Bank of England, Stuck between a rock and hard place

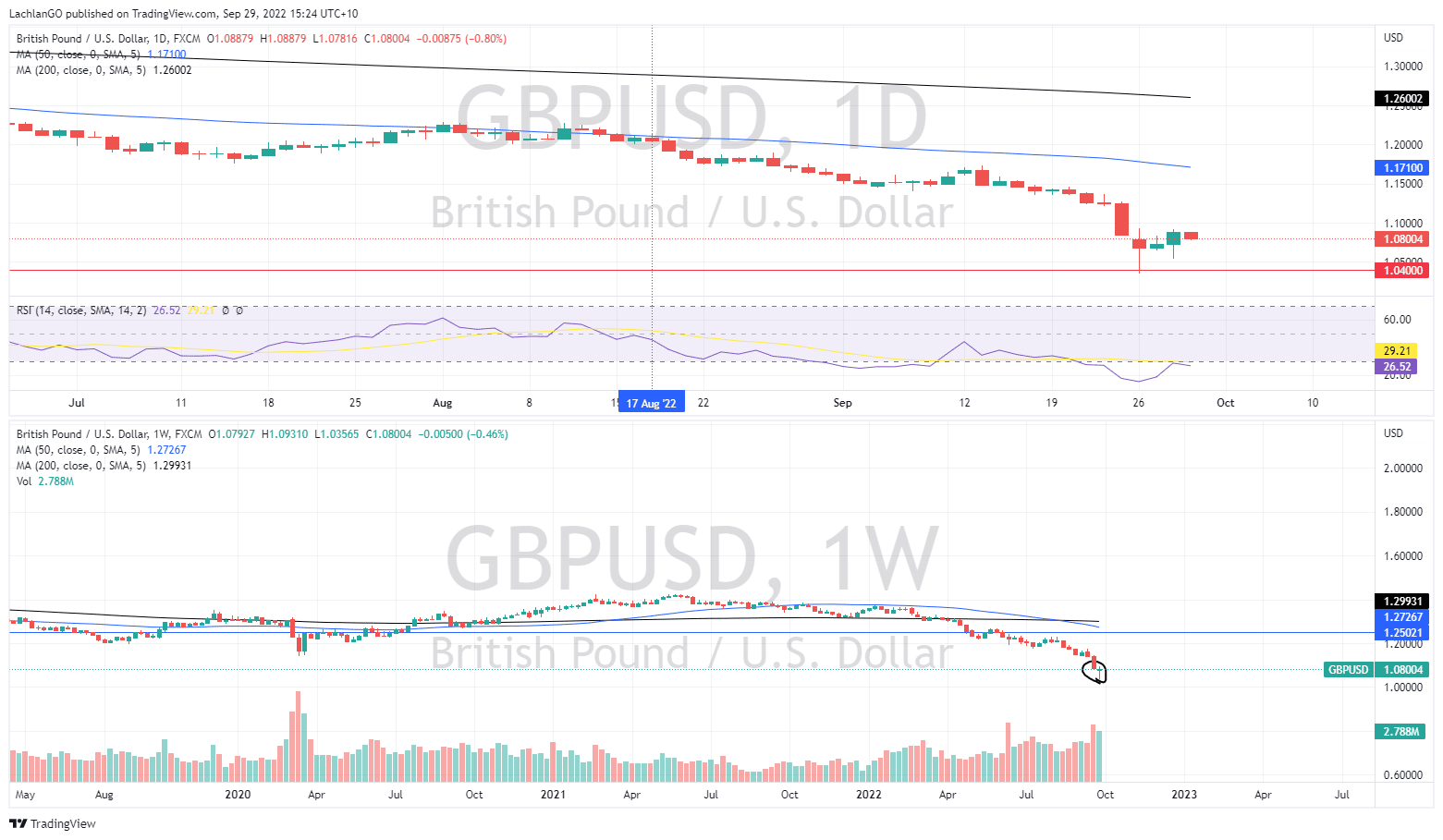

29 September 2022The UK financial system has been under extreme pressure from rising inflation and recessionary pressures. It culminated in the GBP reaching record lows and a UK government bond crisis that could have almost brought down the system. So why is the Bank of England now buying government bonds after attempting to stem inflation and raise interest rates. To onlookers it would seem the Bank is confused with its own direction, however with a deeper look it seems the Bank is choosing the lessor of two evils.

Collapse in Bond prices

The spark that caused the mess was the new British government, led by Liz Truss government releasing its mini budget in which the chancellor Kwasi Kwarteng and new Prime Minister Liz Truss’s created tax cuts for the citizens and businesses. However, this goes against contradictory to the Bank’s hawkish policy and the rest of the world’s fight against inflation.

