FX Analysis – USD dips , GBP falls on cool CPI, JPY jawboning , EUR up on data

15 February 2024USD dipped in Wednesday’s session after the CPI inspired surge on Tuesday. The US dollar index (DXY) hitting resistance at the 105 level and dropping to a low of 104.65. Reports of Fed Chair Powell downplaying Tuesday’s hotter than expected CPI along with the Fed’s Goolsbee stating US inflation is still consistent with the Fed’s path back to target weighing somewhat on yields and the USD.

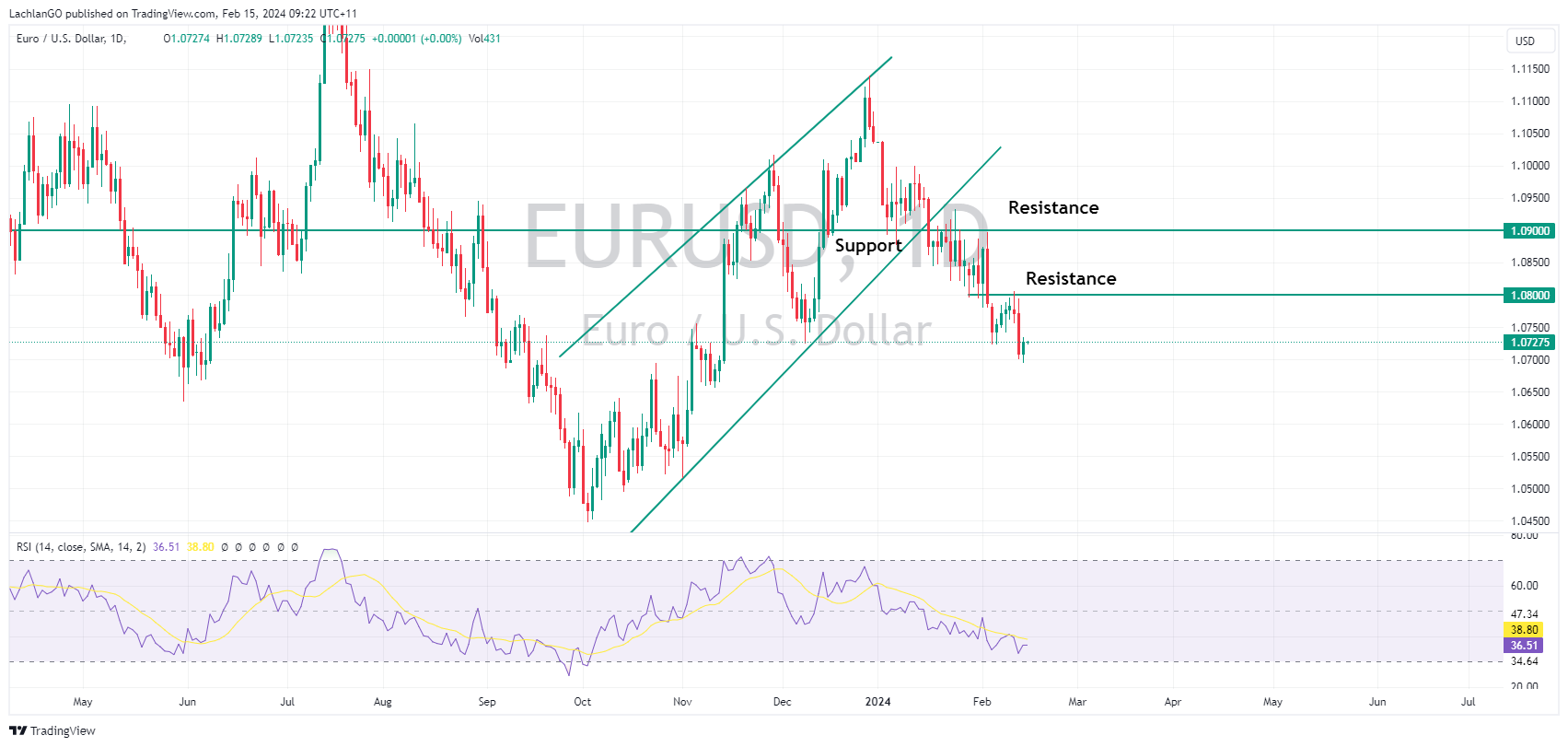

EURUSD rallied modestly, holding the key 1.07 level where it found support on Tuesday. A soft USD and beats in Q4 employment and industrial production data support the pair. Euro watchers have ECB president Lagarde testifying at the EU parliament later in the session to look forward to.

