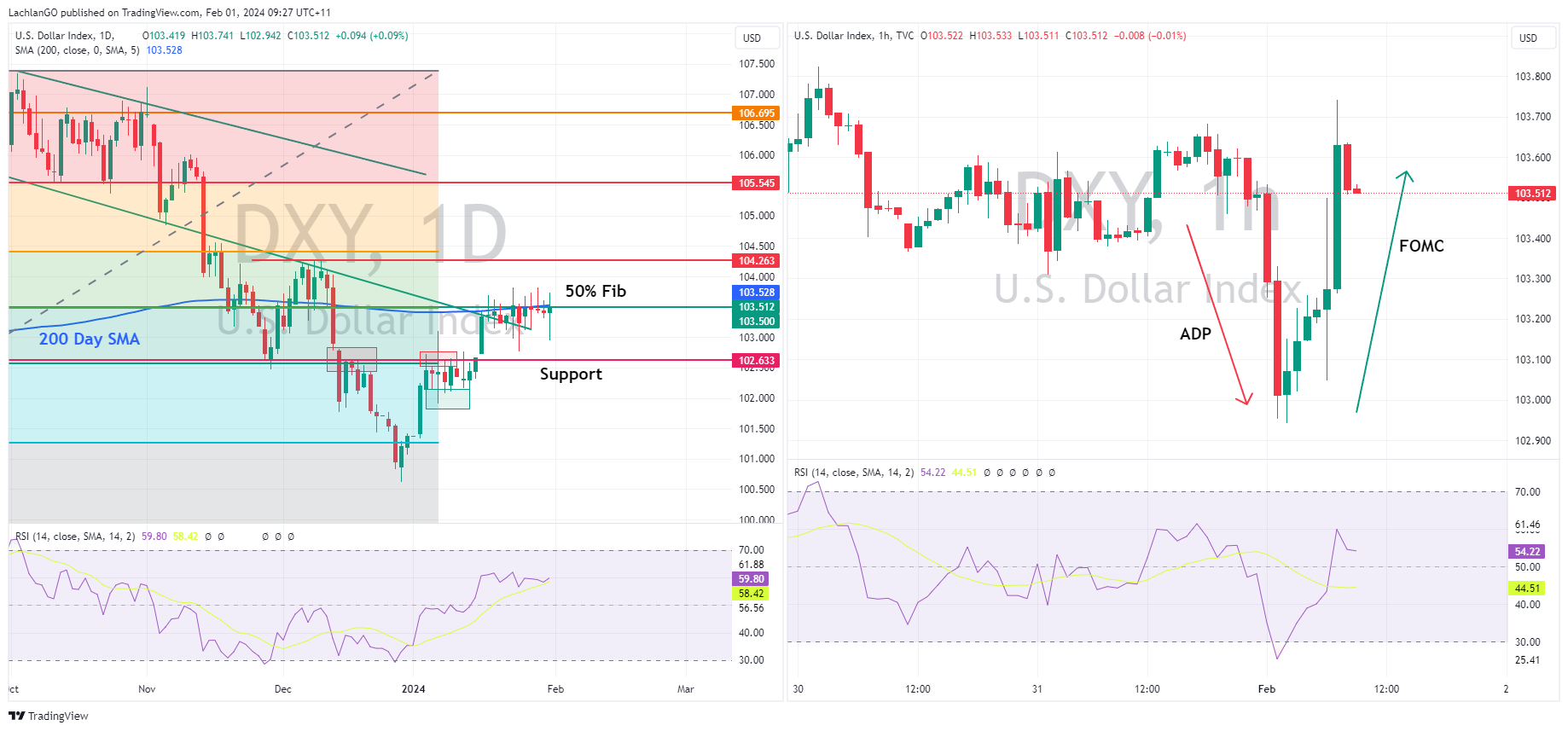

FX analysis – USD pops on FOMC, Cool CPI hits AUD, Yields support JPY

1 February 2024USD started the session weaker with the US dollar index (DXY) hitting a low of 102.94, as it was weighed on by dovish economic data, with misses in ADP employment and Employment Cost Index. This turned around dramatically after what was seen as a hawkish result out of the FOMC where the Fed left rates unchanged as expected but pushed back on the markets expectation of near term rate cuts. Chair Powell also said he “does not think a March rate cut is likely”, this saw futures reprice to a 35% chance of a cut in March, from 50% going into the FOMC which was USD positive.

Ultimately DXY finishing almost unchanged on the day, with the 200-day SMA and 50% fib resistance still capping further upward momentum.

JPY was the only G10 currency to outperform the greenback on Wednesday, with it showing strength pre and post the FOMC rate announcement. USDJPY dropping to test the big figure at 146 before finding some support. Yield differentials between US-JP 10 Y tightening significantly the main driver in this pair and price plays catch up to the downside. A hawkish BoJ summary saw JGB yields move higher more than offsetting the hawkish reaction to the FOMC in US yields.

AUDUSD dipped below 0.6600 after a cooler than expected CPI figure out of Australia weighed on the local currency, along with USD strength post FOMC. The next big level to the downside for this pair is the 2-month low support at 0.6525, a level that could come into play with major US data still to come this week, headlined by Fridays NFP.

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice.

Next Article

Earnings preview – Apple, Meta, Amazon

Big tech earnings continue this week with three more of the Magnificent seven in Amazon, Meta and Apple due to report Q4 earnings after the US close on Thursday. So far, we’ve had mixed results from the first three Mag 7 tech stocks, none of them impressed stockholders much, with Tesla, Microsoft and Alphabet all down post earnings to varying ...

Previous Article

Boeing stock takes off as earnings land above estimates

The Boeing Company (NYSE: BA) reported Q4 2023 financial results before the market open in the US on Wednesday. World’s largest aircraft manufact...