US equities extend losses into month end on weak US job data and hot EZ inflation

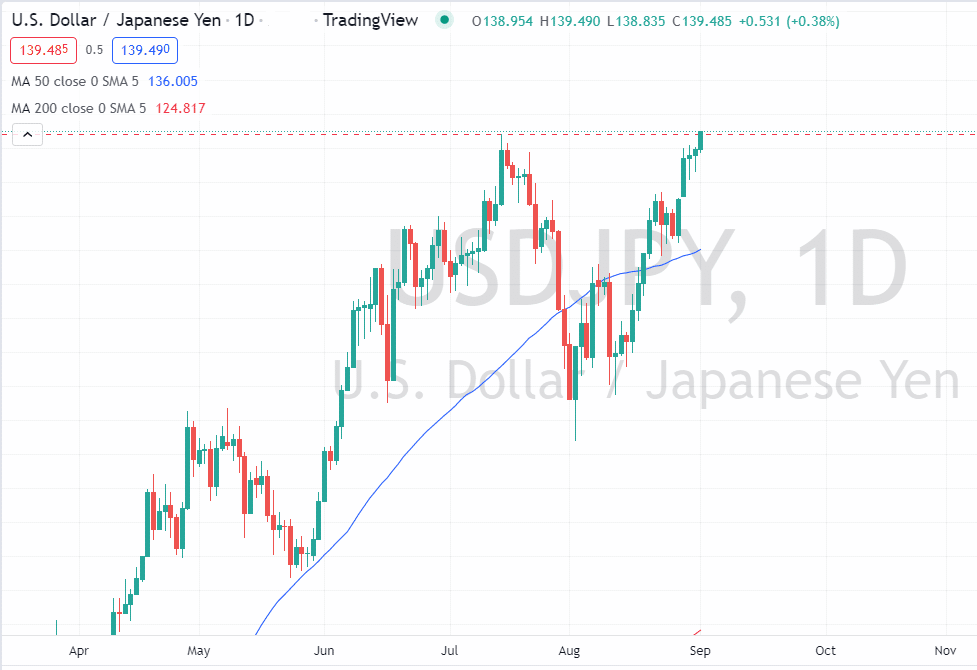

1 September 2022All major US indices were down for a fourth straight session as hawkish rhetoric from Central bankers and persistent inflation continues to keep the markets well in risk off mode.

Futures were pointing to a positive going into the session, but hot Eurozone inflation figures and a disappointing ADP employment figure saw markets turn around and sell off into the close as the bears took charge.

US equity market performance for August can be summarized as a tale of 2 halves – investors developed an appetite for risk assets in the first half of the month on expectations of a potential peak in inflation and an eventual Fed pivot. This was followed by a steep reversal (and then some) after Fed Chair Jerome Powell re-iterated the Feds determination to tame inflation at the Jackson Hole symposium, this rhetoric has been followed up by other FOMC members, the most recent being voting member Mester who stated that restrictive policies were likely to remain through 2023.

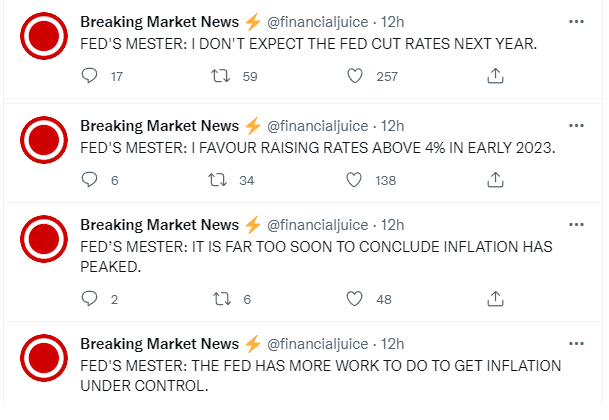

After trading up to their 200-DMAs mid-month, all the US majors are now back well below the 50-DMAs which had provided some support.

In FX the USD had a choppy session before finishing fairly flat, the EUR performed well reclaiming parity on the higher than expected EZ inflation figures and the rates market now pricing in a 75bp hike from the ECB as the most likely outcome of their September policy meeting.

