Stocks tumble again as BoE inspired rally fizzles

30 September 2022US stocks again were heavily pressured, selling off hard into the last day of the month and quarter as Wednesdays rare BoE inspired positive session proved to be a dead cat bounce thus far.

Tech led the sell-off after a rare downgrade of Apple (AAPL) from Bank of America added to tech woes with many of the heavyweights underperforming as Microsoft (MSFT) and Alphabet (GOOG) set 52 week lows, the Nasdaq index was down over 2.8% on the session before finding support around the June lows.

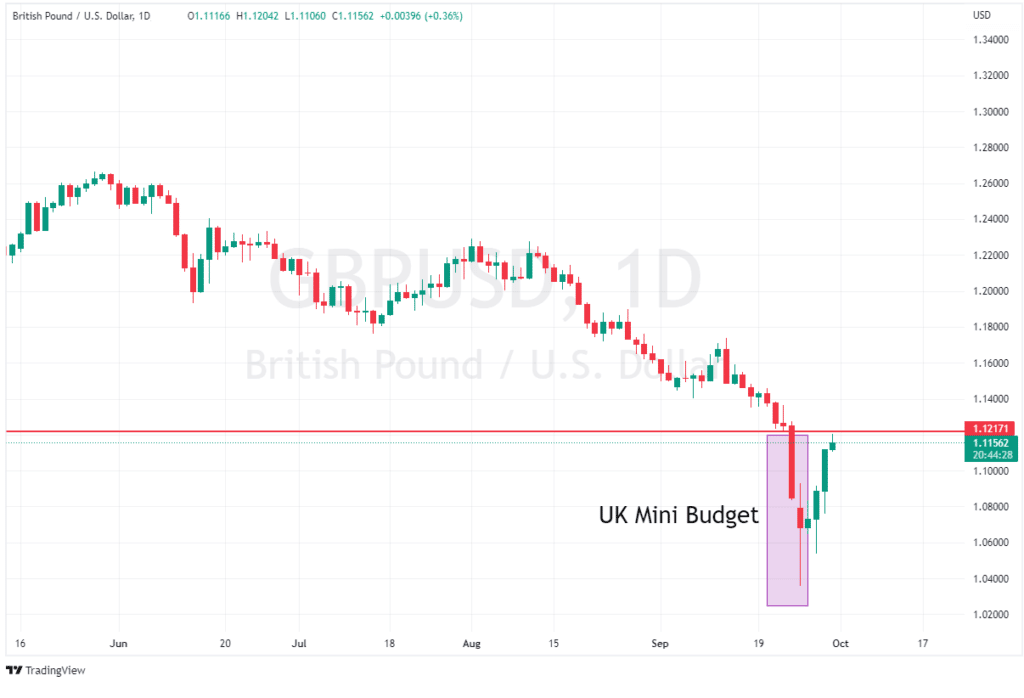

But unlike recent selloffs which were mostly catalysed by surging yields, or a soaring US dollar, we saw neither in this session, as both 10Y US Treasury yields and 30Y UK gilts went nowhere. The USD also sold off, with a surging GBP almost erasing all of the UK mini budget inspired flash crashes of Friday and Monday on the back of the Bank of England’s actions to calm a tumultuous domestic bond market.

