FX Analysis – CNH strengthens on intervention talk – JPY breaks losing streak – Gold breaks key support

18 August 2023FX WRAP

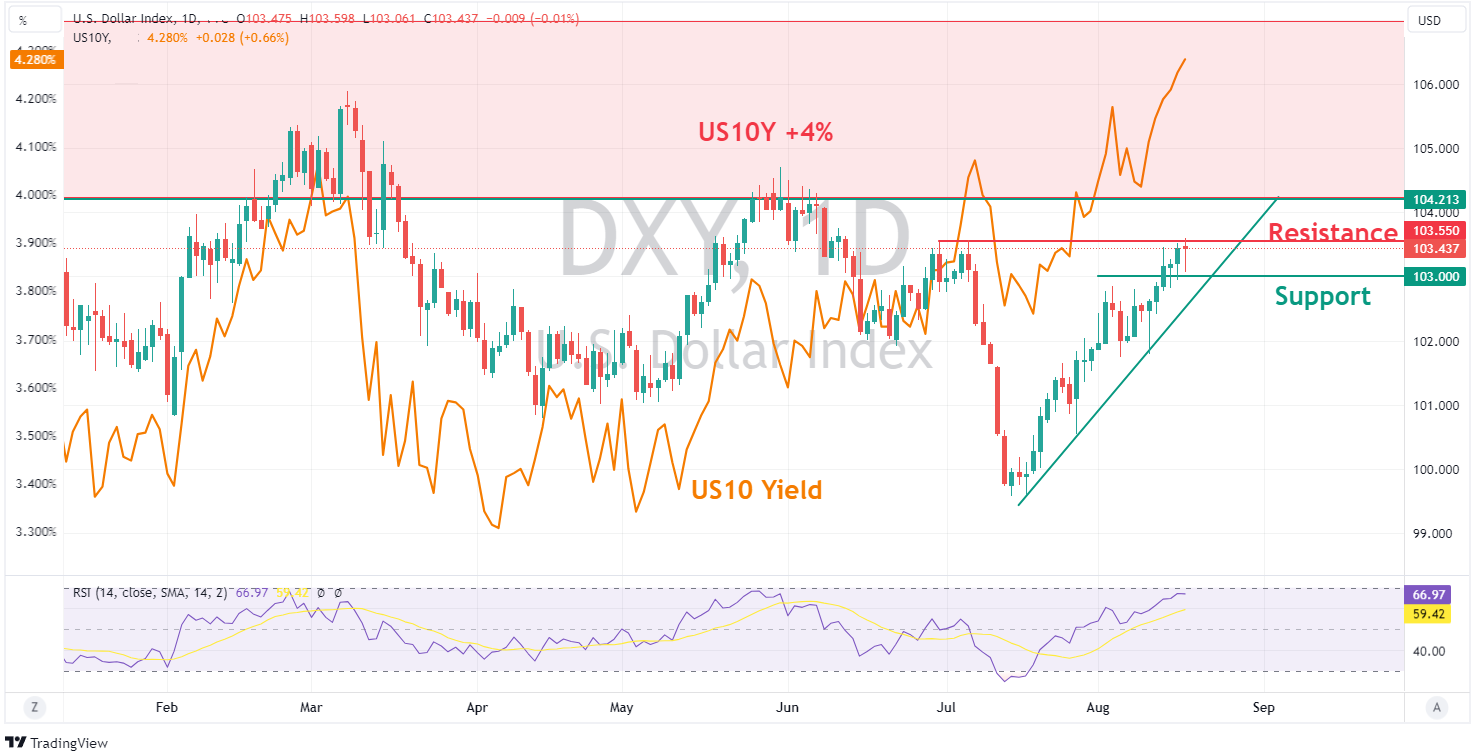

USD was choppy with the US Dollar Index ending the session flat in range bound trade. Unemployment claims dropped to 239k from 250k the prior week which was in line with consensus and having little effect on the USD, though Philly Fed Manufacturing figures did have a big beat coming in at +12.0 vs an expected -9.8, which was the highest print since April 2022. This, along with stubbornly high yields and a general risk-off background, saw the USD reverse some early weakness on Yuan intervention headlines. DXY pushing its head above the resistance at July’s highs before stalling.

