Weekly USD Round-up: 08/10/18

8 October 2018Last week’s ATR: 95-96.1

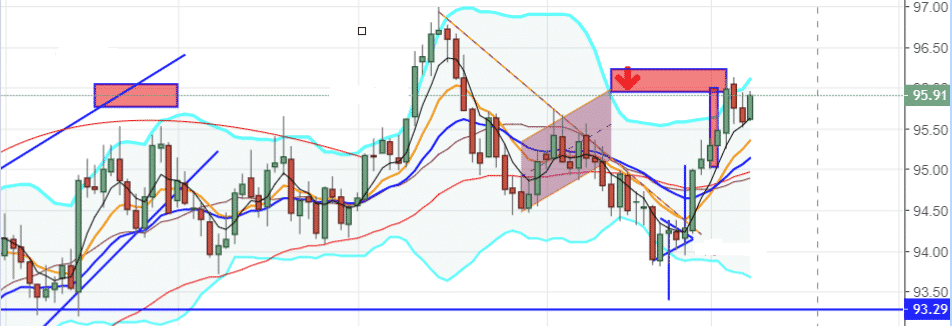

From the daily chart below, we can see that the US Dollar Index is currently testing its right shoulder, and I have marked the left and right shoulders by two red rectangles.

It will take weeks for the price to tumble around the rectangle area, and there might be a lot of fake movements occur, thus it is still too soon to determine a directional bias.

While waiting for the outcome to reveal, we should bear in mind that a candlestick chart under larger time frame (i.e., daily or weekly) is like looking at the larger picture. By keeping daily or weekly chart as your main chart to look at, it should help you to try and avoid some of those fake breakouts on smaller time frames such as 4 hours chart.

Last week, the US dollar index rose for the second consecutive week, and the Fed’s interest rate hike news continued to support this trend.

Federal Reserve Powell pointed out on Wednesday: “Interest rates are still loose, but we are gradually moving towards a neutral level, which means neither blocking nor stimulating economic growth. Interest rates may exceed neutral levels.”

In his fourth public speech in a week, Powell reiterated his optimistic expectation of the US economy. He also pointed out that the US economy is in a very stable, low inflation period accompanied with extremely low unemployment.

This week, the market will focus on the US CPI report for September, which will be announced on Thursday (October 11).

The survey shows that the US CPI annual rate in September is expected to increase by 2.4%, the previous value is 2.7%; the core CPI yearly rate in September is expected to grow by 2.3%, the last value is 2.2%.

By Lanson Chen – Analyst

This article is written by a GO Markets Analyst and is based on their independent analysis. They remain fully responsible for the views expressed as well as any remaining error or omissions. Trading Forex and Derivatives carries a high level of risk.

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice.

Next Article

How to Access GO Markets Complimentary VPS

If you're an existing GO Markets client, simply get in touch with a member of our Support Team and we'll help you get set up. How it works: GO Markets offers complimentary monthly VPS subscription to clients who have completed a minimum trade volume of US $1 Mil per calendar month (approximately 5 round turn FX lots). A service fee starting f...

Previous Article

Latest US Jobs Report

The Buraeu of Labor Statistics have released the latest jobs report for September. Let’s take a look at the latest numbers. The total non-farm payr...