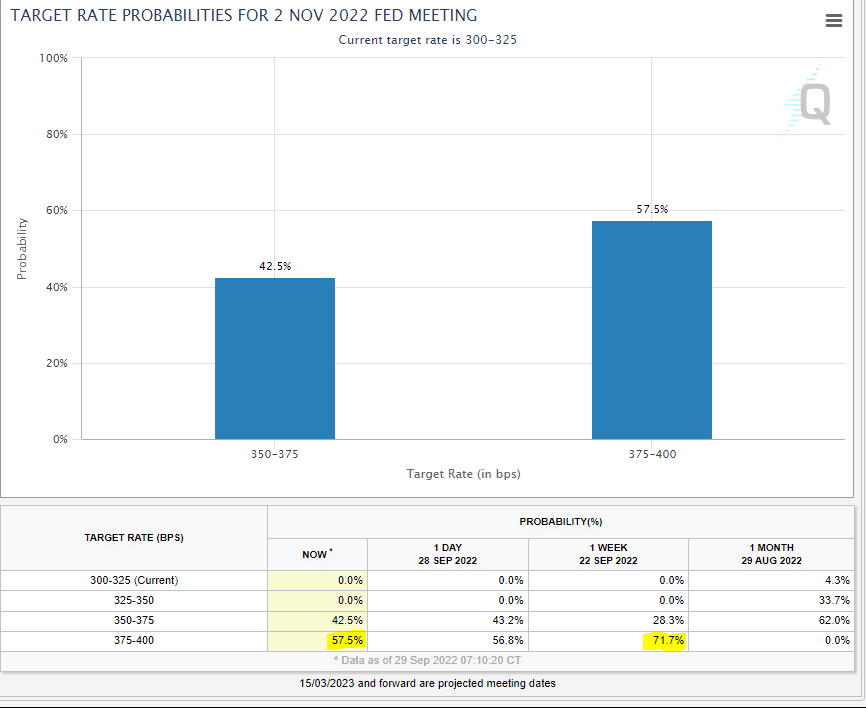

Another catalyst for the USD drop in recent sessions is Fed rate hike expectations moderating. A 75bp hike at their next meeting has dropped from 71.7% priced in from a week ago to 57.5% today.

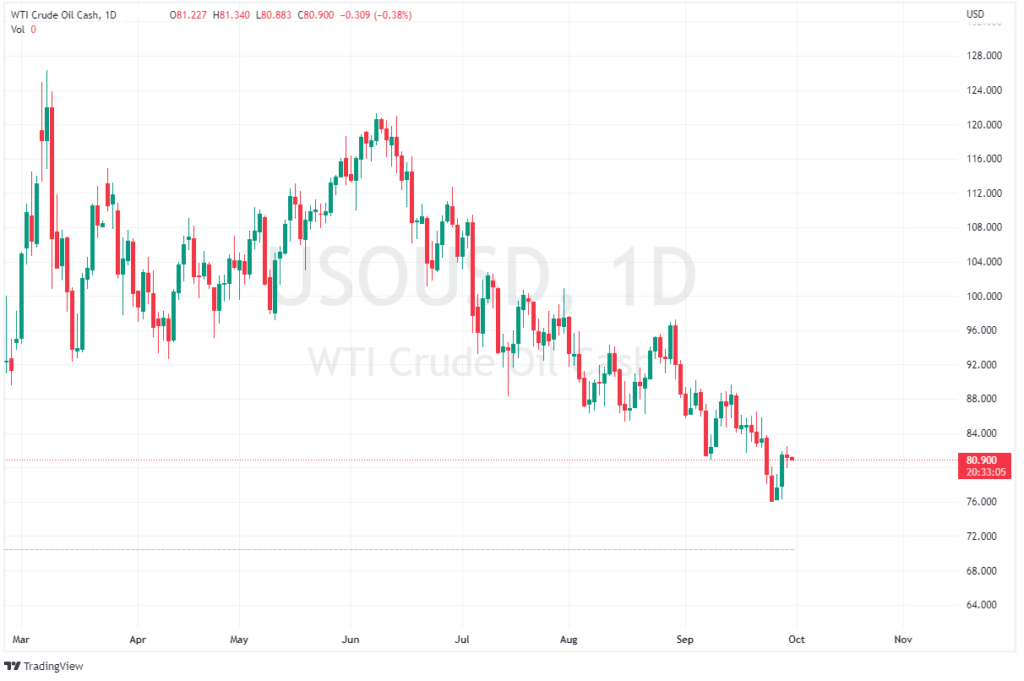

Despite global growth concerns which have weighed on the price of oil recently, a weaker US dollar and a report that OPEC+ would cut output by 500K-1MMb/d next week saw support for US crude oil.

