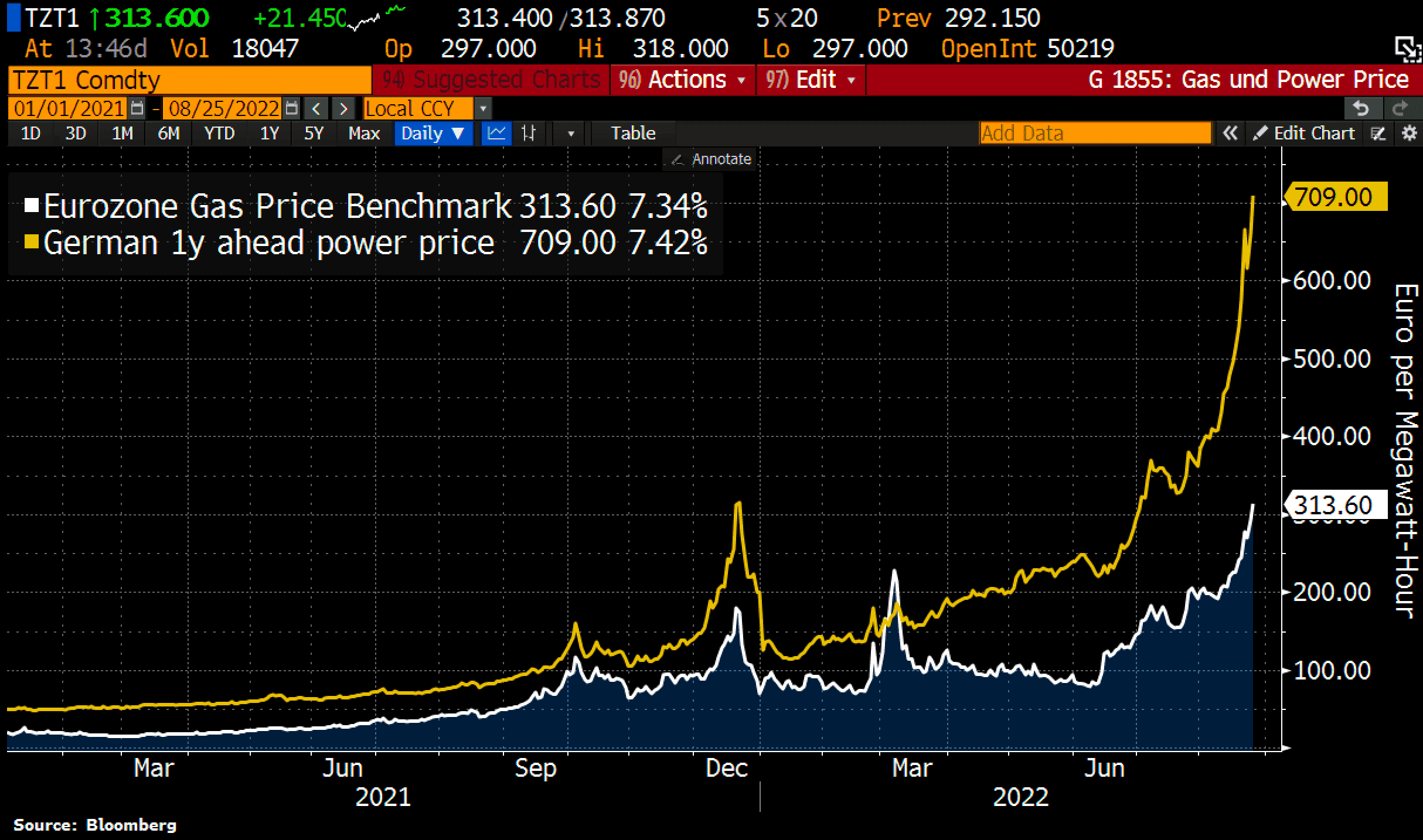

Eurozone data will be providing key input into Septembers ECB decision with the debate between the hawks and the doves heating up again on future ECB policy and hiking trajectory. With Gas prices still elevated, pushing up prices for consumers, German and Eurozone CPI figures will be closely watched and should see some volatility on their release in the Euro and Eurozone equities. Eurozone unemployment figures will also add to the mix, giving a sense of how the labour market is responding to the weaker economic conditions.

Calendar major economic news week beginning 29/8/22

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice.

Next Article

Space X and T-Mobile Joint Enterprise

Space X – Space Exploration Technologies Corp. is an American spacecraft manufacturer, space launch provider, and a satellite communications corporation headquartered in Hawthorne, California. It was founded in 2002 by Elon Musk, with the goal of reducing space transportation costs to enable the colonization of Mars and T-Mobile – The Ameri...

Previous Article

Jackson Hole Symposium set to get underway today

The Kansas City Federal Reserve is set to host the 45th Annual Symposium at Jackson Hole Lodge in Wyoming’s Grand Teton National Park. Som...