Indices Trading – What are Indices and how to use CFDs to trade them

13 April 2023Index trading is one of the most popular class of markets to trade for CFD traders, rivalling major FX pairs in trading volume, but what is indices trading and how does trading them with CFDs work?

Most people will be familiar with the names of the major stock indices from financial reports in all forms of media, the most popular stock indices of CFD traders and the stocks they track are below:

USA

The Dow Jones Industrial average – 30 largest blue-chip companies in the US

NASDAQ Composite Index – Top 100 largest non-financial companies in the US (Mostly Tech)

S&P 500 Index – 500 large cap companies in the US (Bank heavy)

Europe and UK

FTSE 100 – Top 100 UK companies

CAC 40 – Top 40 French companies

DAX 40 – Top 40 German companies (Formerly known as the DAX30 which it may still be labelled as)

Asia and Australia

ASX 200 – Top 200 Australian companies

Hang Seng – A selection of the largest companies in Hong Kong.

Nikkei 225 – Consists of 225 stocks in the Prime Market of the Tokyo Stock Exchange

Some of the advantages of trading indices:

- You can take a broad view of the health (or not) of that countries stock market, i.e. rather than take a position in a single stock, take a position in a basket of stocks by buying or selling the index they are components of.

- Higher leverage available to trade stock indices, up to 100:1 for qualified Pro clients.

- Extended trading hours, you can take positions in most indices up to 23 hours a day, far greater hours than the underlying stock exchanges.

- Take positions long or short with ease to profit from both a rising and falling market.

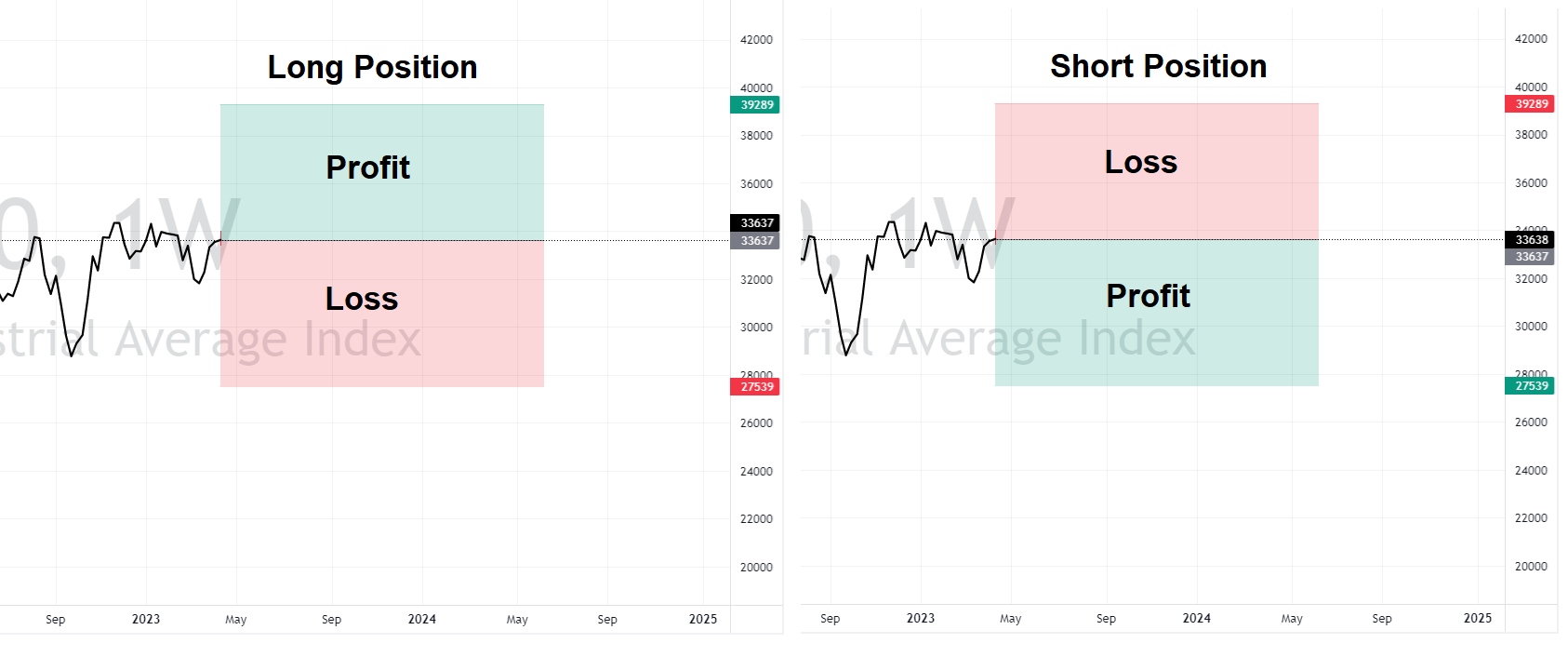

When you take a Long (Buy) position you profit if the market moves up, a Short (Sell) position will profit when the market moves down.

