US stocks end slightly lower in a choppy session after hot PPI data and mixed FOMC minutes.

13 October 2022US markets mostly tread water ahead of todays CPI figure, equities and the USD traded in a fairly tight range, a lack of expected chaos out of the UK and what were considered a mixed FOMC minutes saw markets in a holding pattern as traders await US inflation data.

Though a modest drop as compared to recent times, it still marked the 6th down day in a row for the S&P 500 and Nasdaq, with the S&P 500 now down over 25% from the highs, putting it well into bear market territory.

US PPI figures (Change in the price of finished goods and services sold by producers) came in at 0.4% for September, a steep rise from the previous month and handily surpassing analyst expectations of 0.2% showing that US inflation is sticking around and could bode for an elevated CPI figure later today.

The VIX index (or fear index as it is sometimes known) was bid today, spiking back up above 34 to touch it’s highest reading this month as investors rushed to hedge themselves ahead of today’s CPI.

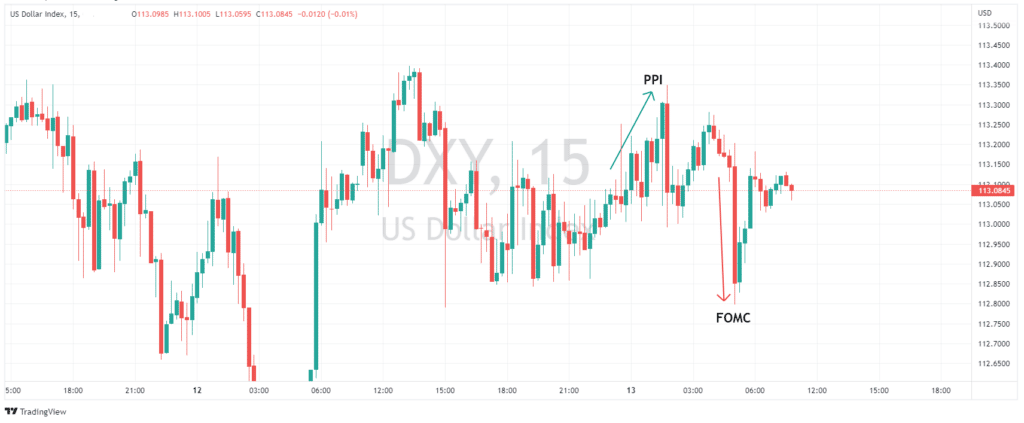

The USD had an initial rally on hot PPI figures, dipped on mixed FOMC minutes and managed to catch a bid to finish the day mostly unchanged for the day.

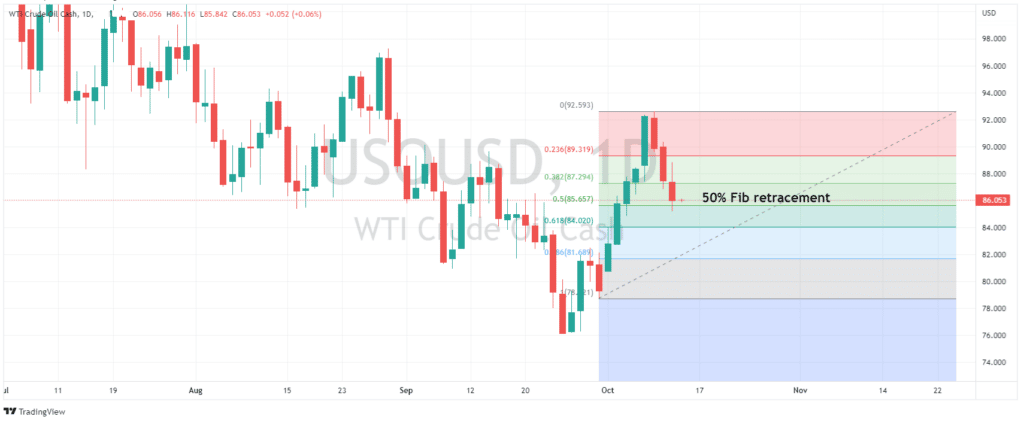

In commodities, Oil was down for 3rd straight day, finding support after hitting the 50% Fibonacci retracement of its October gains. This came on the back of growth concerns after a report from OPEC/EIA cutting global demand growth expectations.

