- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Share CFDs

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Share CFDs

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & Analysis

- Articles

- Central Banks

- Jackson Hole Symposium set to get underway today

- Home

- News & Analysis

- Articles

- Central Banks

- Jackson Hole Symposium set to get underway today

News & AnalysisNews & Analysis

News & AnalysisNews & AnalysisThe Kansas City Federal Reserve is set to host the 45th Annual Symposium at Jackson Hole Lodge in Wyoming’s Grand Teton National Park. Some of the countries and world’s most important central bankers, economists, and academics will be meeting to discuss the biggest issues facing the global economy. The key issue on the agenda is of “Reassessing Constraints on the Economy and Policy.”

All eyes will be on Jerome Powell, with the chairman of the Federal Reserve expected to speak on Thursday and provide an update on the proceedings of the conference. At last year’s event Powell was caught out after stating that inflation was transitory, only to see it become a huge long-lasting issue. Therefore, he may try and correct this perception and portray a much more conservative attitude. There is also a view from some analysts that the Fed came across too dovish in the July meeting which led to the market rally. At this stage the market has priced in a 75-bps increase at the September meeting, however this may change. With key inflation measures slowing somewhat, the question will be whether the fed continue its aggressive interest rate hikes or eases their policy to avoid a potential recession.

The market will be hoping that Powell provides some clues for what the Fed plans to do after rates peak. They will be hoping for clarity over whether the bank will hold the rates at the high levels for some time or lower them straight away to avoid a recession.

Market participants should be weary that although Jackson Hole may provide some important context to the future rates, no official policies will be set. The conference will most likely have a relatively small impact on the market, it still has the potential to provide some volatility for both equities and currency if significant attitude shifts are expressed.

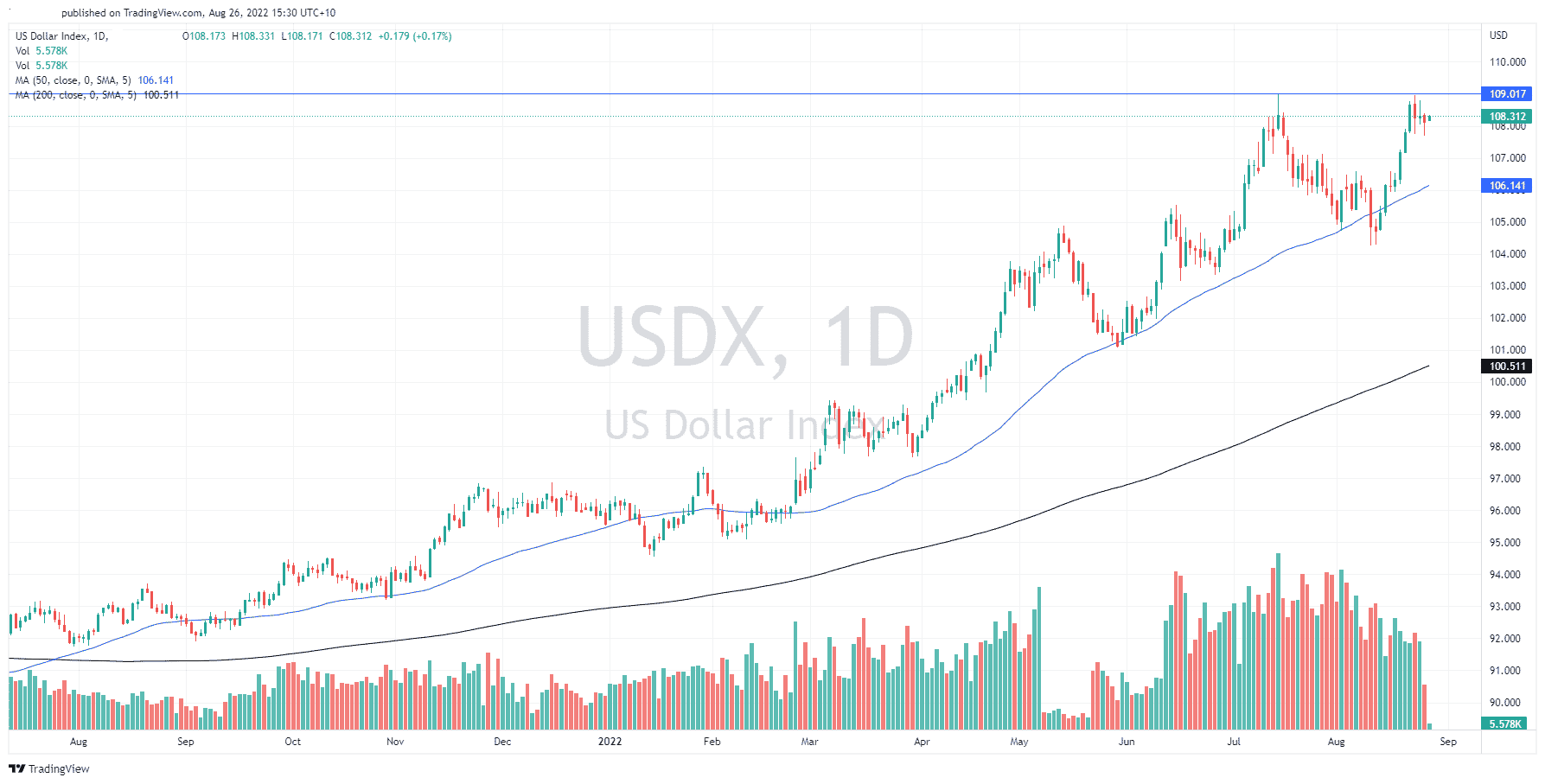

The USD is currently at 5 year highs and with some positive catalysts for the currency, it may continue to rise further if the Fed continues to be aggressive in its rate hikes.

Ready to start trading?

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice.

Next Article

Is the price of wheat ready to bounce?

The price of wheat is finally starting to show positive signs after an aggressive sell off that has been ongoing since May 2022. There is hope that the price of the commodity may begin to climb again with the price finally finding some support. The price has been impacted by growing fears that production may slip may increasing volatili...

August 30, 2022Read More >Previous Article

How to develop a good training plan?

Trading FOREX, equities, commodities, and any other asset can be an emotional rollercoaster. With so many different emotions and external factors diff...

August 25, 2022Read More >Please share your location to continue.

Check our help guide for more info.