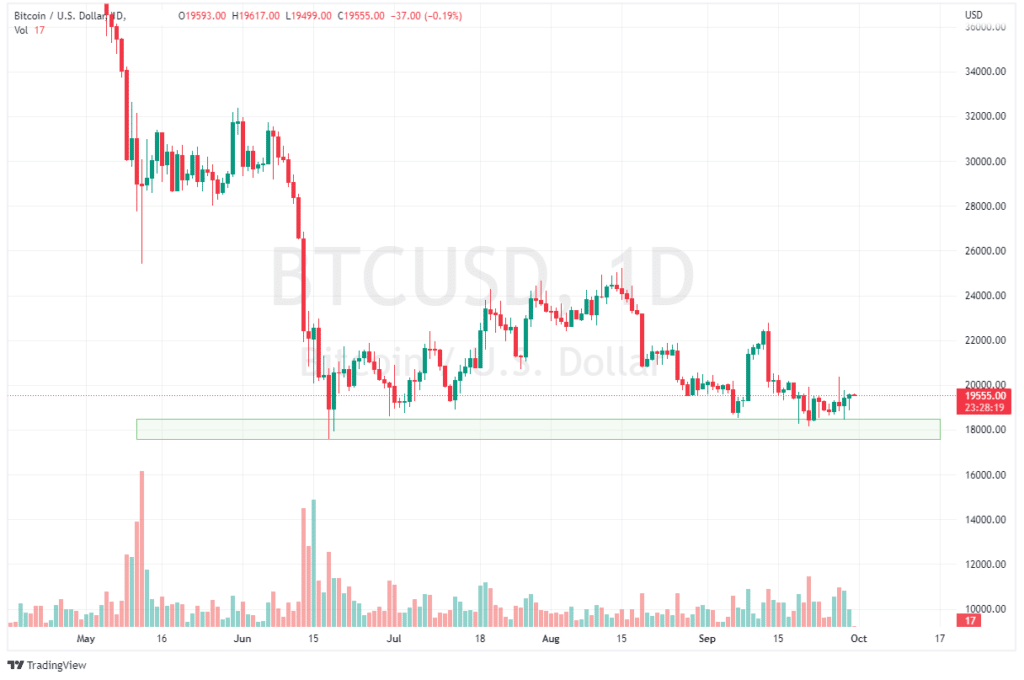

In Crypto, Bitcoin has found strong support at around 18500 USD, despite heavy tech losses in recent sessions which have previously been a driver in BTCUSD declines.

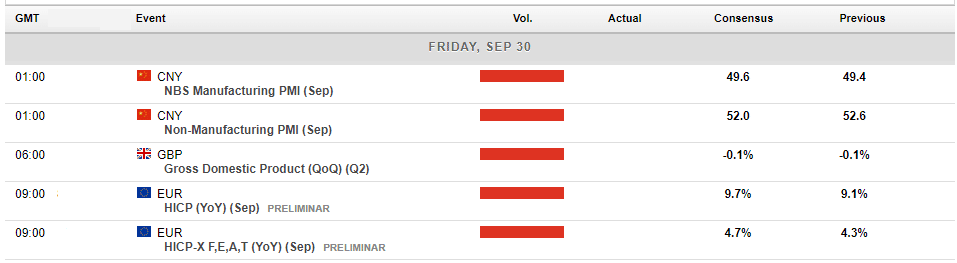

In economic releases today, Chinese PMI figures will be an important one to watch for AUD and CNH traders, whilst those brave enough to be trading the Pound have UK GDP figures released.

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice.

Next Article

Natural Gas getting ready to test important level

Natural Gas prices have had a volatile year to say the least. After finding multi decade highs on the back of geo-political volatility and record high inflation levels the price has seen an aggressive retracement. With the overall commodities market suffering a big drop as recessionary pressures have taken over and a resilient USD, Natural gas has ...

Previous Article

Bank of England, Stuck between a rock and hard place

The UK financial system has been under extreme pressure from rising inflation and recessionary pressures. It culminated in the GBP reaching record low...