US stocks slide on weak JOLTS report and lingering bank fears ahead of FOMC

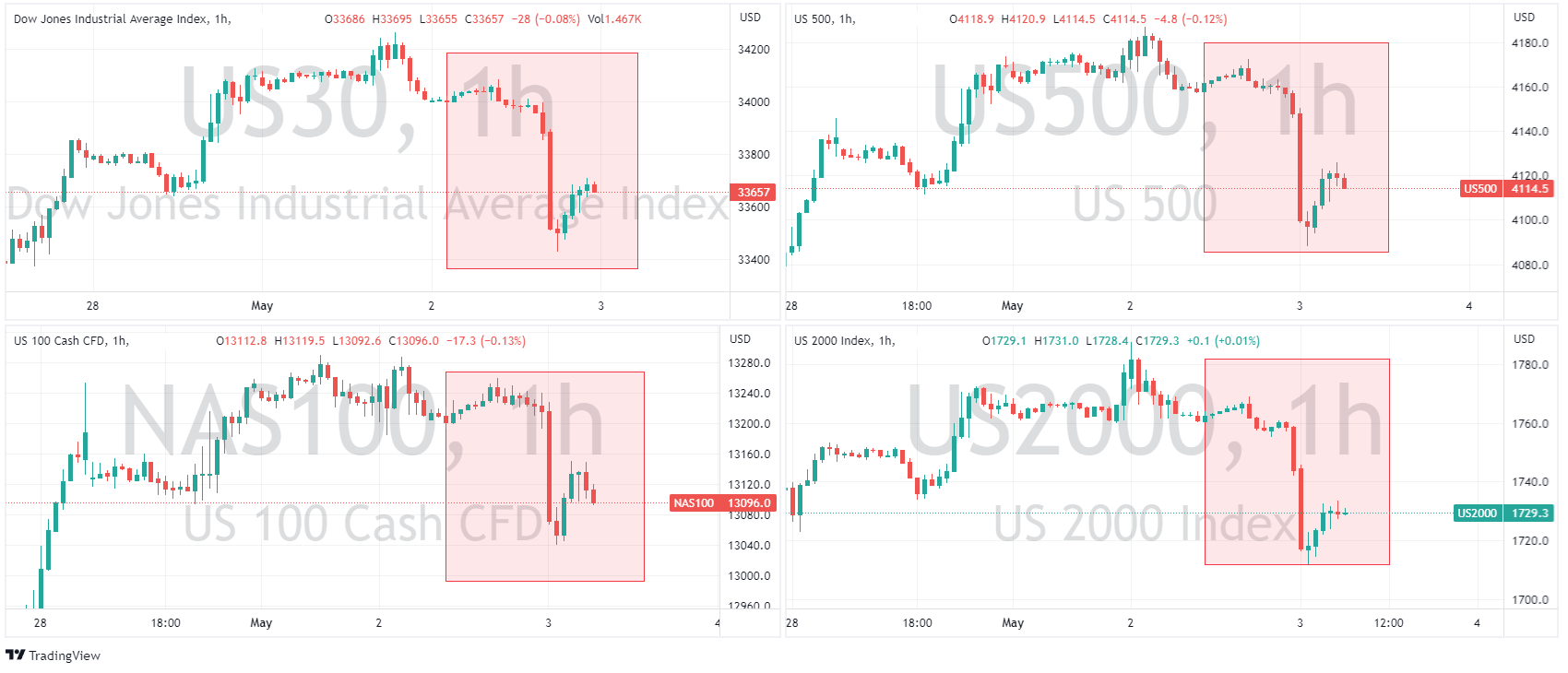

3 May 2023Risk off returned as US stock indices were broadly lower in Tuesdays session on JOLTS job opening data showing a rapid weakening of the US labour market and regional banks again resuming their slide on lingering fears of the health of the sector. All four major indices finished well in the red, with the home of the aforementioned regional banks, the Russell 200 leading the charge lower, down by over 2% on the session.

JP Morgans bailout of First Republic Bank was quickly forgotten with the S&P Regional Banking ETF (KRE) tanking over 6%, showing that investors are far from convinced the regional bank crisis is over just yet.

FX Markets

The US Dollar was mostly weaker on the session after a miss from the JOLTS job opening figure which showed a weakening in the US labour market. This saw bond yields falling and a repricing of the Feds actions in their Wednesday meeting, with hike odds falling to 85% from the 90%+ on Monday, dragging the USD lower despite the sour risk tone, the US Dollar index falling below 102.

The Aussie Dollar initially outperformed, with AUDUSD breaking above 0.67, after the RBA took markets by surprise with a 25bp hike on Tuesday while also noting inflation remained too high and left the door open for further tightening of policy. This rally however fizzled later in the session as the downbeat risk tone weigher on the Aussie, AUDUSD giving up the 0.67 handle and retracing 50% of the post RBA bump.

