US equities surge after shrugging off hot CPI figure in chaotic session

14 October 2022US stocks ripped higher after a hot CPI figure saw the S&P 500 open over 2% down from the previous close only to finish up 2.6%. This came despite an Inflation figure that was higher than analysts expectations (8.1% YoY) at an 8.2% increase from September last year and a 40 year high.

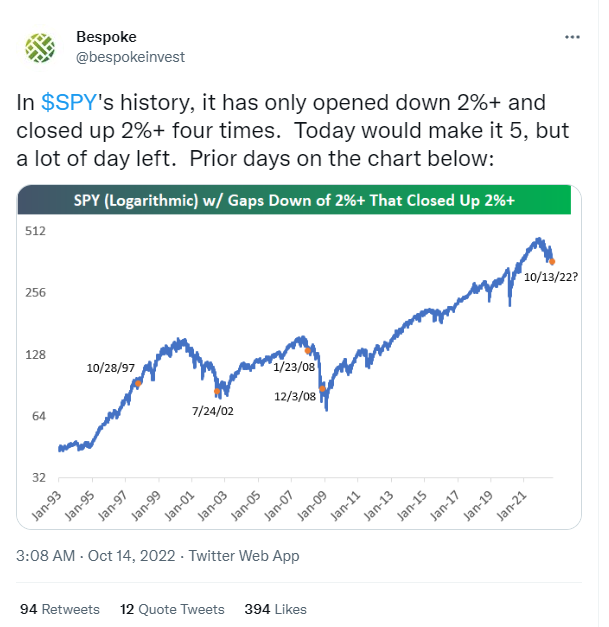

S&P 500:

This is only the 5th time in history the S%P 500 has done this, opening over 2% down to finish over 2% up, two of those happened in the depths of the GFC highlighting the turmoil in risk markets currently.

Treasuries were just as chaotic as stocks today with the US 10 year T-Note yield spiking above 4% on the CPI print, then a complete reversal even as rate hike odds at the Feds November meeting jumped to a 99% expectation of a 75bp move up.

US 10 Year T-Note yield:

Price moves in other risk assets were almost identical, with large moves on the CPI print, retracing some or all of the CPI move as the session went on.

Bitcoin followed a similar path to stocks with a spike down on CPI followed by a buying panic as it again found strong support in the 18000 – 19000 zone back above $19000…

Gold ended the day lower despite US weakness, though did recoup most of the CPI print drop.

XAUUSD:

Oil prices dumped, then pumped hard after the CPI print as a weaker US dollar coupled with the big equity turn-around bolstered crude.

USOUSD:

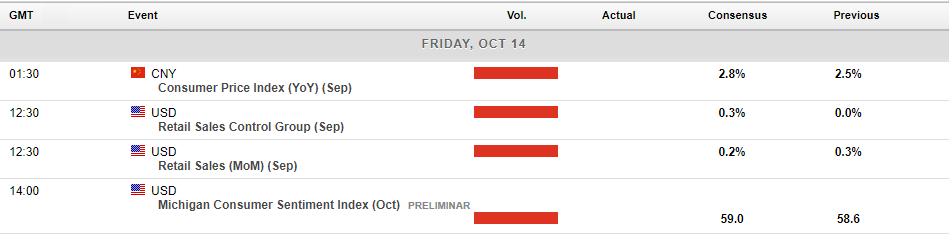

In todays economic news, some more big US figures in retail sales and consumer confidence will be released today. They probably won’t generate as much fireworks as yesterdays long awaited CPI figure, but with a Federal Reserve in a “data dependant” mode, we could still see some volatility.

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice.

Next Article

AUD bounces strongly in line with US equity’s jump

The US indices pumped higher as holders of shorts had to close their positions which resulted in one of the strongest sessions in recent months. The US dollar finally dropped back down, and it gave the AUD some much needed relief and is showing some potential of a short-term reversal. The question remains, whether this bounce will hold, or whether ...

Previous Article

How to maximise your trading strategy using Relative Volume?

For new traders, it can be difficult to know which indicators to use, the saturation of various moving averages, RSI’s, MACD’s and more ...