US stocks rally in quiet session, Yields and USD down, AUD holds major support.

29 August 2023US indices finished in the green, managing to hold onto gains following an upside boost from the Asian session. Asian bourses broadly rallied after Chinese stocks were buoyed by authorities taking measures to help boost their local market by cutting stamp duty on stock trades.

With markets being risk-on predictable drops in the USD and yields (US 10 year again struggling above the 4% level) saw rallies in risk currencies, with the AUD being the biggest beneficiary, also bolstered by the news out of China.

FX Markets

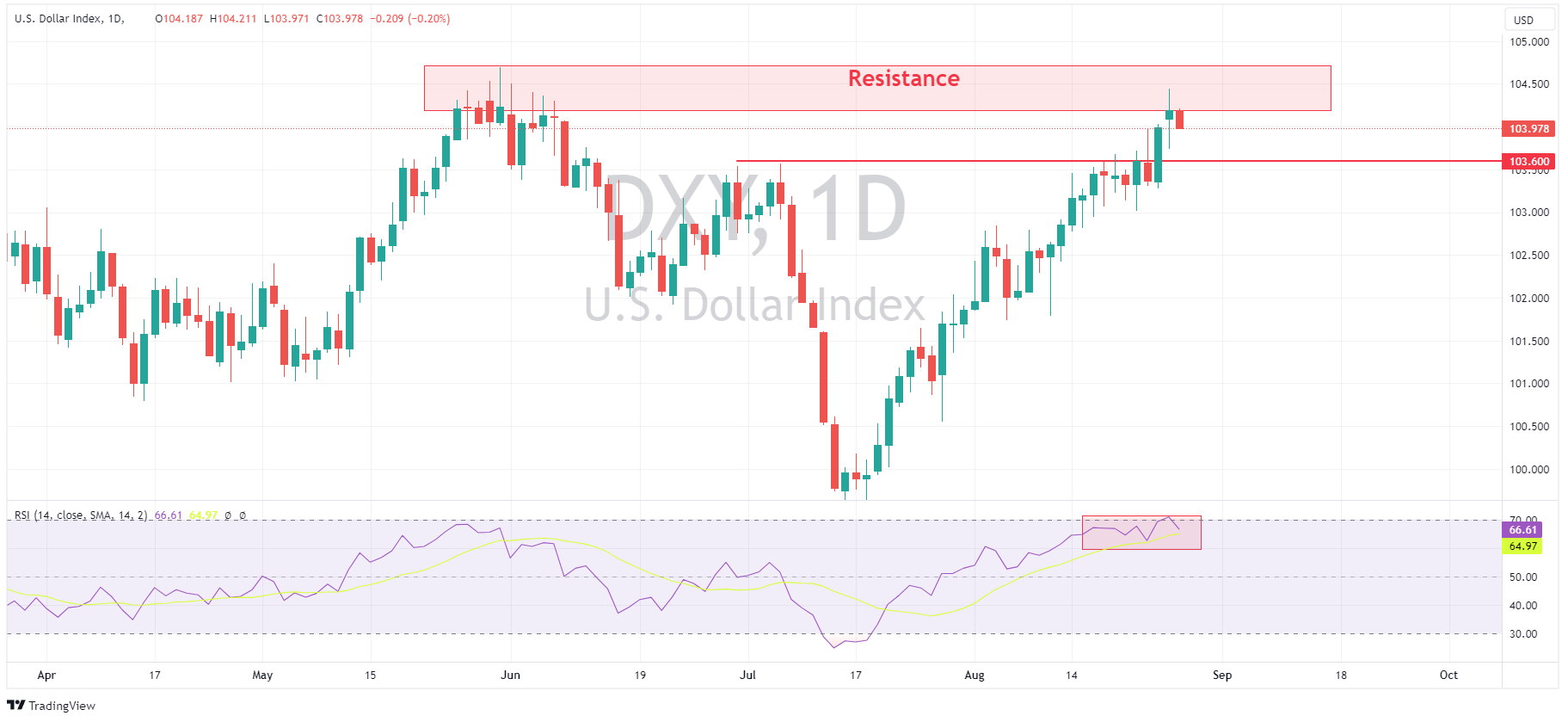

USD was lower to start the week, erasing Fridays gains after we saw a decisive push late last week above the 103.60 resistance. Besides the China news it was a thin newsflow session for US releases so the primary driver was risk sentiment, that will change in the coming days with key risk events on this week’s calendar, including NFP. DXY printed a high of 104.21, where it found resistance at the May/June highs.