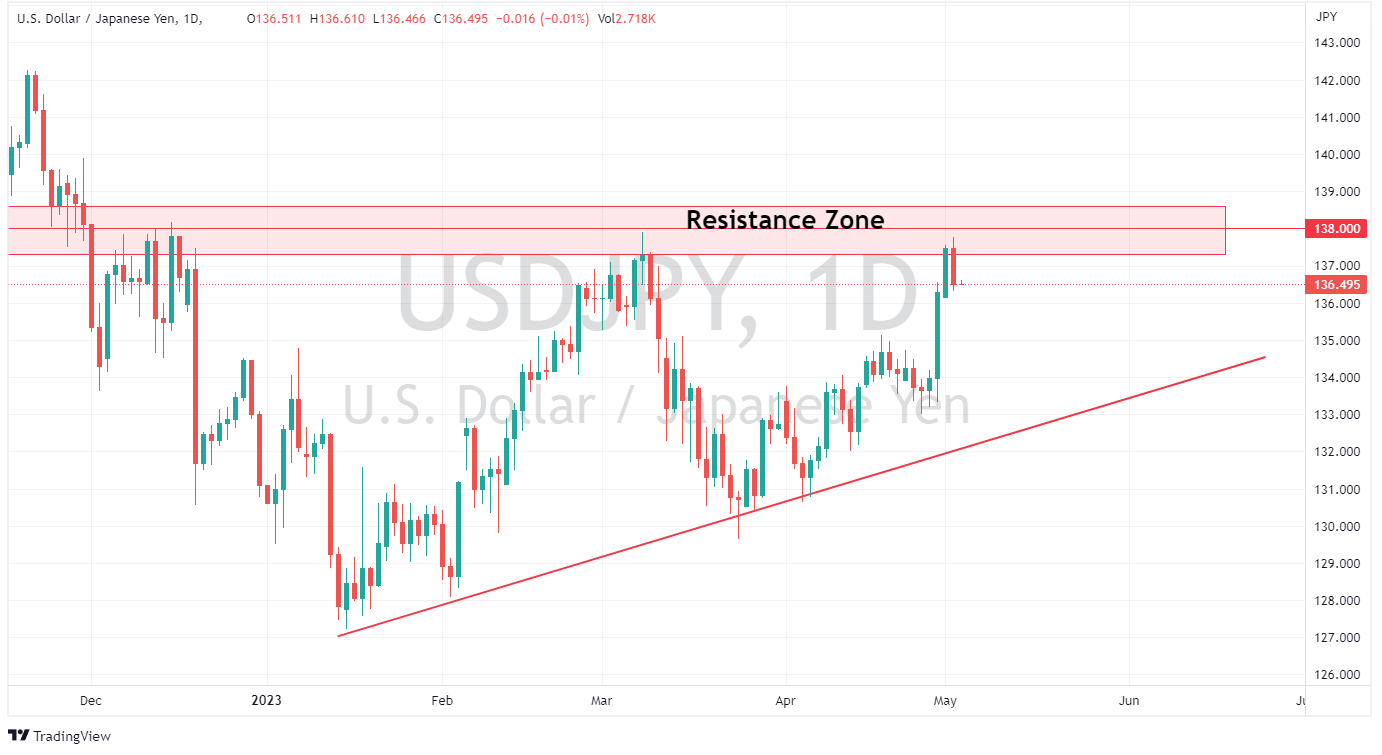

The Yen was the outperformer, again showing it’s favoured safe haven status as it rallied strongly against the Greenback as it benefitted from the risk off sentiment and falling US yields. USDJPY pushing strongly lower out of its resistance zone that has been in place during 2023.

