FX Analysis – USD and GBP up on hot data, JPY and AUD under pressure

18 January 2024A hotter than expected CPI reading out of the UK along with a beat in US retail sales saw global markets turn risk off as rates markets hawkishly re-priced chances of cuts coming from Central Banks.

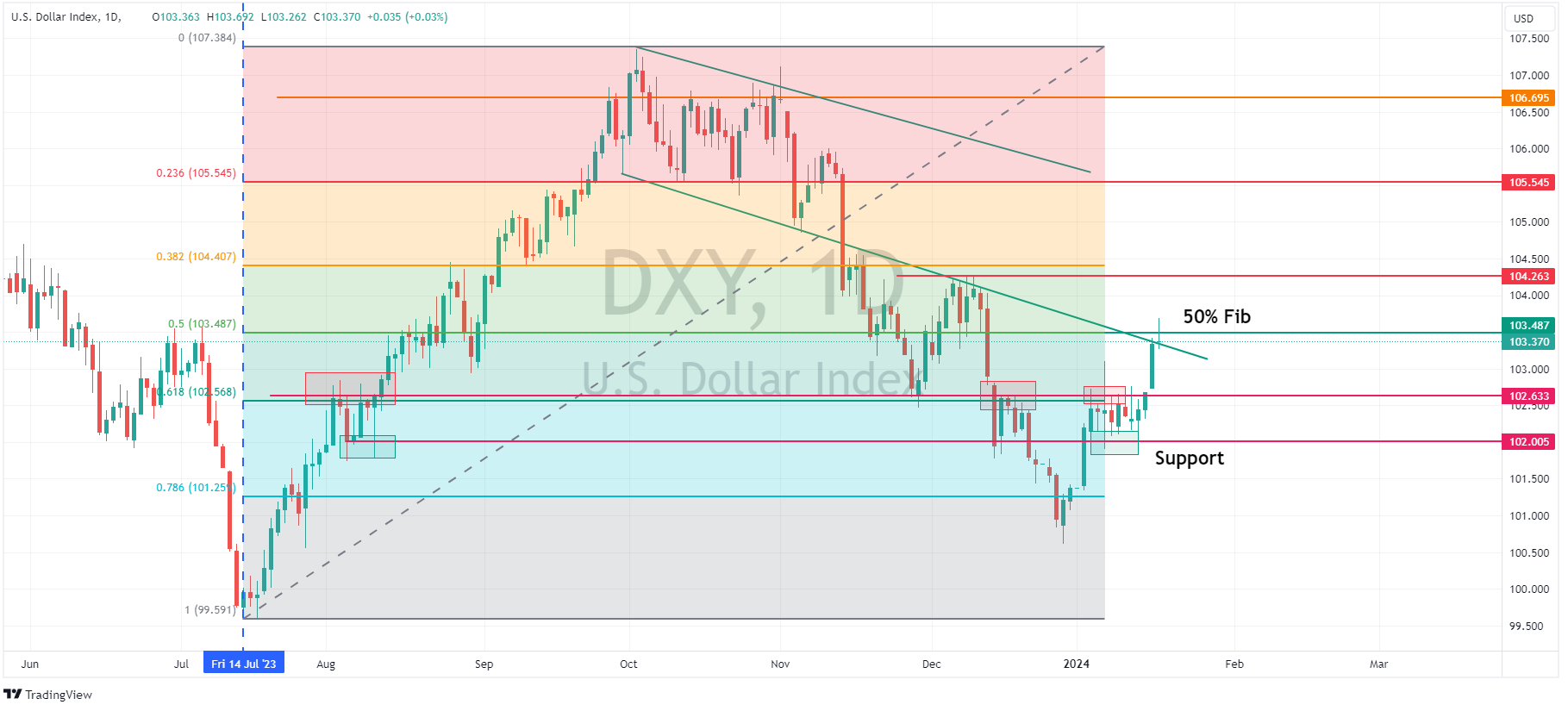

The unwinding of priced in Fed cuts saw a spike in treasury yields and the USD bid, with DXY hitting a high of 103.69 after the December US retail sales report came in hotter than expected. DXY finding resistance at the July-October 50% Fib level before paring gains.