How Indices are priced and understanding your position size

Stock Indices are priced in the native currency i.e., the Dow Jones (WS30 on the GO Markets platform) is priced in USD, the FTSE100 in GBP, the ASX200 in AUD etc.

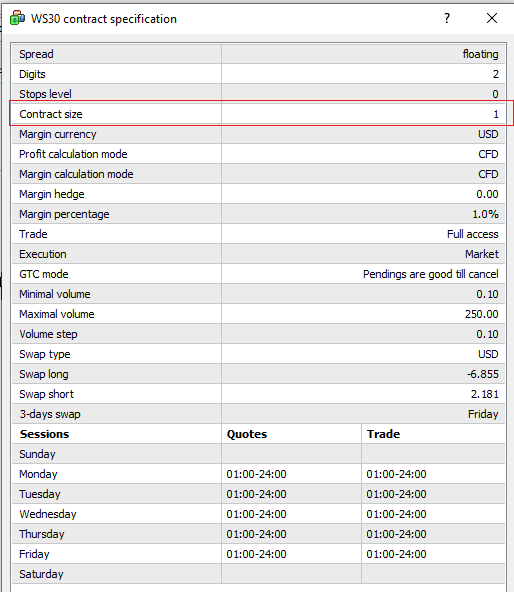

This is important to keep in mind when choosing your position size, it also important to know the specifications of the contract you are trading is to make sure you understand the lot sizing before entering a trade. You can check the specifications of any contract on MT4 and MT5 by right clicking it in the Market Watch Window and selecting “Specification”

An example specification of the Dow (WS30) is below (MT4 specs, MT5 is very similar):

You can see in the example above that the WS30 contract with GO Markets has a contract size of 1, this means 1 lot will equal $1 USD per point movement in PnL if you take a position.

e.g., if you buy 1 lot at a price of 33670 and the price rises to 33680 you are in profit by 10 points, which would equal $10 USD

Most indices will have a contract size of 1, though it is advisable to always check as some may have different values, an example in the S&P 500 (US500) which has a contract size of 10. It is important to understand the contract size and base currency of the index you are trading before entering a trade to avoid any nasty surprises.

Main drivers of what moves an Index’s price.

In choosing which Index to trade it is also important to understand the drivers of that index and it’s component stocks.

All Indexes will have some common drivers, such as global growth concerns, geopolitical events and non-US indices will be affected (fairly or not) by what US markets are doing. Each index will also have its own individual drivers as well though.

Examples

- The NASDAQ (NDX100) is heavily weighted with mega cap tech stocks, the health of the Tech sector will heavily influence its price.

- The ASX200 and FTSE100 both have large contingents of miners, meaning commodity prices will be big drivers of these 2 indexes, more so the ASX200.

- The Russell 2000 has many regional and mid-size banks as its component stocks, which is why during the recent banking crisis it underperformed other US indices.

Understanding these unique drivers for each Index is recommended to make the best trading decisions possible.

In Summary, trading Indices opens up some great opportunities to position yourself to profit from market moves, spreads on Indices with GO Markets are some of the best in the CFD industry, with tight spreads in and out of hours( Some brokers will artificially increase spreads on Indices outside the stock market hours of that country)

They allow you to seamlessly take long or short positions to speculate for profit, or to headge existing stock positions from an overnight move. You can click the link below to learn more about Index trading with GO Markets.

https://www.gomarkets.com/au/index-trading-cfds/

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice.

Next Article

Tech leads US Stocks higher on soft PPI and employment figures, Gold surges towards all time high

A significantly softer than expected PPI print confirming Wednesdays CPI saw the green light for risk on in Thursday’s session and saw a broad rally in risk assets. All major US indexes rallied strongly with the Tech heavy NASDAQ outperforming while the S&P 500 closing at its highest level since February. The March producer price index...

Previous Article

US Stocks give up gains on cool CPI as Fed minutes stoke recession fears

Major US stock indices slid in Wednesday’s session after a cooler than expected CPI figure gave them a boost only run out of steam and ultimately fi...