Mixed earnings, weak data and hawkish Fed speak see US stocks finish lower

21 April 2023US stocks finished broadly lower in Thursday’s session in a choppy, low volume session as economic disappointed, Fed talking heads remained hawkish and a mixed batch of earnings.

The biggest miss in earnings was Tesla (TSLA) who’s aggressive price cutting saw profit margins compress, seeing the auto giant down almost 10% on the session and the stocks worst day since January, dragging the Nasdaq down 0.8% to see it as the worst performing major US index.

With the Fed blackout window beginning next week investors were watching the handful of Fed governors speaking on Thursday, who were almost unanimously hawkish, putting extra pressure on stocks ahead of the Fed May meeting. Where the futures markets are pricing in a 82% of another hike.

DOVISH – *FED’S GOOLSBEE: STILL FIGURING OUT CREDIT IMPACT OF BANK STRAIN

HAWKISH – *FED’S MESTER: INFLATION STILL TOO HIGH, PROVING TO BE STUBBORN, NEED REAL RATES IN POSITIVE TERRITORY FOR SOME TIME

HAWKISH – *FED’S MICHELLE BOWMAN: LOWERING INFLATION ESSENTIAL FOR ECONOMY

HAWKISH – *DALLAS FED’S LORIE LOGAN SAYS INFLATION HAS BEEN MUCH TOO HIGH

Not too much excitement in FX market in Thursdays session, the USD was mildly lower on weak data with the Philly Fed manufacturing index and jobless claims data both coming in soft, hawkish Fed speak didn’t manage to lift the greenback as a rate hike in the May FOMC meeting was already mostly priced in.

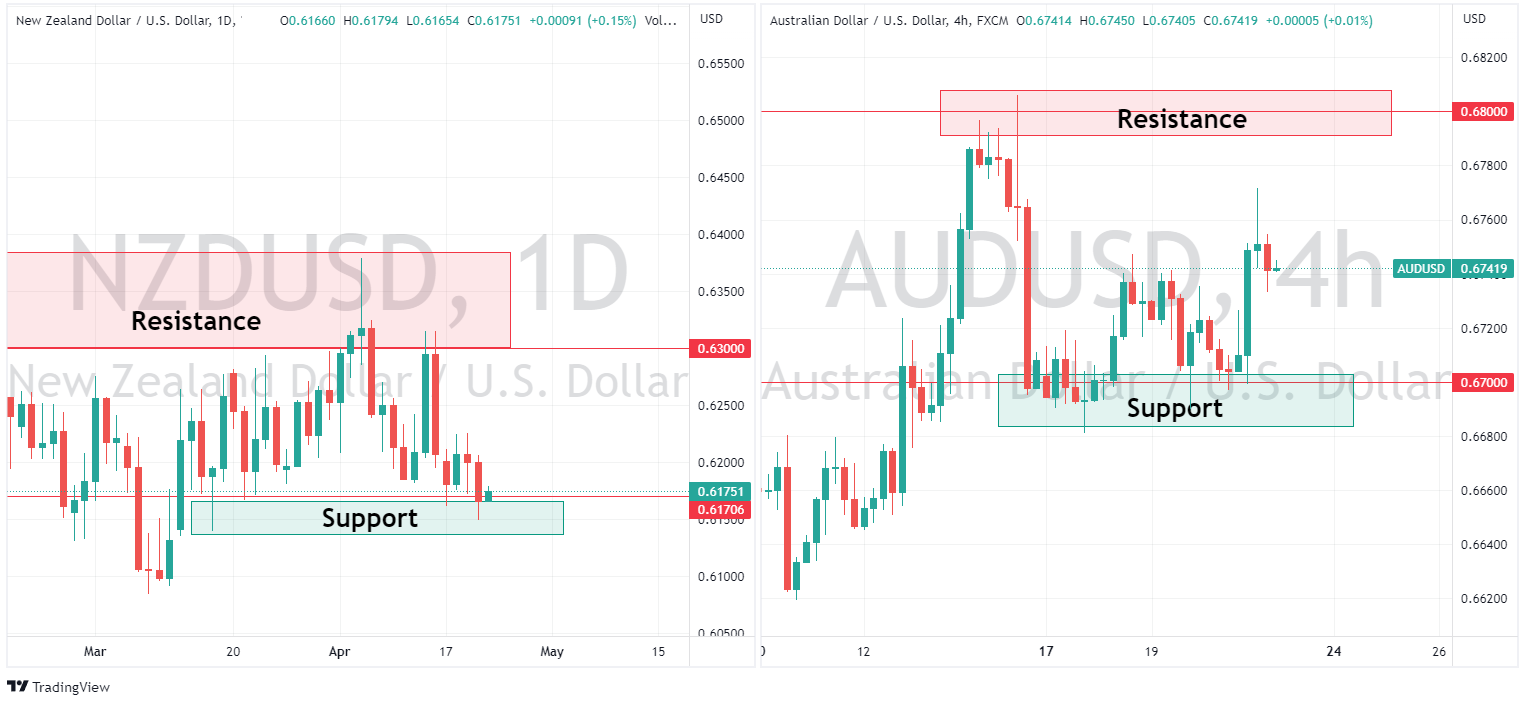

AUD benefitted from a weak USD, finding support at 0.67 and pushing higher , looking to test the 0.68 resistance level before pulling back later in the session ahead of flash Services and Manufacturing PMI figures out of Australia today.

NZD floundered after a weaker than expected CPI print on Thursday bringing into question the aggressive rate hiking from the RBNZ up to now, NZDUSD was the worst performing G10 pair, dropping into it’s support zone at 0.6170 before finding some relief.

