The Week Ahead – The FOMC, inflation and growth all in the spotlight

25 July 2022After a turn around in equity markets last week, where the S&P 500 was up over 2%, The Federal reserve will take centre stage this week along with a slew of inflation and growth figures coming out of developed economies looking to set the market tone.

It’s a big week ahead for the US with the July FOMC meeting being the highlight, but also the important Q2 GDP figure and the Feds preferred inflation gauge the core PCE Price Index being released.

US GDP is expected to come in at a modest 0.4% growth, though another negative print is a definite possibility, one that many analysts are predicting, and this would meet the technical definition of recession after the negative print in Q1. If this happens, will the Fed be swayed from their current tightening cycle by this? Unlikely, judging from the communication coming out the Fed which has made it abundantly clear that fighting inflation over the medium-term trumps short term growth concerns.

Going into Wednesdays FOMC meeting expectations are firmly centred on a 75bp interest rate increase, rates markets were pricing in a possibility of a 100bp move after the hot June 9.1% inflation print earlier in the month. Since then we have seen a softer batch of economic data and more importantly the Feds biggest two hawks Bullard and Waller push back on the need for a 100bp hike at this time, without their votes 100bp is highly unlikely, rates markets seem to agree with yields pulling back to price in 80bp (small chance of a bigger than 75bp)

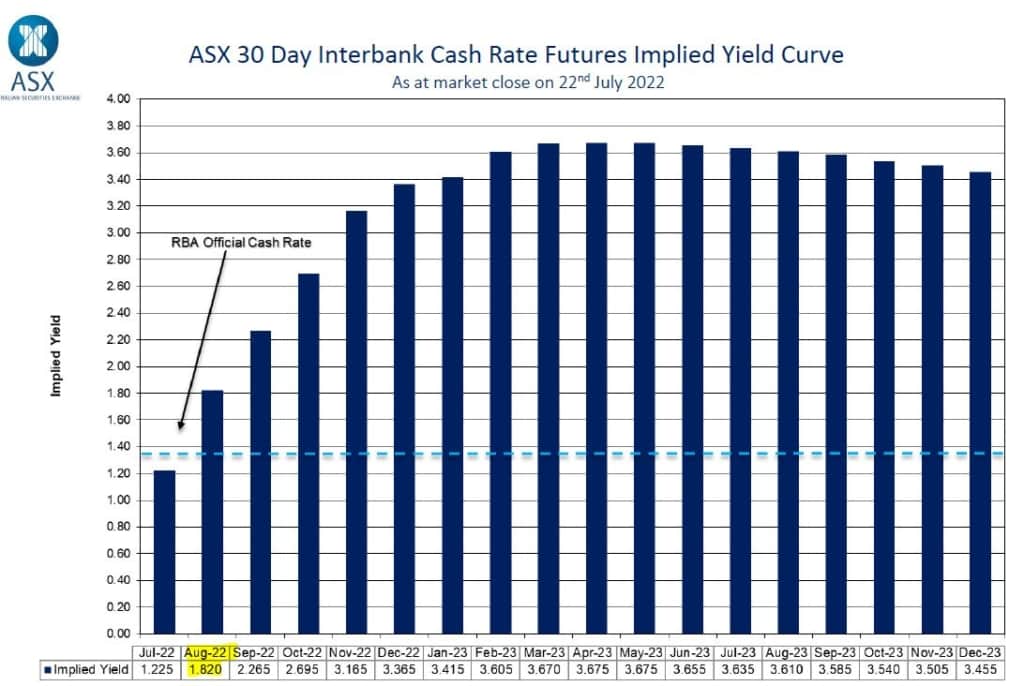

Also on Wednesday , belated Q2 CPI figures are set to be released in Australia, after the recent strong labour report, CPI will need to come in soft to lessen the chances of another 50bp hike from the RBA at it’s August meeting, a hotter than expected could see the rates market start to seriously price in a 75bp move. With the futures market currently pricing in 47bp (1.82% up from 1.35%) at the next meeting, AUD traders shouldn’t miss this figure as we may get some decent moves if the futures re-price on the back of the CPI figure.

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice.

Next Article

Tech and Bitcoin drop, Oil and Gas jump in mixed US session

US stocks were mixed in a quiet session, the Dow and S&P 500 eked out small gains whilst against a backdrop of a the Federal Reserve meeting on Wednesday, the Tech heavy Nasdaq saw a modest decline. With a news quiet Monday behind us, there is a full calendar ahead with a slew of corporate earnings and of course the big one, the FOMC policy ...

Previous Article

Wall st rallies on tech lead, ECB turns hawkish, kind of

Tech stocks led US equities higher overnight, the Nasdaq rallied 1.3% making it three up sessions on the trot, led by tech heavyweights Amazon (AMZN) ...