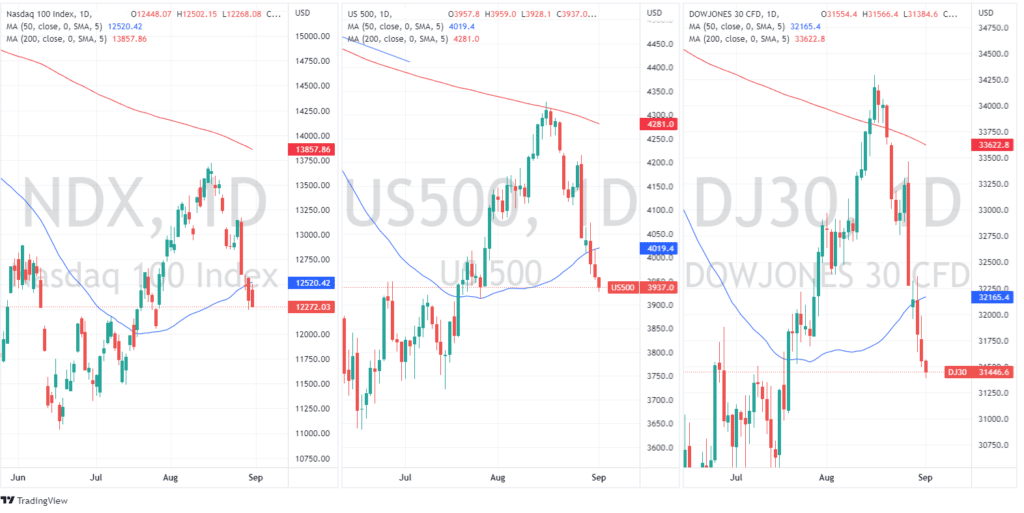

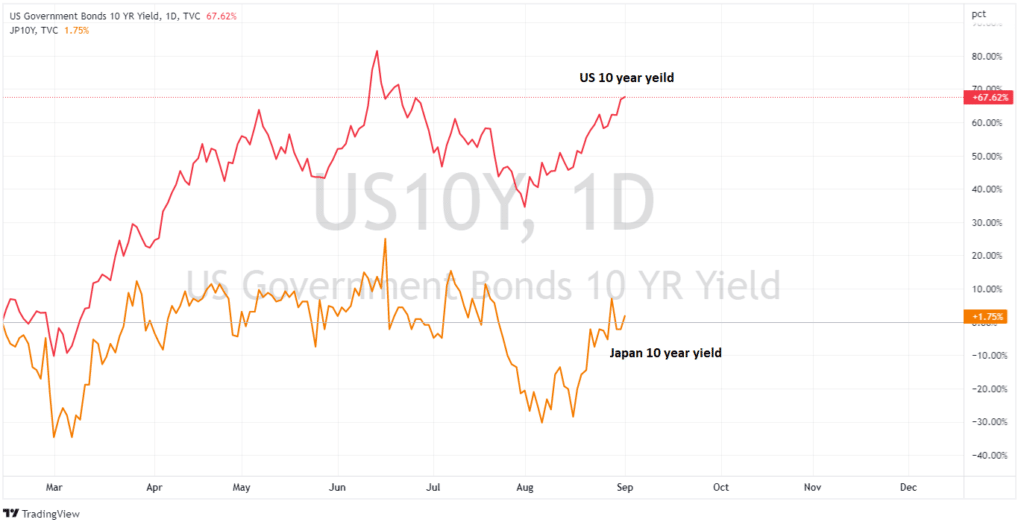

The big news in FX world though is the JPY which hit its lowest point against the USD since 1998, breaking this year’s highs and the USDJPY looking likely to head to 140 as US and Japanese 10 year bond yield differentials continue to widen to the US’s favour, which has been the driving force of the meteoric rise in USDJPY this year.