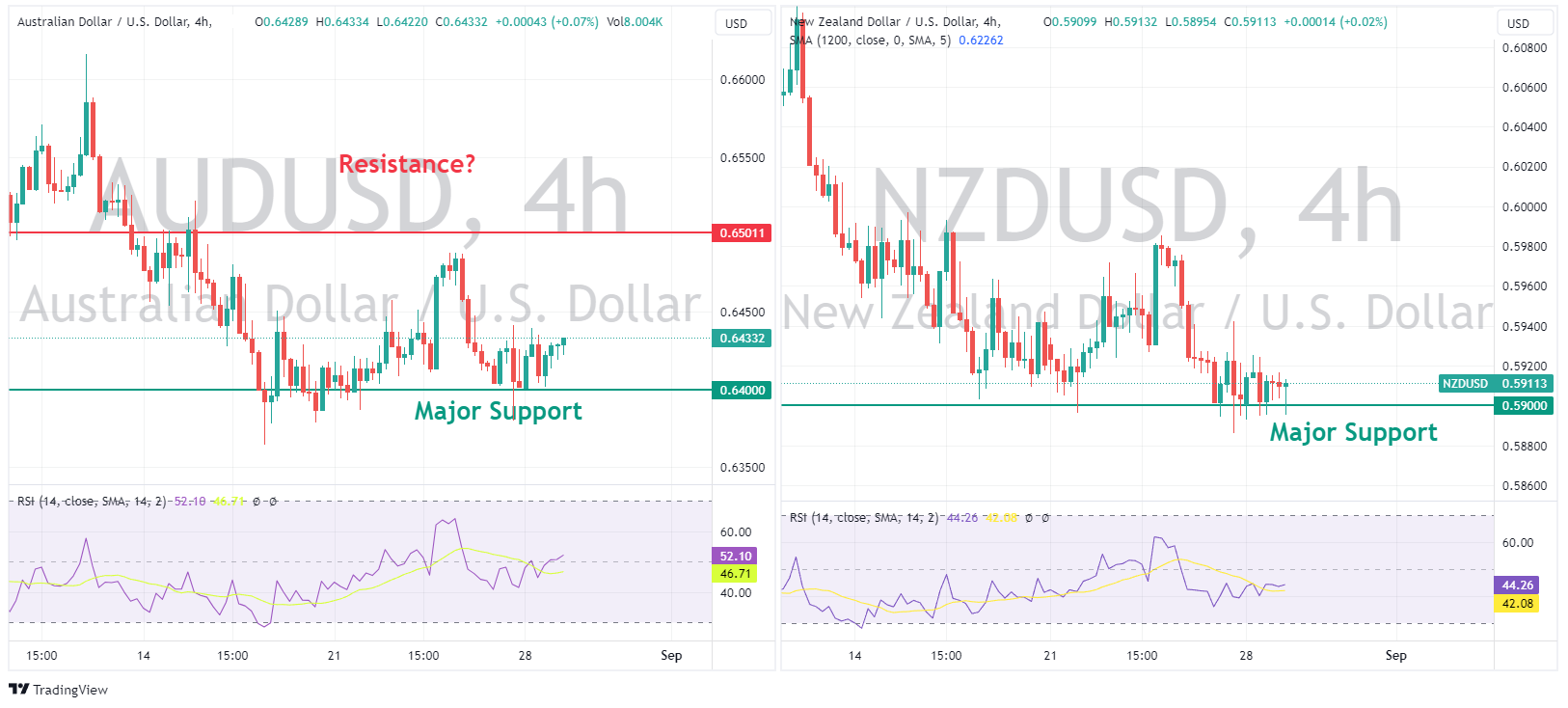

Cyclical currencies AUD and NZD were stronger against the USD, outperformance was seen by the Aussie with an upward revision to retail sales figures and Chinese attempts to prop up their equity market adding to the risk-on tailwinds. AUDUSD bounced decisively from the major support level at 0.6400 and held above the whole session, closing around the high of 0.6440. GBP and NZD saw mild gains, like its Aussie counterpart, NZDUSD managed to also hold its major support at 0.5900 (though not as convincingly), AUDNZD also rallied to 1.0878, setting new August highs. Aussie traders have the RBA’s incoming Governor Bullock speaking today to look forward to.