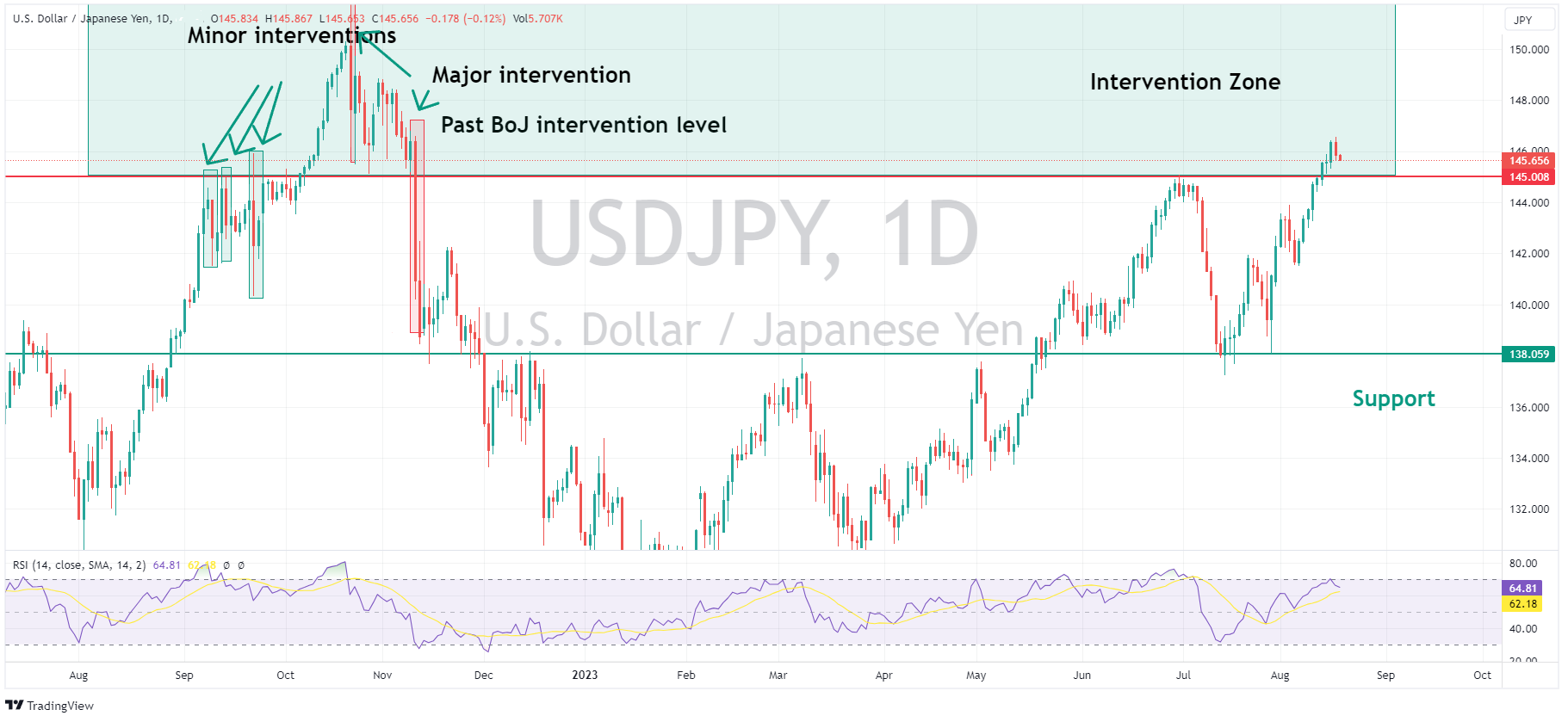

JPY was the G10 outperformer against the USD. USDJPY now having eight straight days printing higher highs and higher lows, its longest streak since October’s BoJ intervention-driven collapse from 32-year highs. USDJPY hit a high in APAC trading of 146.56 on weak Japanese data , before fading to hit a low of 145.62. Not a peep out of the Japanese MoF yet but desks put the recovery down to yield differentials as US Treasury yields plateaued, while a poorly received Japanese JBG bond auction saw Japanese yields spike on the 30 years.