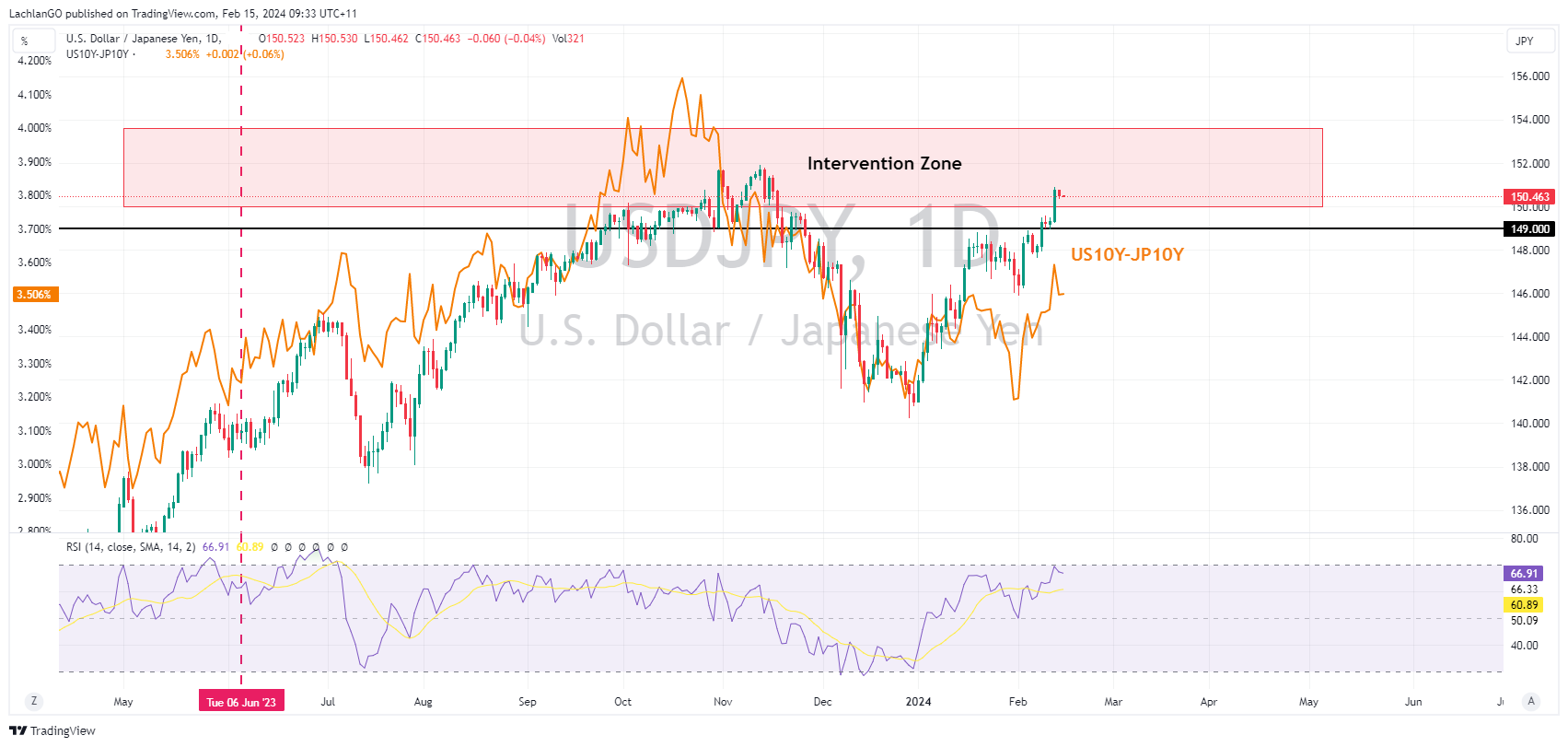

JPY saw small gains against the USD with lower UST yields across the curve benefitting the Japanese currency. Though with USDJPY still well above the “intervention” level of 150 some jawboning from Japanese officials materialised. Japanese Finance Minister Suzuki saying he is closely watching FX market moves with a strong sense of urgency and currency diplomat Kanda noting he is watching FX moves and will take appropriate actions if needed on FX.

