Tech leads US equity rally, USD and yields fall again, AUDUSD breaks out, USDJPY breaks down

21 November 2023US equities enjoyed a broad rally, with tech leading after news that recently ousted OpenAI CEO Sam Altman had been snapped up by Microsoft, the news helped MSFT and AI Chip maker NVDA stock rally over 2% each and pushing the Nasdaq to be the top performing US index.

More weak data out of the US as well with leading indicators missing expectation, putting more pressure on yields and the USD, with the US Dollar index falling to it’s lowest point since the start of September and sitting just below its 200 day SMA and on its 50% fib retracement support at 103.49 going into the Asian session.

Another big drop in USDJPY as well for a third day in a row as it seems to be playing catch up with US-JP yield differentials.

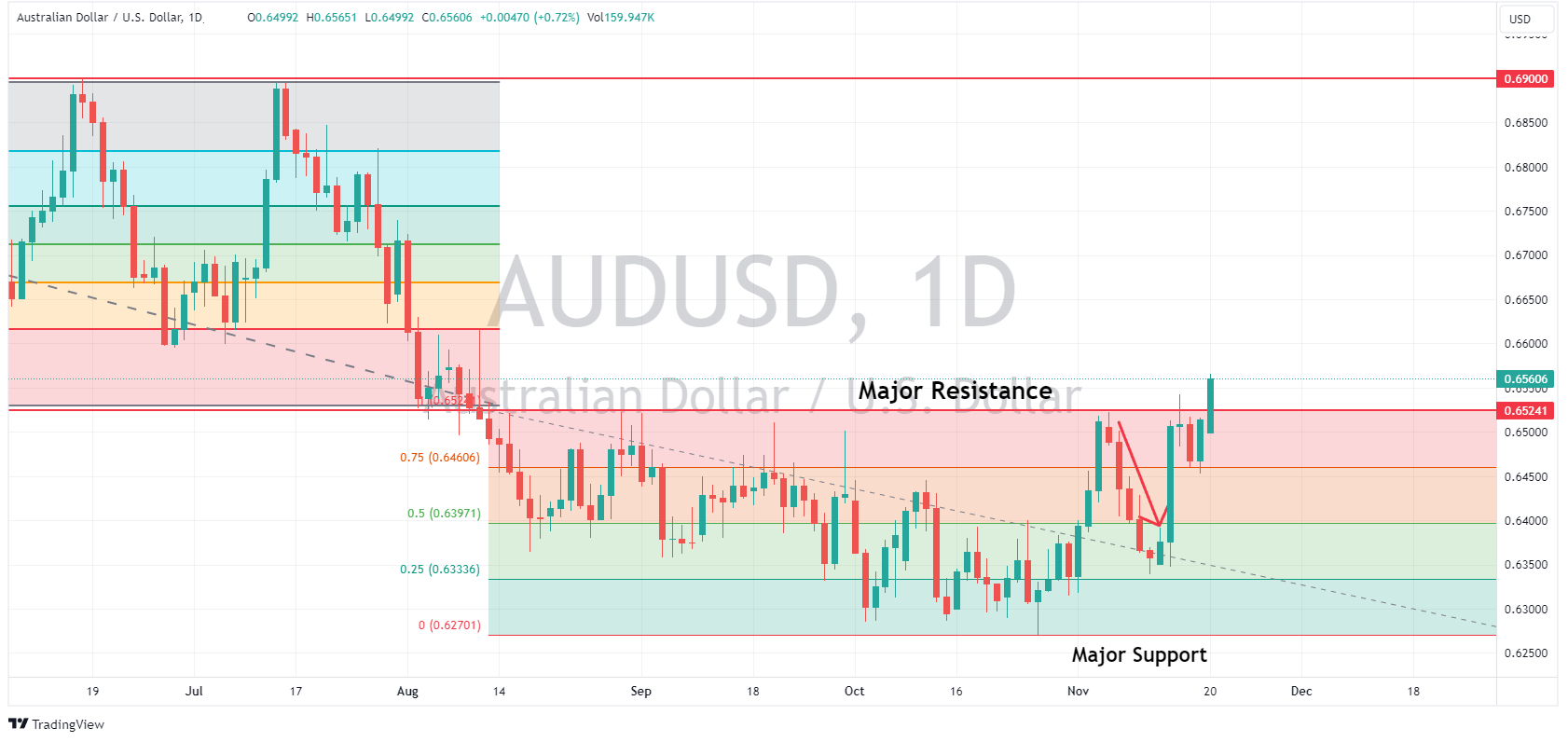

AUDUSD broke and held the 0.65 level on the improved risk sentiment and USD weakness. This will be a key level to watch for Aussie traders today with RBA minutes and RBA governor speaking both scheduled for today.

Crude oil also rallied to its upper trend line before finding some resistance, with WTI touching on 78 USD a barrel before pulling back modestly.

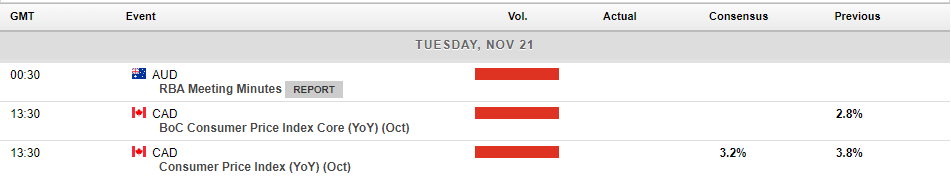

Calendar of todays major economic releases:

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice.

Next Article

Zoom tops estimates and raises full-year forecast

Zoom Video Communications Inc. (NASDAQ: ZM) released its latest financial results for the third fiscal quarter after the market closed in the US on Monday. Company overview Founded: April 21, 2011 Headquarters: San Jose, California, United States Number of employees: 8,484 (January 2023) Industry: Tech Key people: Eric Yuan (Cha...

Previous Article

The Week Ahead – Charts to watch , AUDUSD, Dow, Gold

Last week price action hammered home the narrative that markets are still dancing to the tune of the Fed, with a broad rally in equities and a fall in...