Oracle beats estimates

15 June 2022Oracle Corporation (ORCL) reported its latest financial after the closing bell in the US on Monday. The company beat both revenue and earnings per share estimates, sending the stock price higher.

The US software and hardware manufacturer reported revenue of $11.84 billion for the quarter (up by 5% year-over-year and up 10% in constant currency) vs. $11.61 billion expected.

Earnings per share reported at $1.54 per share vs. $1.37 per share estimate.

”We continued to improve our top line results again this quarter with total revenue growing 10% in constant currency,” Oracle CEO, Safra Catz commented on the latest results after the announcement.

”These consistent increases in our quarterly revenue growth rate typically have been driven by our market leading Fusion and NetSuite cloud applications. But this Q4, we also experienced a major increase in demand in our infrastructure cloud business—which grew 39% in constant currency. We believe that this revenue growth spike indicates that our infrastructure business has now entered a hyper-growth phase. Couple a high growth rate in our cloud infrastructure business with the newly acquired Cerner applications business—and Oracle finds itself in position to deliver stellar revenue growth over the next several quarters,” Catz concluded.

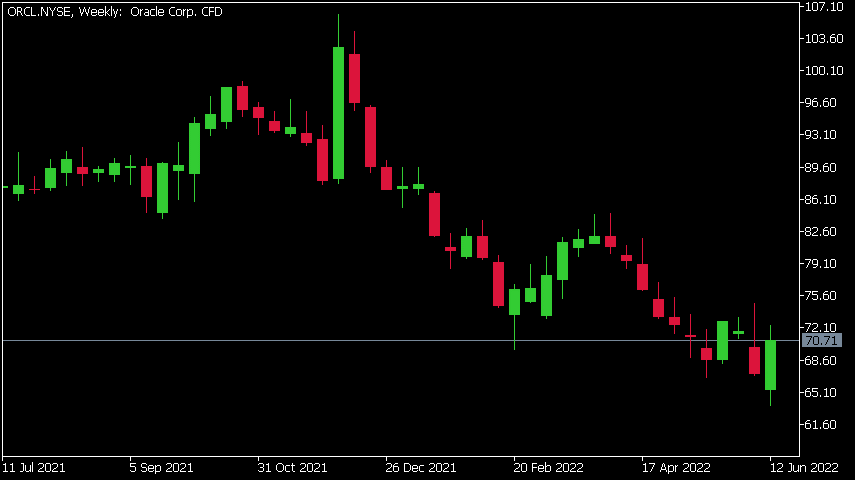

Oracle Corporation (ORCL) chart

Share price of Oracle was up by over 10% on Tuesday after the latest earnings beat, trading at $70.71 per share.

Here is how the stock has performed in the past year:

- 1 Month -1.61%

- 3 Month -12.26%

- Year-to-date -18.91%

- 1 Year -13.38%

Oracle price targets

- Jefferies $80

- JP Morgan $82

- BMO Capital $86

- Stifel $72

- Cowen & Co. $98

- Morgan Stanley $88

Oracle Corporation is the 45th largest company in the world with a market cap of $197.79 billion.

You can trade Oracle Corporation (ORCL) and many other stocks from the NYSE, NASDAQ, HKEX and the ASX with GO Markets as a Share CFD.

Sources: Oracle Corporation, TradingView, MarketWatch, Benzinga, CompaniesMarketCap

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice.

Next Article

Are ETFs really Passive?

What is an ETF Most people have heard of ETFs but not everyone knows what they are. An ETF is an Exchange Traded Fund and they are extremely popular amongst retail investors and novice investors. Companies such as Beta shares, Vanguard, Blackrock and others create and manage these holdings on behalf of investors. An ETF is a collections of stock...

Previous Article

AUD/USD finds new buyers at the 0.70 price mark

As depicted in the AUD/USD hourly chart above, the pair has recently reached a monthly low of 0.69117 as it enters today’s European session. As ...