Tabcorp’s mixed results are in

24 February 2022Tabcorp is Australia’s largest gambling company. They operate three market leading businesses: Lotteries and Keno, Wagering and Media and Gaming Services. They currently employ more than 5,000 people.

Like many companies, Tabcorp has fears that rising inflation can potentially negatively affect revenue, as higher cost of living can lead to a reduction in customer’s willingness to spend on discretionary expenses (such as betting in Tabcorp’s case).

However, Tabcorp also believes that the current low employment rate should be able to alleviate some of the concerns as more people with jobs will usually equal more people with disposable income to spend on their products.

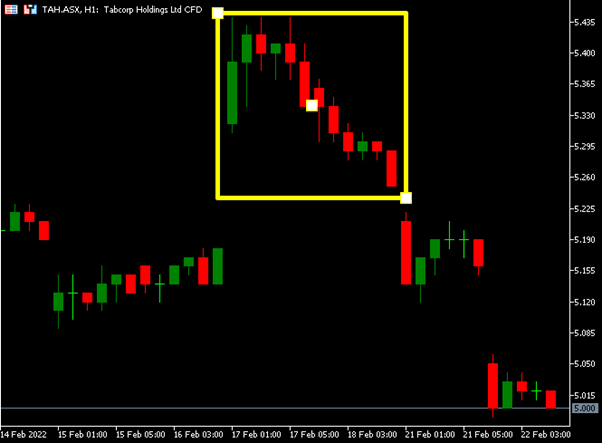

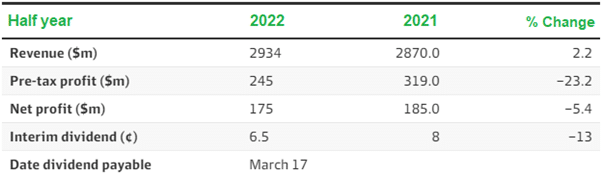

Last Thursday, Tabcorp posted a 5% drop in statutory interim profit to $175 million and a dividend payment of 6.5 cents a share. This is a reduced figure compared to last year’s dividend payment. Despite the announcement, the share price remained relatively stable between $5.25 and $5.43 throughout the day.

Pre-tax profits were greatly affected, down from $319 million to $245 million, with the prior period including amounts set aside for a $62 million disputed tax bill. The prior period also included a $69 million injection from the sale of Jumbo Interactive shares and $8 million in government assistance via JobKeeper subsidies.

Earnings from race bettings were also greatly affected as it has been reduced by almost a third due to unforeseen pandemic lockdowns. This has affected NSW, one of the more profitable markets. Horse racing venues were forced to temporarily close as it was deemed a non-essential service.

Tabcorp announced that there were 102 lost days of trading in venues in metro NSW in the second half of 2021, compared to 13 in the same time period the year before. The closures also resulted in 74 fewer days of trading in regional NSW, compared to no days lost in the previous period.

Revenue from Tabcorp’s wagering and media subscription division has gone down 9.8% to $1.07 billion.

Ongoing costs meant divisions earnings before interest, tax, depreciation and amortisation were down 35% to $148 million.

There is some positive news, the big drop in earnings was somewhat mitigated by an increase in customers who participated in the lotteries. Unlike wagering, the lottery does not have a social element (pubs and social club networks), therefore, lottery vendors were allowed to operate as they were deemed ‘essential’. This coupled with an increase in mobile app usage have resulted in revenue from the lottery side increasing by 12.7% to $1.66 billion.

Overall, Tabcorp is experiencing some hard times at the horse races but at the same time, enjoying the good times via the lottery. With the lockdowns ending due to the vaccination rollout, revenues might be on track to recovery.

If you would like to take this opportunity to invest in Tabcorp and don’t already have a trading account, you can register for a Shares or Shares CFD account at GO Markets.

Sources: GO Markets MT5, ASX, Wikipedia, AFR.

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice.

Next Article

Ukraine Conflict Causes Moves To Safety

As geopolitical tensions continue to escalate in Ukraine following news of a full-scale Russian invasion, we are starting to see evidence of fear and heightened uncertainty enter financial markets across the globe. The driving force of instability is the unknown impact of these latest events in Europe and the potential economic, political, and soci...

Previous Article

eBay beats Wall Street estimates in Q4

US e-commerce company eBay Inc. reported its Q4 2021 financial results after the closing bell on Wall Street on Wednesday. The company reported rev...