The situation

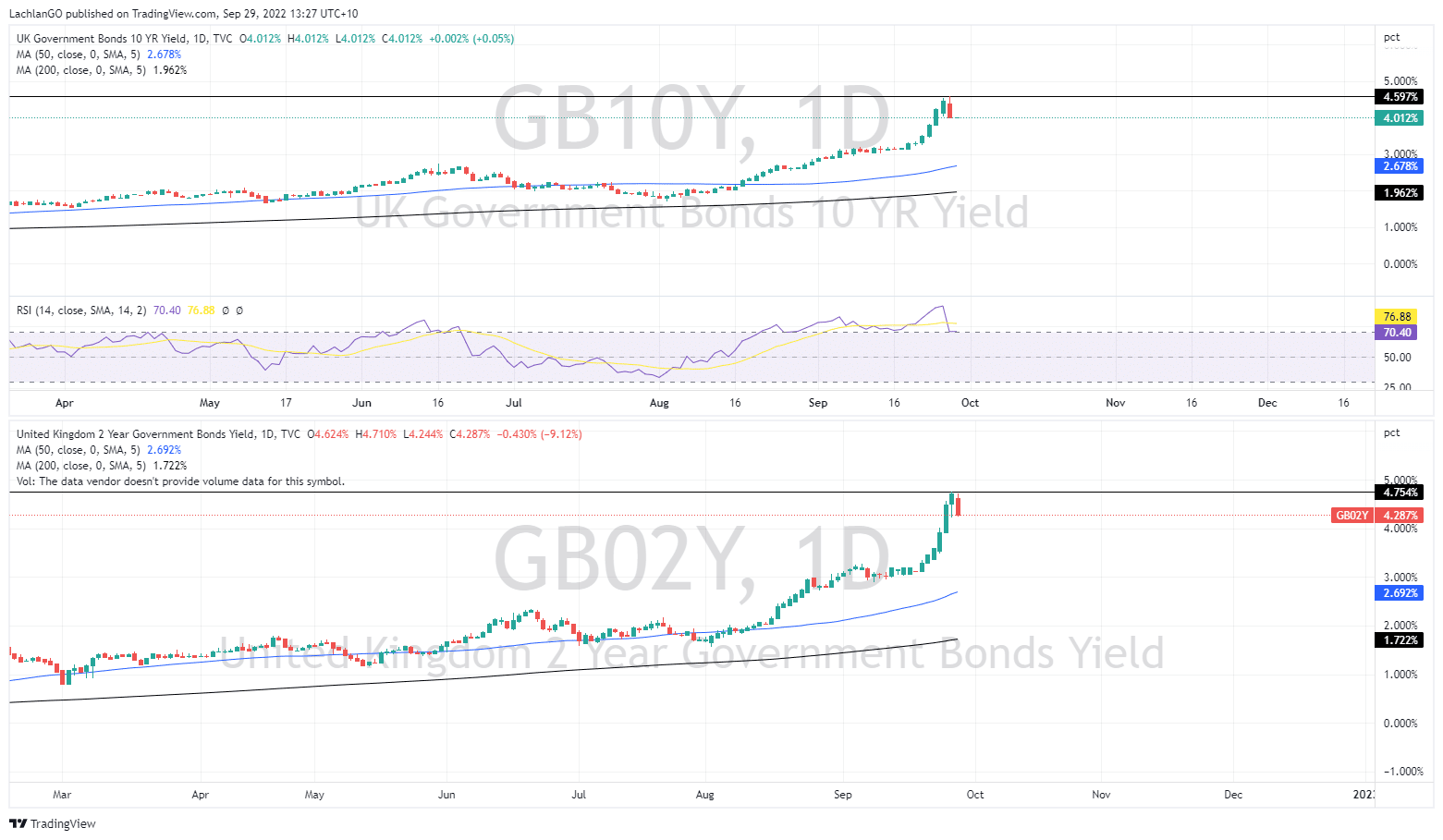

In response to the budget announcement, the bond market sent yield’s sky high and drove prices lower. The crashing bond prices is problematic because of liquidity issues for the Liability Driven Investment Funds, (LDIF). They are large funds including retirement funds that hold UK government bonds and other bonds worth almost 1 trillion pounds. Structural problems with these funds meant that much of there holdings use leveraged buying requiring collateral to cover the positions. The managers of these funds can then use the bonds as further collateral for other purchases. This can increase return but also create exposure and liquidity risks if the bond market turns for the worse as it did on the 27th of September. When the price of these bonds began to drop these funds had to sell their holdings to cover collateral requirements. However, this selling cycle further pushed down the price of the bonds driving up the yield. With the price of bonds and yield being inversely related, as the yield pushed up the prices dropped significantly.

A potential catastrophe averted for now

This selling pressure had the potential to push these funds into insolvency as their liabilities began to outweigh their assets. The Bank of England was forced to intervene to reassure the bond market and keep these big funds from becoming insolvent and ensure a safer transition to lower bonds prices in which the funds could manage without going insolvent. Therefore, the Bank’s commitment to purchase 65 billion pounds worth of government bonds was pivotal in averting a crisis. The chart below shows the impact that the bond purchasing had on the yields. The price of GBP also benefited from the announcement after falling to record lows the price made an important bounce.

The downside of intervention

On the other hand, the move to purchase these bonds and cut in tax rates by the government goes against the actions needed to slow inflation. Whilst this measure should settle the bond market and give the funds time to settle their solvency issues, in the long term it places the Bank of England between a rock and a hard place as it looks navigate a difficult period.

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice.

Next Article

Stocks tumble again as BoE inspired rally fizzles

US stocks again were heavily pressured, selling off hard into the last day of the month and quarter as Wednesdays rare BoE inspired positive session proved to be a dead cat bounce thus far. Tech led the sell-off after a rare downgrade of Apple (AAPL) from Bank of America added to tech woes with many of the heavyweights underperforming as Microso...

Previous Article

What are Bonds and how do you trade them?

Maturity, Yields, Par Values and Coupon payments. These are words that everyone has heard of but not many have a good understanding of what they mean....