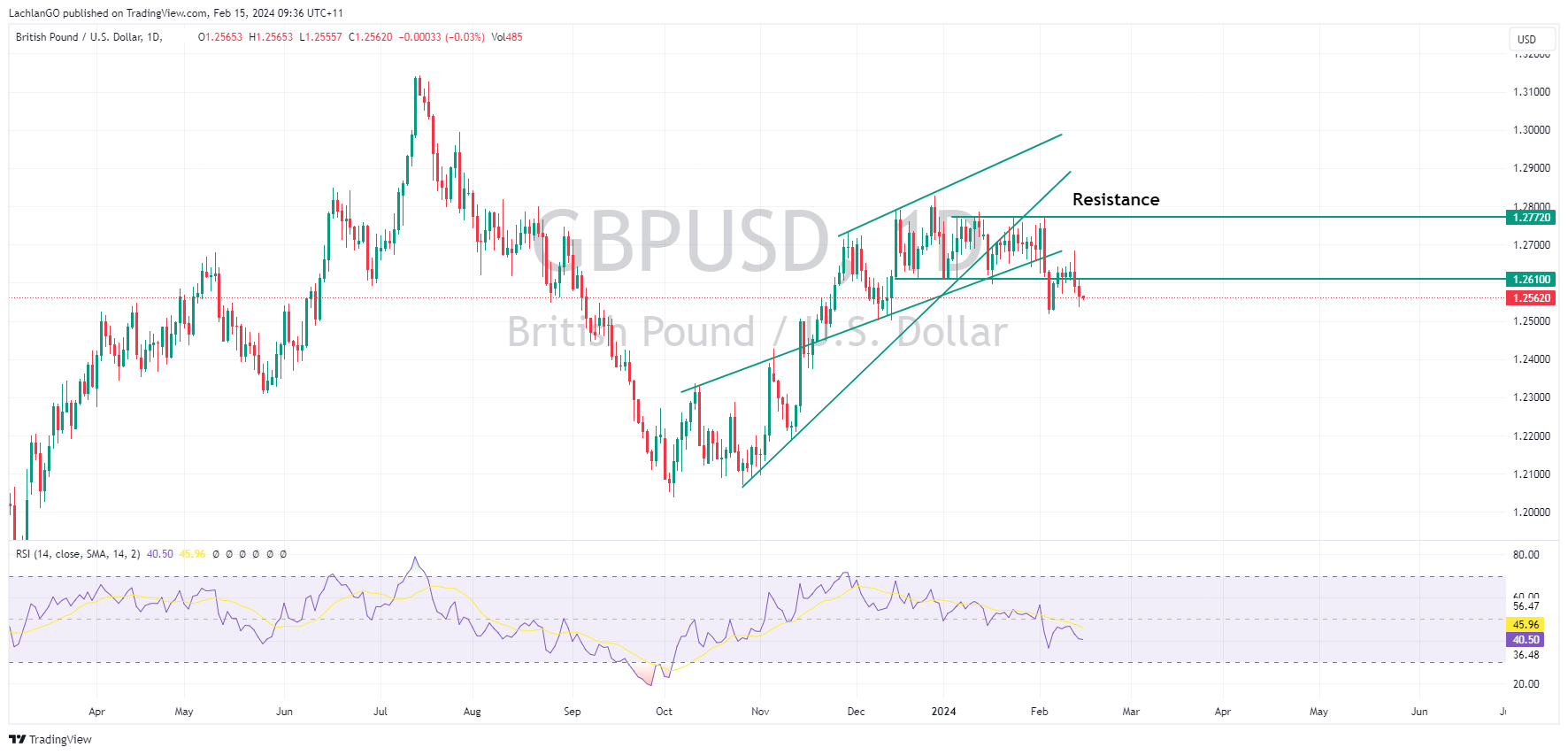

GBP was the G10 underperformer with GBPUSD setting one week lows after cooler than expected UK CPI data. The headline Y/Y maintaining a 4.0% pace, beneath the 4.2% forecast. UK GDP is ahead for Sterling traders where a contraction of -0.2% is expected.

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice.

Next Article

Deere & Company beats estimates – the stock is falling

US machine manufacturer Deere & Company (NYSE: DE) announced the latest financial results before the opening bell on Thursday. Deere achieved revenue of $10.486 billion for the three months ending 28/1/24, beating analyst estimate of $10.303 billion. Revenue was down by 8% vs. the same period year prior. Earnings per share (EPS) reported ...

Previous Article

Cisco tops Wall Street estimates

Cisco Systems Inc. (NASDAQ: CSCO) released the latest earnings results for fiscal Q2 of 2024 after market close in the US on Wednesday. The US tele...