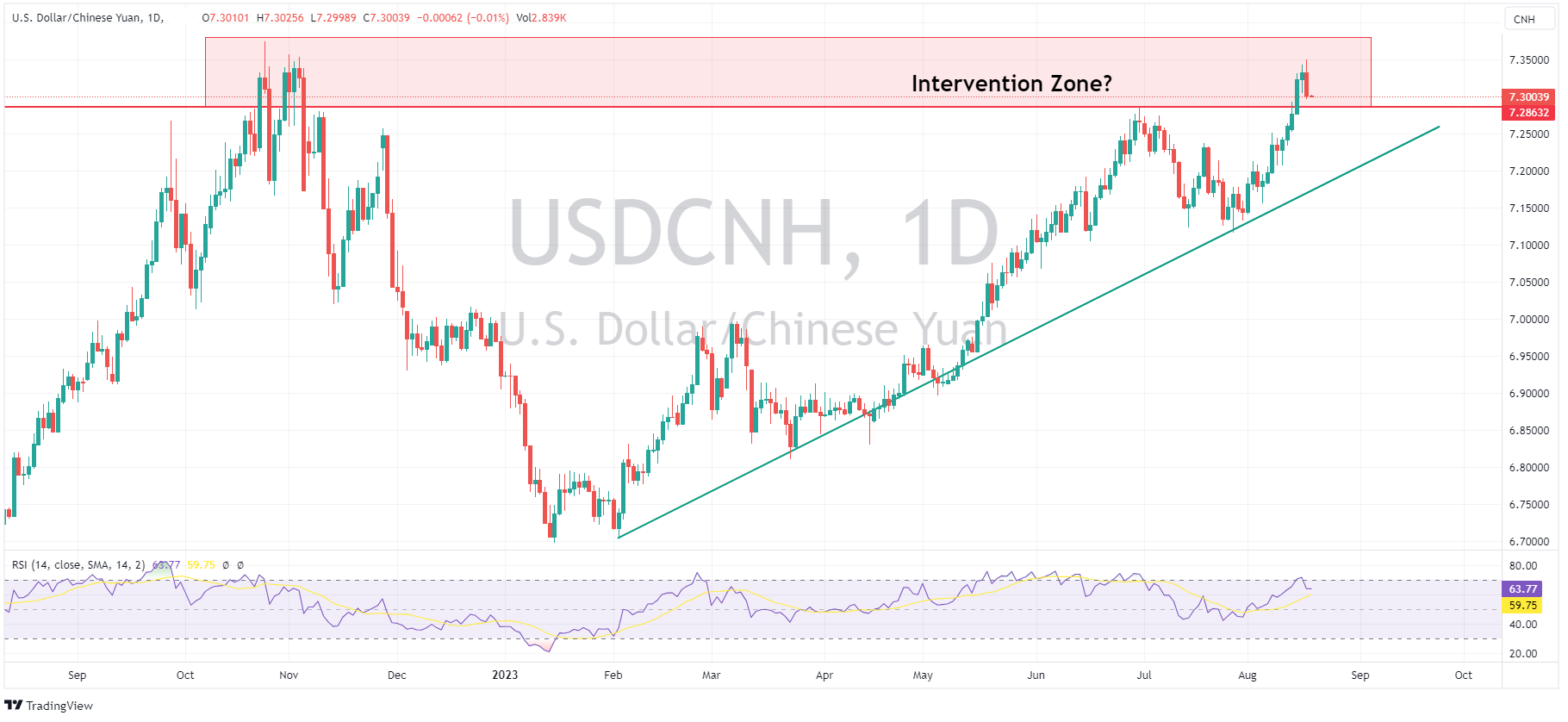

Another currency on the intervention watchlist is the Chinese Yuan. Bloomberg reports of Chinese authorities reportedly telling state banks to escalate Yuan intervention saw USDCNH have its largest drop of the month, breaking a 5-day rally. There is also theories floating around that China is funding Yuan intervention through selling US Treasuries, which would explain US treasury weakness (keeping yields elevated), which is unusual in an equity market risk off environment.

AUD and NZD were the G10 underperformers again, AUD underperforming the NZD after a big miss in the Aussie employment report, where unemployment unexpectedly rose to 3.7% and jobs fell by 14.6k vs a 15k rise expected. AUDUSD printed a low of 0.6366, but moved higher on the back of Yuan strength as the session went on. AUDNZD recovered the losses after the Aussie jobs report to move back above the key 1.080 level.

Gold again moved lower, with XAUUSD breaking key support at 1892, after a test of the 1902 resistance early in the session was forcefully rejected.

The economic calendar is very light today, with only UK retail Sales being of any significance.

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice.

Next Article

The Week Ahead – Powell and Jackson Hole, EU PMI’s, Japanese Inflation

Global markets enter the final full week of August on a downbeat risk-sentiment after another losing week in US equities saw the Nasdaq 100 have its lowest weekly close since June. The hangover from the surprise Fitch downgrade of US debt continues to keep yields elevated, the US 10 Year stubbornly holding above 4%, creating a headwind for risk ass...

Previous Article

Asian Open – Hawkish FOMC sees US stocks slide again, USD rally. JPY clobbered, AUD dips ahead of Jobs Data.

Asian indices are looking to open soft in Thursday’s session after major US Indices extended their sell-off in Wednesdays session on stronger than e...