NIO January deliveries announced

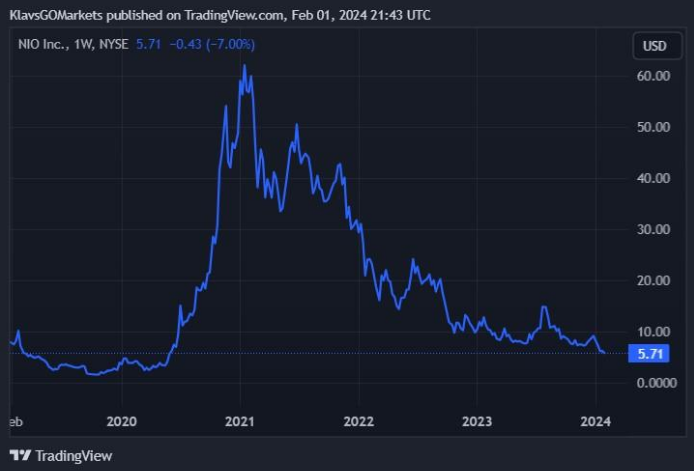

2 February 2024Chinese electric vehicle company, NIO Inc. (NYSE: NIO), hasn’t had the best start to 2024 with the stock plummeting by 37.05% year-to-date.

That’s despite the company signing battery-swap agreements with other Chinese automakers, including, Changan Automobile, Geely Group, JAC Group and Chery Automobile.

Back in the December, NIO also announced a $2.2 billion investment from Abu Dhabi. You can read more about it here.

On Thursday, the company released the latest delivery numbers for January, which had a rare positive effect on the share price.

NIO delivered 10,055 cars last month, which was up by 18.2% from January 2023.

The company has delivered 459,649 vehicles in total as of 31/1/2024.

The EV maker is expected to announce the latest financial results for the fourth quarter on around 21/3/2024.

Company overview

- Founded: November 2014

- Headquarters: Shanghai, China

- Number of employees: 20,000+ (2023)

- Industry: Automotive

- Key people: William Li (CEO), Lihong Qin (President), Wei Feng (CFO)

Stock reaction

The stock was up by 1.60% at the end of trading day on Thursday at $5.71 a share and is currently trading at the lowest level since June 2020.

Stock performance

- 5 day: -5.46%

- 1 month: -30.96%

- 3 months: -26.70%

- Year-to-date: -37.05%

- 1 year: -52.26%

NIO stock price targets

- Mizuho: $15

- Deutsche Bank: $16

- CLSA: $14

- Sanford C. Bernstein: $8

- JP Morgan Chase & Co.: $10.50

- Citigroup: $19.20

- UBS Group: $15

- Nomura: $7.50

- Barclays: $8

- Morgan Stanley: $12

NIO Inc. is the 1367th largest and 5th largest electric vehicle company in the world with a market cap of $11.91 billion.

You can trade NIO Inc. (NYSE: NIO) and many other stocks from the NYSE, NASDAQ, HKEX and ASX with GO Markets as a Share CFD.

GO Markets now offers pre-market and after-market trading on popular US Share CFDs.

Trade the pre-market session: 4:00am to 9:30am, normal session, and after-market session: 4:00pm to 8:00pm, Eastern Standard Time.

Why trade during extended hours?

- Volatility never sleeps. Trade over earnings releases as they happen outside of main trading hours

- Reduce your risk and hedge your existing positions ahead of a new trading day

- Extended trading hours on popular US stocks means extended opportunities

Sources: NIO Inc., TradingView, MarketWatch, MarketBeat, CompaniesMarketCap

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice.

Next Article

Exxon Mobil tops earnings estimates but falls short on revenue

World’s second largest oil & gas company, Exxon Mobil Corporation (NYSE: XOM), announced results for the previous quarter before the market opened on Friday. Exxon Mobil stated that the revenue reached $84.344 billion for the quarter, which was below analyst estimate of $90.032 billion. Earnings per share was reported at $2.48 vs. $2.19...

Previous Article

Meta Platforms smashes Wall Street estimates – the stock is flying in the after-hours

One of the most anticipated earnings calls of the week is here. Mark Zuckerberg’s, Meta Platforms Inc. (NYSE:META), announced the latest results fro...