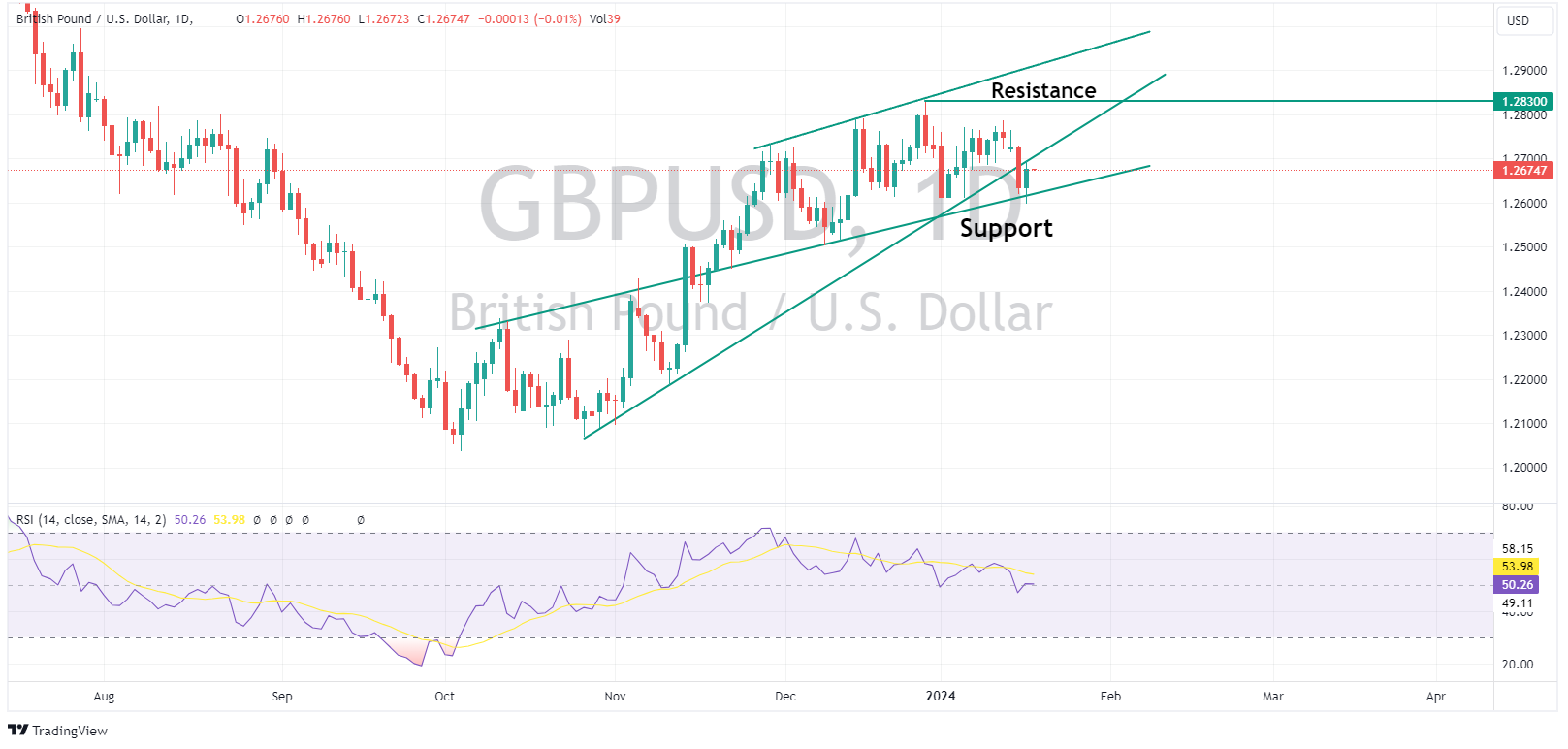

GBP saw decent gains vs the USD and EUR after a beat in the December UK CPI reading where the Y/Y figure came in at 4% vs an expected 3.8%. GBPUSD fell just short of breaching the 1.2700 level, hitting a high of 1.2696 as UK rates markets priced in a lower amount of 2024 rate cuts.