Commodities

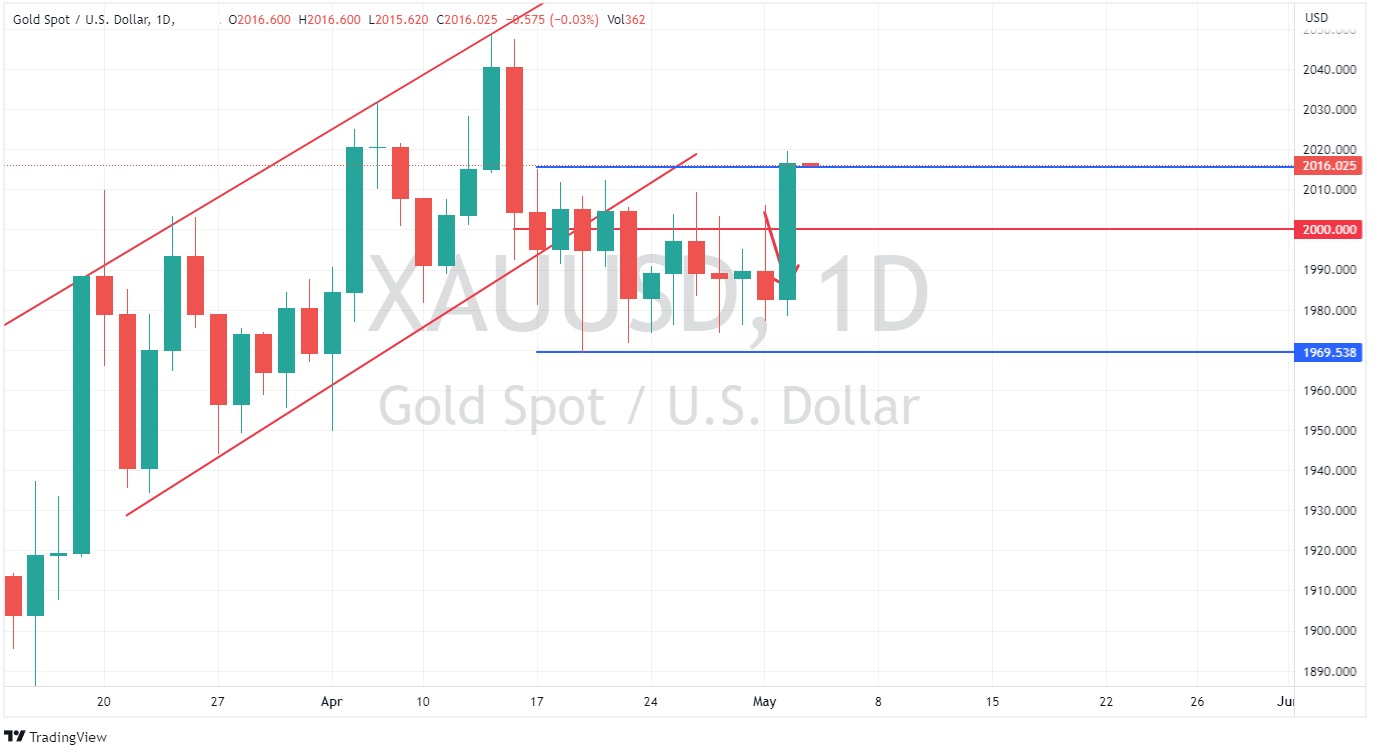

Lower yields, a weaker USD and safe haven flows due to banking woes and US debt ceiling issues saw gold soar above 2000 USD an ounce to hit it’s highest level in 3 weeks, the 2000 level has been a real battle in the last couple of weeks, if XAUUSD can hold above that critical level a new leg higher to all-time highs is on the table.

Crude oil tumbled, crashing through its April lows on a combination of risk-off fears, continued angst around Fed hikes weighing on demand and rising Iranian oil production. USOUSD tumbling down to a 71 handle and now well and truly erasing all the post OPEC+ cuts rally.

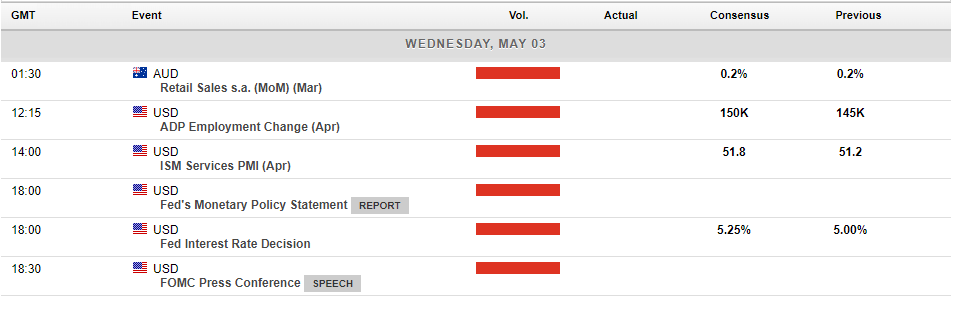

In today’s economic calendar, the big risk event is the FOMC meeting later in the US session. Markets are still strongly pricing in a 25bp hike (they were also strongly pricing in a hold from the RBA yesterday and we know how that turned out) so a move higher in rates should have too big an impact on the markets, the accompanying statement and presser is where the volatility will come from as traders try to decipher what the Feds intentions are going forward.

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice.

Next Article

Market Analysis 1-5 May 2023

XAUUSD Analysis 1 – 5 May 2023 The gold price outlook is positive in the medium term. Although last week's closing of the buying pressure bar would indicate a loss of buying momentum due to the weekly selloff. But the price is still moving in a narrow range above the 1960 support or the recent high on the Weekly timeframe. resistance 2...