JPY sees a wild trading session

29 July 2016Upcoming News

» 10:30pm GDP – CAD

» 10:30pm Advance GDP – USD

» Sat 6:00am EBA Bank Stress Test Results – EUR, USD, JPY

The JPY saw a wild trading session today as the BOJ boosts dollar lending and ETF purchases. Interest rates to be kept steady at this point. We found out on Wednesday the amount of the stimulus package.

This weekend we have the EBA stress test results, while today was important this could be critical. News has been emerging of the unserviceable debt the Italian Banks are holding. If we have very bad news emerging from these tests it could put real pressure on the European Union. Some have spoken of a second financial crisis in the EU, lead by the collapse of the Italian banks. I hope we see levels not outside what’s known about currently. If there are very negative results released on Saturday we could see the USD open a lot stronger on Monday.

We had a wild Asian session today on the JPY with the JPN225 and JPY pairs all making strong moves. Today was a classic stay out and watch day. We had strong moves down but the counter rallies were deep. The USDJPY had a 256 pip range. The JPN255 reached 16732 before dropping down to 16025 45 minutes later. Gold fell $9 and recovered back to a high of 1343 all in 30 minutes of trade. The AUD, GBP,and EUR had smoother starts to the day all making ground on the USD. The AUS200 has pared early losses to be trading positively at 5575.

I’m seeing 5585 as current resistance for the AUS200. US30 is showing short-term support at 18385.

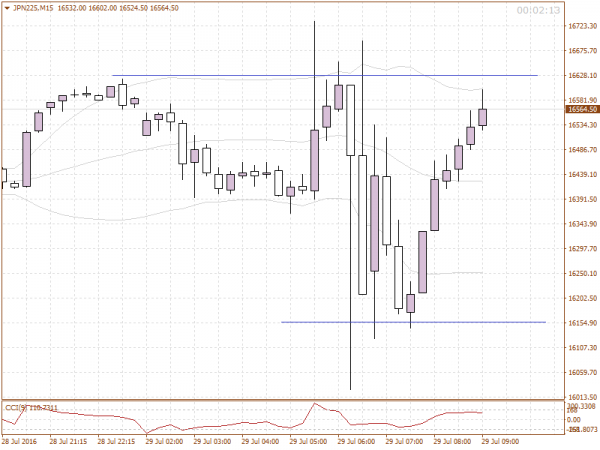

JPN225 – You can see how strong the moves where today off the 15 min chart. Breakout type trades today could have been disastrous. Two classic bull traps at the top of the range. The two largest moves all happened in under 30 minutes. We did have a nice bounce off the bottom of the range that produced a smooth rally. I hope seeing this chart takes away the idea of trading events like today. While there was a lot of movement, catching it is the hard part and could have resulted in some good trades but possibly a lot of damage.

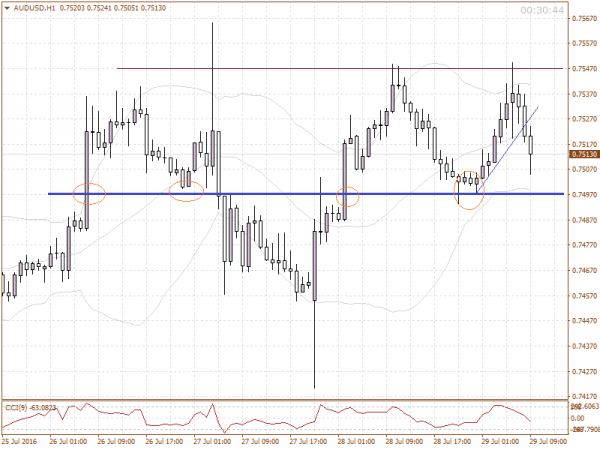

AUDUSD – We had a very nice rally to start the Asian session. Once .7544 was touched we have seen a turn. .7500 is showing possible support on the 4H chart. This will need to be confirmed. The USD has started to show some strength early in the European session.

Good Trading.

All times are in AEST

Please note that trading Forex and Derivatives carries a high level of risk, including the risk of losing substantially more than your initial investment. Also, you do not own or have any rights to the underlying assets. You should only trade if you can afford to carry these risks. Our offer is not designed to alter or modify any individual’s risk preference or encourage individuals to trade in a manner inconsistent with their own trading strategies.

Joseph Jeffriess, GO Markets Market Strategist

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice.

Next Article

RBA cut interest rates

Upcoming News » 6:30pm Construction PMI - GBP » No release time, GDT Price Index - NZD As expected the RBA cut interest rates by 25 basis points. The AUDUSD dropped on the news but has retraced most of its drop. The AUDUSD lost 54 pips to .7488, buyers have come back in taking it back above .7500. The AUS200 lost ground after the disappointing...

Previous Article

Top Candlestick Patterns and How to Use them in Your Trading

Candlestick charts are one of the most popular and commonly used tools by traders in analysing the markets. In this article, we will briefly...