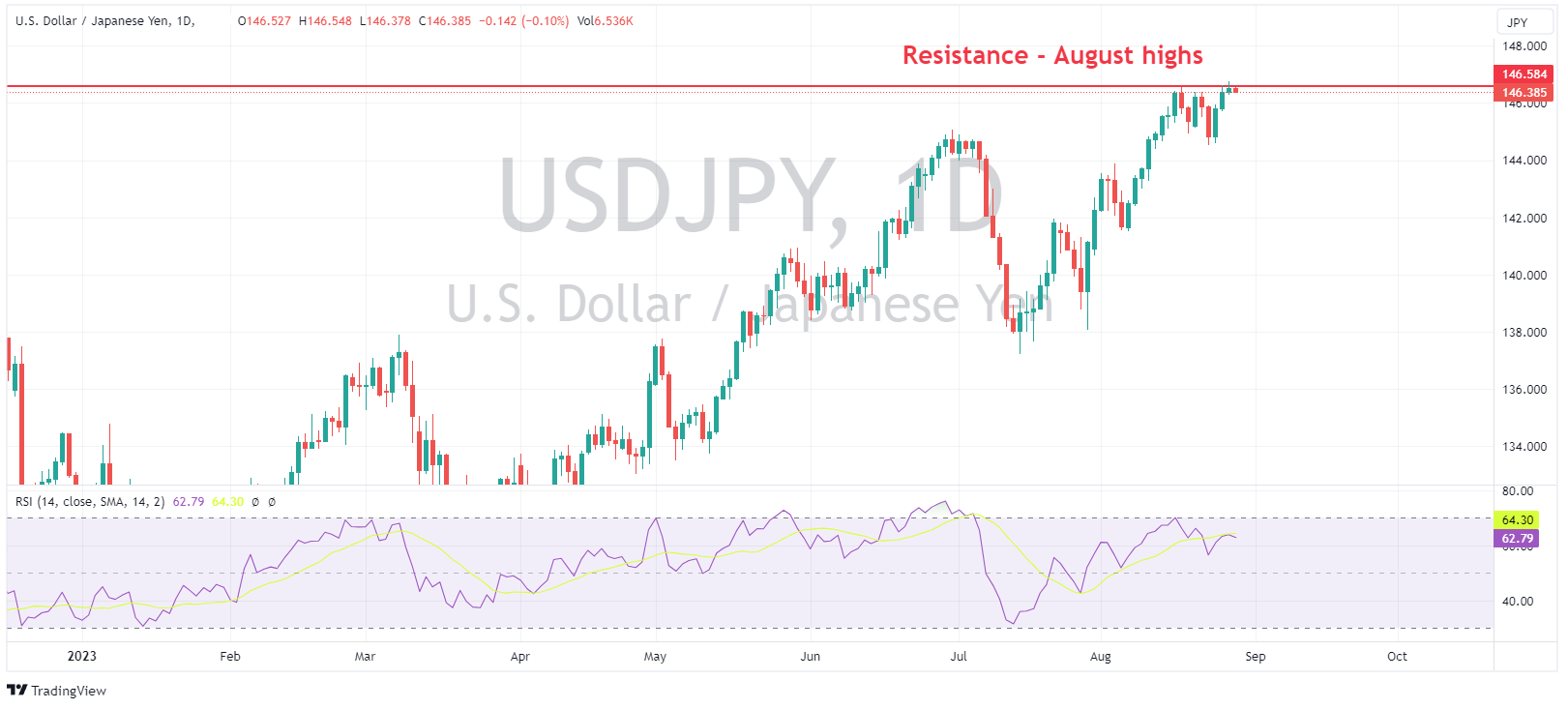

JPY was the G10 underperformer with losses vs. USD. A Goldman Sachs note to clients predicted USDJPY hit highs not seen since the 1990s if the BoJ sticks to its dovish stance, with a 155 projection in the next 6 months. USDJPY hit a high of 146.75 in Monday’s session, constrained by the resistance level at the August highs. With the Yen still underperforming despite US yields sliding, this resistance level looks precarious at best.

Gold took advantage of a weaker USD and falling yields, continuing it’s week-long rally of the major 1885 support level. XAUUSD hit a high of 1926, the next test looking to be the June/Jul Support/Resistance level.

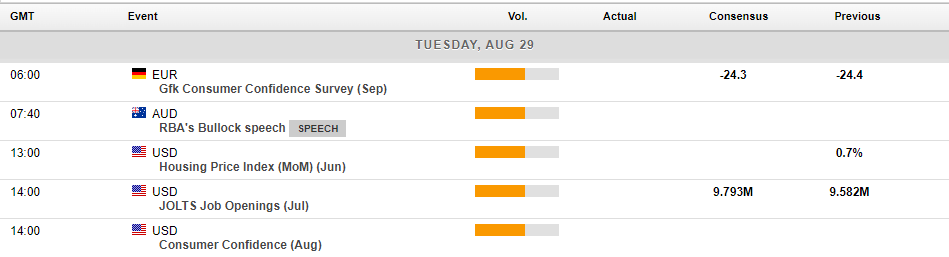

In today’s economic calendar, the week in earnest begins, with RBA incoming governor Bullock to speak and Jobs and consumer confidence data out of the US.

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice.

Next Article

Asian Open – FX analysis – USD and yields tumble, risk currencies rally on weak US data

USD was firmly in the red in Tuesdays session, with the US Dollar Index (DXY) having it’s largest drop since mid-July. A rally in DXY during the Asian and early European session dramatically reversed after big misses on the JOLTS report and consumer confidence saw a dovish repricing in rates markets and a risk-on back in charge. Stocks rallied an...

Previous Article

PE ratios: What they tell you (and what they don’t)

What is a P/E Ratio? The Price-to-Earnings (P/E) ratio is a indicative valuation metric that measures a company's current share price relative to i...