US stocks rip higher again, China falters and Yen-tervention fails

25 October 2022Another day, another push higher in US equities as the market mood remains buoyant during what has so far been a good earnings season, with much more to come. Services and manufacturing PMI figures out of the UK, EU and US all came in weaker than expected and well in contraction territory, in the equity market theme is “Bad news is good news” (weaker economy = les aggressive rate hiking) this also gave risk assets a tailwind, with the Dax and FTSE also rising with their US peers.

The one major market that did buck the risk on trend was China, with the National peoples Congress wrapping up on the weekend. The market seemed unimpressed with what investors perceive as Xi’s new era appearing anything but more open, as a result Chinese stock markets sold off hard and the Chinese Yuan tanked with the USDCNH rising to record levels.

Sticking with FX, the big story is the volatility in USDJPY as the Japanese authorities seemingly continued to intervene in the FX market to strengthen the Yen as it sits around 32-year lows against the greenback. So far, the multiple interventions haven’t had much success, yesterdays was almost fully retraced in a couple of hours, with Fridays larger push down now 50% retraced. Though upward momentum has been slowed on the USDJPY as traders are wary of being caught on the wrong side of one of these BoJ initiated rapid selloffs in USDJPY.

In the market ahead, a bombardment of earnings figures looks sure to see a volatile US equity market with tech giants Alphabet (GOOG), Microsoft (MSFT) joining Dow stalwarts General Electric (GE) and General Motors (GM) in releasing their Q3 results.

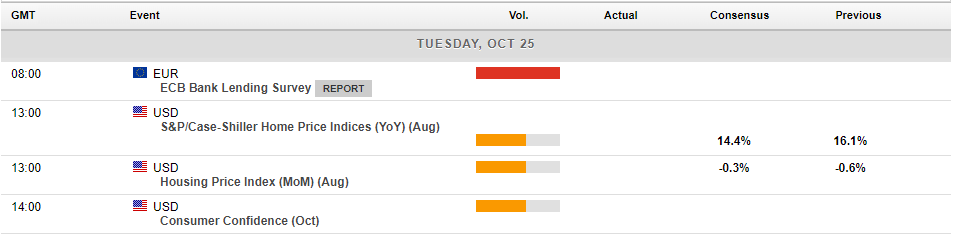

In scheduled economic releases, today is a bit of a calm before the storm of Central bank later in the week, though Fed watchers will be paying special attention to US house prices and Consumer confidence released later today.

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice.

Next Article

Pound gearing up for a reversal?

The UK has had to deal with recessionary fears, sky high energy prices, a cost-of-living crisis, and a breakdown in political leadership. This has caused the GBP to fall to lows not seen since the last century. The British economy has also had to deal with a potential liquidity crisis caused by some of the large UK retirement funds almost bringi...

Previous Article

US stocks rip higher again, China falters and Yen-tervention fails

Another day, another push higher in US equities as the market mood remains buoyant during what has so far been a good earnings season, with much more ...