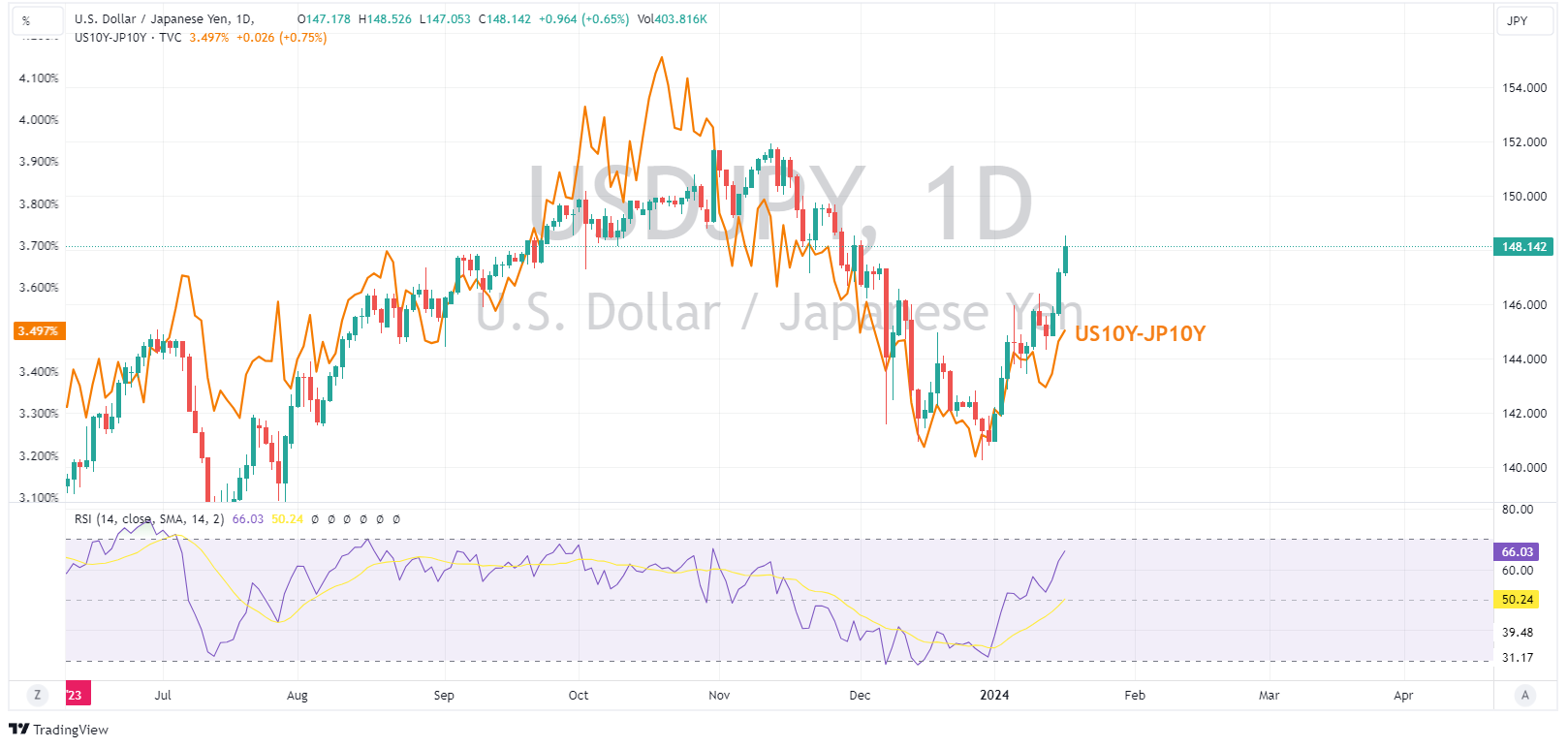

JPY was weak throughout the session with losses accelerating after the US retail sales report. USDJPY taking out the big figure at 148 rising in lockstep the US-JP yield differential. On current momentum the psychological 150 level is possibly coming into play, and with it, BoJ intervention speculation.