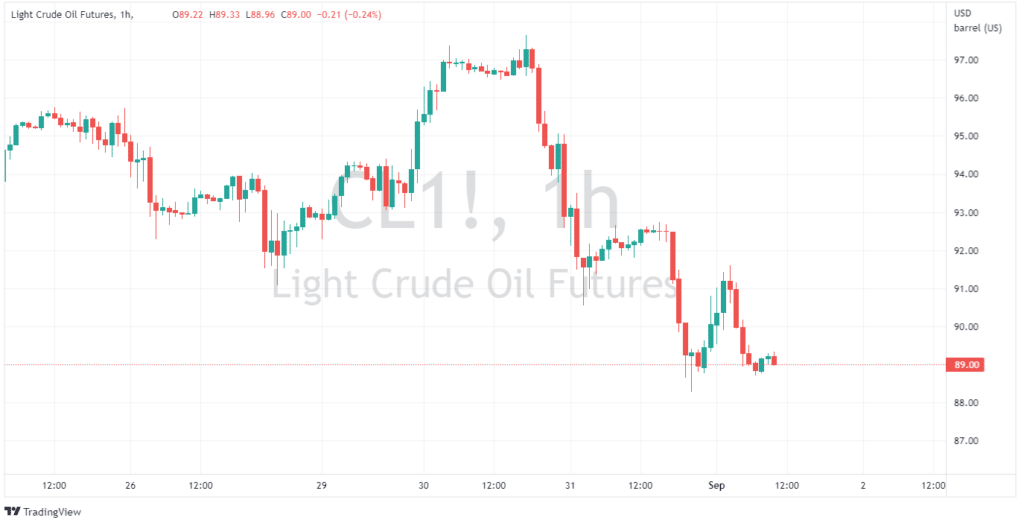

Commodity markets saw WTI crude finish August as the worst month of the year (and 3rd straight month lower)

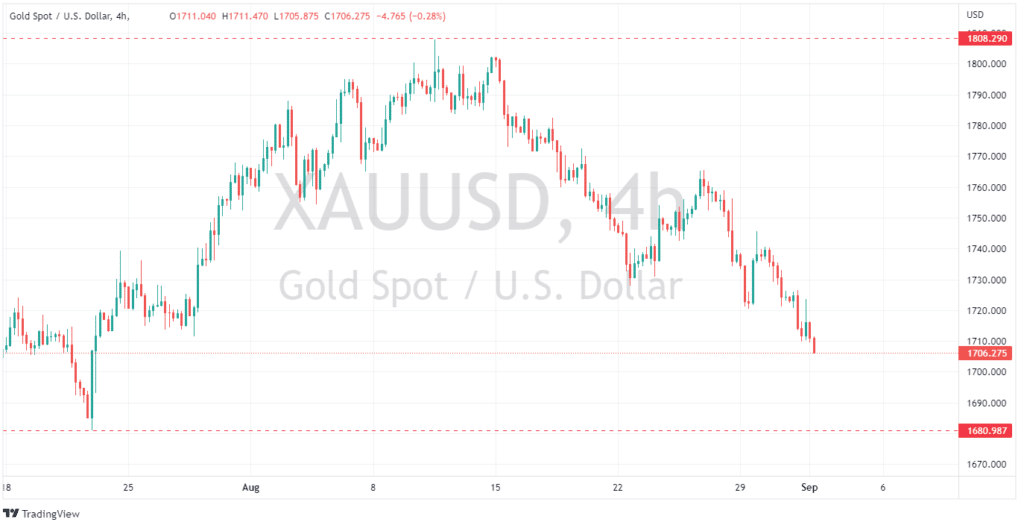

Gold’s roundtrip continued after bouncing off $1680 in mid-July and stalling above $1800 around mid-August, plunging back lower since on USD strength and it’s seeming loss a safe haven asset.

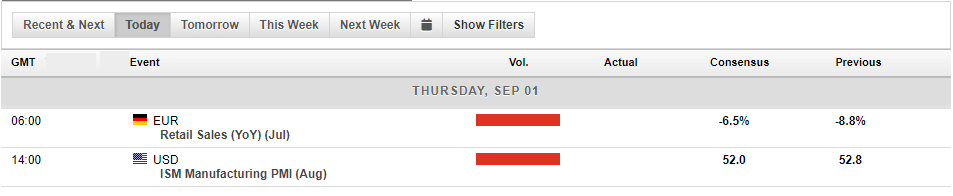

Major upcoming economic releases below

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice.

Next Article

Will gold hold its support or will the USD push it below $1660

Will gold hold its support or will the USD push it below $1660 Gold has dumped again after recession fears and a strong US dollar continue to grip the market. With Gold priced in US dollars it means that when the USD is strong the price of gold and other commodities is reduced. In recent days, following on from Jackson Hole the price has slum...

Previous Article

Opportunities await trading the JPY

With central banks aggressively hiking interest rates to combat inflation, one specific country stands alone in maintaining a dovish stance. The count...