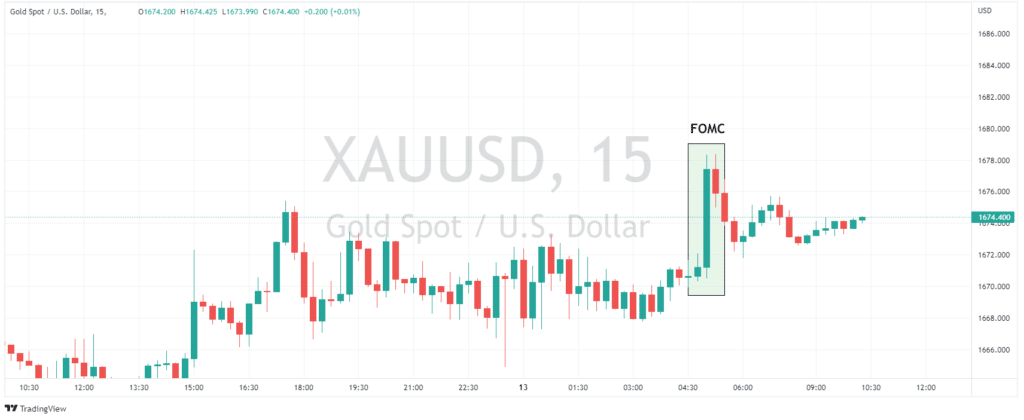

Gold climbed modestly for the day, rallying after the FOMC minutes but giving that spike back late in the session as the USD caught a bid.

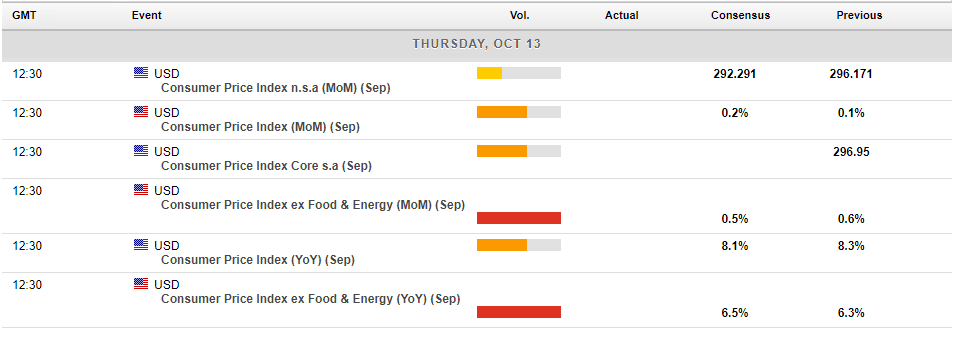

In economic announcements, all eyes will be on tonight’s US CPI figure. Analysts expects to see inflation increase 8.1% from a year ago in September. Anything above the prior reading of 8.3% should see a sharp decline in risk assets. On the flip side, a much softer reading may result in a sharp relief rally as markets re-price their Fed hiking predictions.

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice.

Next Article

How to maximise your trading strategy using Relative Volume?

For new traders, it can be difficult to know which indicators to use, the saturation of various moving averages, RSI’s, MACD’s and more can be overwhelming and counterproductive. However, utilising relative volume, as an indicator is one of the most important sources of information for technical traders. What is Volume? Vo...

Previous Article

Bank of England gives Funds three days to get books in order

The Bank of England has seemingly turned its back on protecting UK Retirement funds, after initially bailing out these funds who were facing serious l...