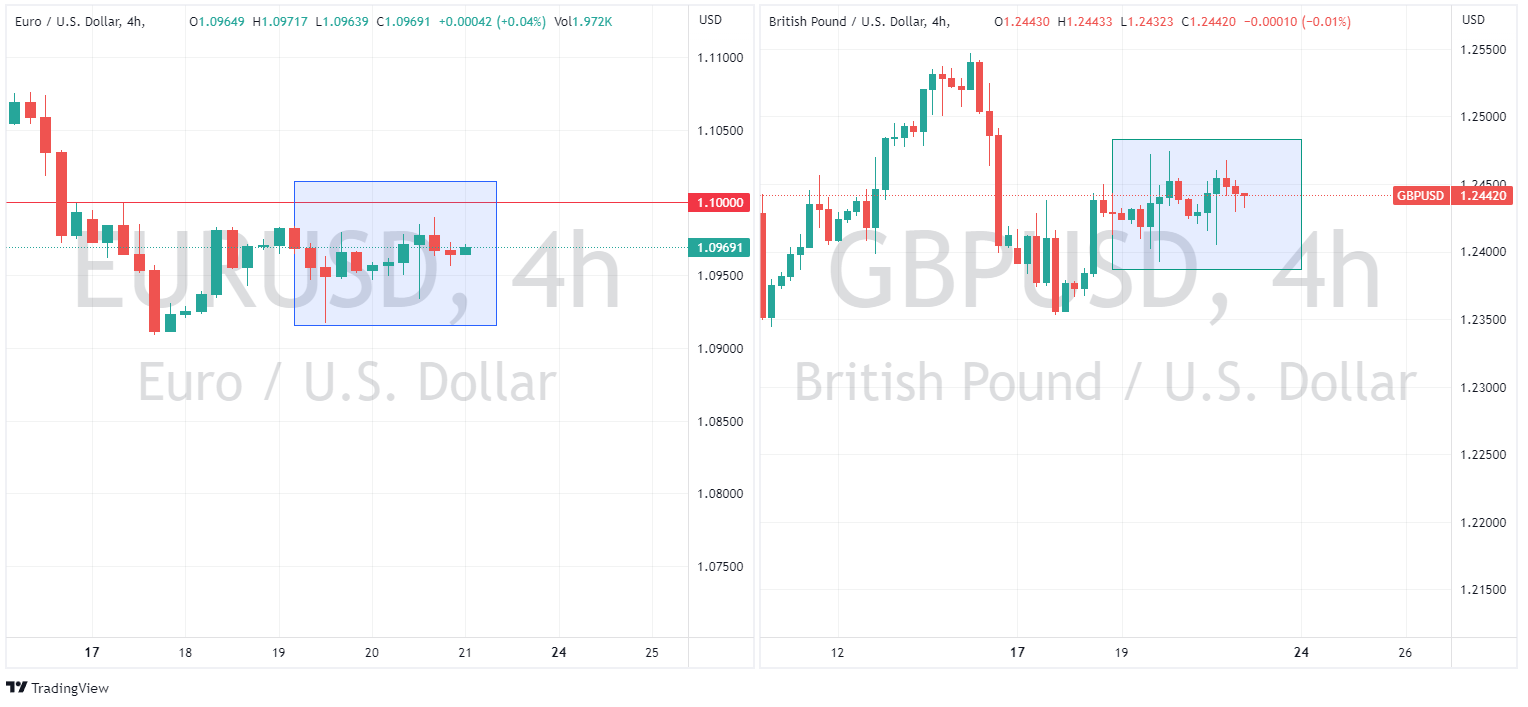

EUR and GBP were flat with mild gains against the USD, EURUSD benefitting somewhat as well from some hawkish ECB rhetoric from members Knot, President Lagarde, and Visco.

Commodities

Oil

Crude Oi prices continued to tumble and fill the gap of the post OPEC+ surprise cuts on Thursday there was a lack of an energy-specific catalyst but continuing recessionary fears on the back of US data seem to be the driving force of cruse prices currently.

Gold

XAUUSD again saw a Bull vs Bear battle around the $2000 USD an ounce level, with the price managing to push through that level before retracing to test it, where it held as support for now.

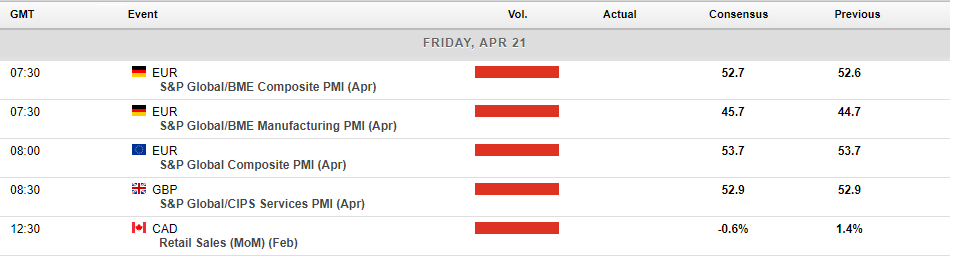

Economic announcements for Friday see a plethora of PMI figures released from the Eurozone , UK and the US which should see some more volatility in FX markets as the health and future direction of rates in those economies will be on display.

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice.

Next Article

Asian Session Update – AUD, NZD continue decline, Hot Japan CPI sees Yen strength

Major Asian stock indexes are following the lead from Wall St where US stocks finished broadly lower in a choppy, low volume session as economic news disappointed, Fed talking heads remained hawkish and a mixed batch of earnings. The ASX200 and Nikkei down around 0.24% while the Hang Seng down just over 0.5 a % FX Markets Have mostly c...

Previous Article

American Express posts mixed results, sets a new quarterly record

American Express Company (NYSE: AXP) announced first quarter financial results before the market open on Thursday, setting a new quarterly revenue rec...