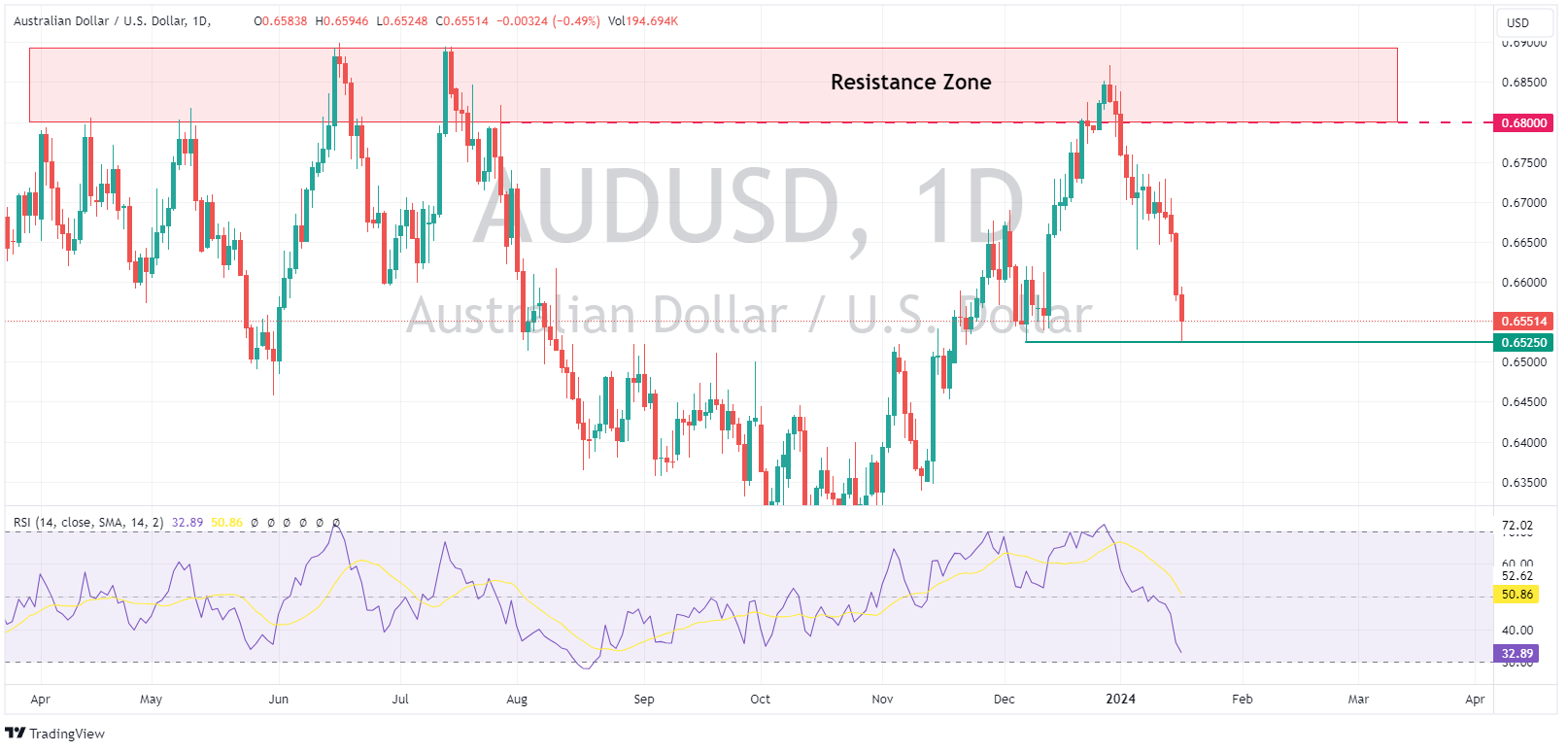

AUDUSD extended January’s losses on the sour risk sentiment and mixed Chinese figures on Wednesday. The Aussie holding below 0.6600 and dropping to Decembers lows at 0.6520 before finding some support. AUD traders have todays key December employment report to look forward to, after a bumper November reading this one will be watched closely.

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice.

Next Article

Morgan Stanley’s share price dips after earnings

US financial services company, Morgan Stanley (NYSE: MS), announced Q4 2023 and full year financial results before the US open on Tuesday. Morgan Stanley reported revenue of $12.896 billion for the previous quarter, narrowly beating analyst estimate of $12.773 billion. Earnings per share (EPS) fell well short of Wall Street expectations at $0...

Previous Article

Middle East conflict & US interest rates send Gold back towards all-time highs.

Since reaching a local bottom in October of last year, XAUUSD has experienced a strong uptrend of over 13%. Closing its third consecutive positive ses...