FX Analysis – GBP, EUR JPY, USD

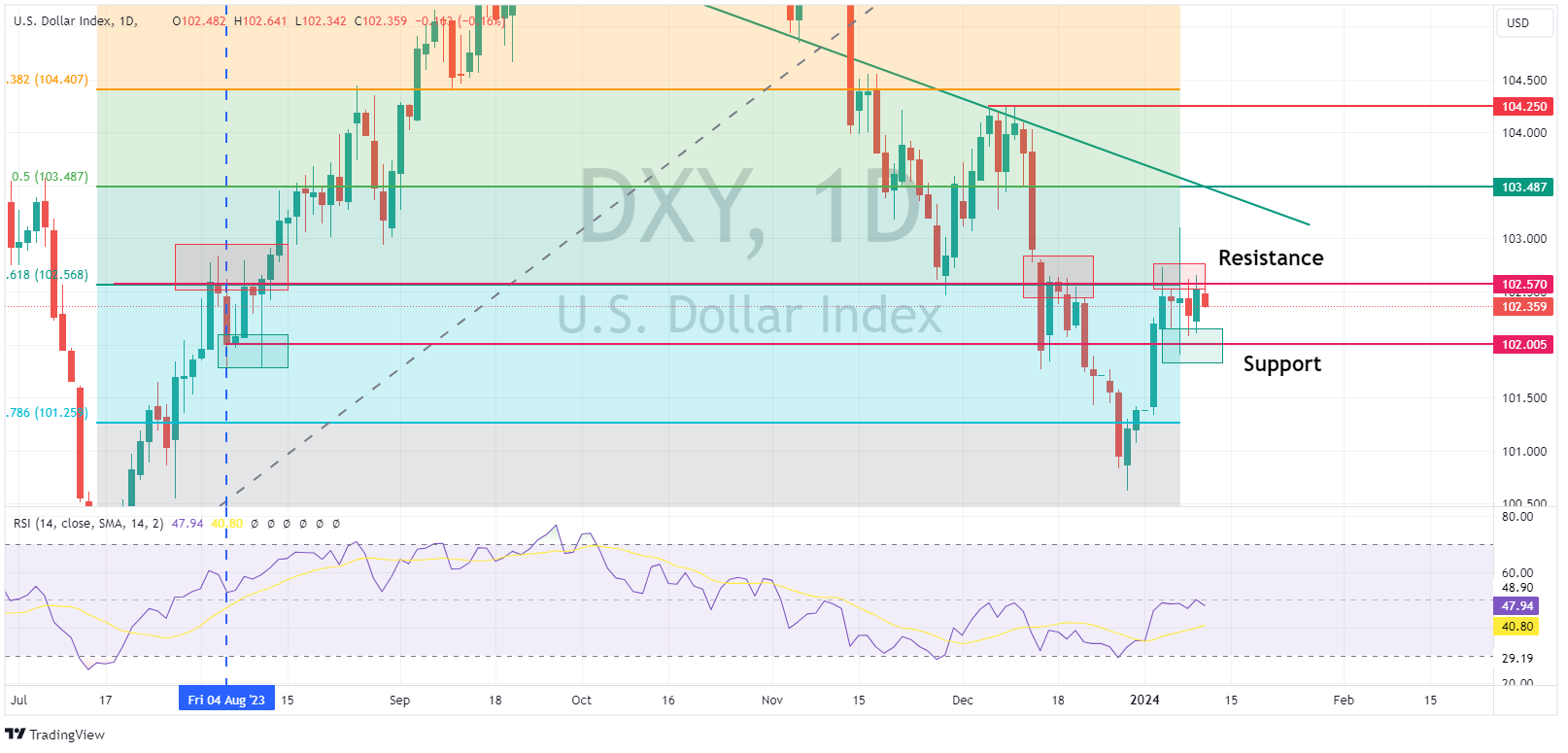

11 January 2024USD saw weakness in Wednesday’s session with a risk on equity market and only a marginal move higher in yields weighing on the Greenback ahead of today’s key US CPI report. There was little in the way of major US data releases but some hawkish leaning comments late in the session from the Fed’s Williams stemmed losses. The US Dollar Index (DXY) did make another attempt to breach the 102.57 resistance, but for the 5th time this year was again rejected, this will be a key level to watch over todays CPI report.

EUR moved higher with EURUSD heading into the APAC session at highs of around 1.0970. EUR was supported by comments from the ECB’s De Guindos who warned the rapid pace of disinflation seen in 2023 is likely to slow down in 2024 and Schnabel who said it is too early to discuss rate cuts.

JPY was the G10 underperformer after Japanese wage data came in much softer than expected, throwing cold water on expectations of the BOJ normalizing rates. USDJPY following the US10Y-JP10Y rate differential higher and breaching the psychological 145 level.

GBP also saw gains vs USD, taking advantage of a weaker USD and a risk-on session in equities. BoE Governor Bailey spoke in the UK session, pushing back on rate cut expectations while stressing the importance of returning inflation to target.

Ahead today the much-awaited US CPI report which will shape market expectations of the Feds next move and should get FX markets moving.

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice.

Next Article

Market Analysis – Hot CPI whipsaws markets – USD, Gold, JPY, AUD

USD was ultimately flat in a choppy session on Thursday after hotter-than-expected US CPI data. The US Dollar Index (DXY) hitting briefly breeching the resistance at 102.63 to hit a high of 102.76. This proved to be another false breakout of this level with DXY gradually retracing for the rest of the session to unchanged levels. JPY outperfo...

Previous Article

Market Analysis – Gold tests key level, AUD dips ahead of CPI, Oil bounces

Global markets chopped about in Tuesday’s session with no key data released with traders seemingly waiting on the sidelines for US CPI and a slew of...