Key Events in the Week Ahead – BoJ meeting, US GDP, Aussie CPI

24 April 2023Coming off a choppy and mostly directionless week for Global Markets, this coming week looks to be more of the same as we enter the Federal Reserve blackout period ahead of their pivotal meeting on May the 3rd.

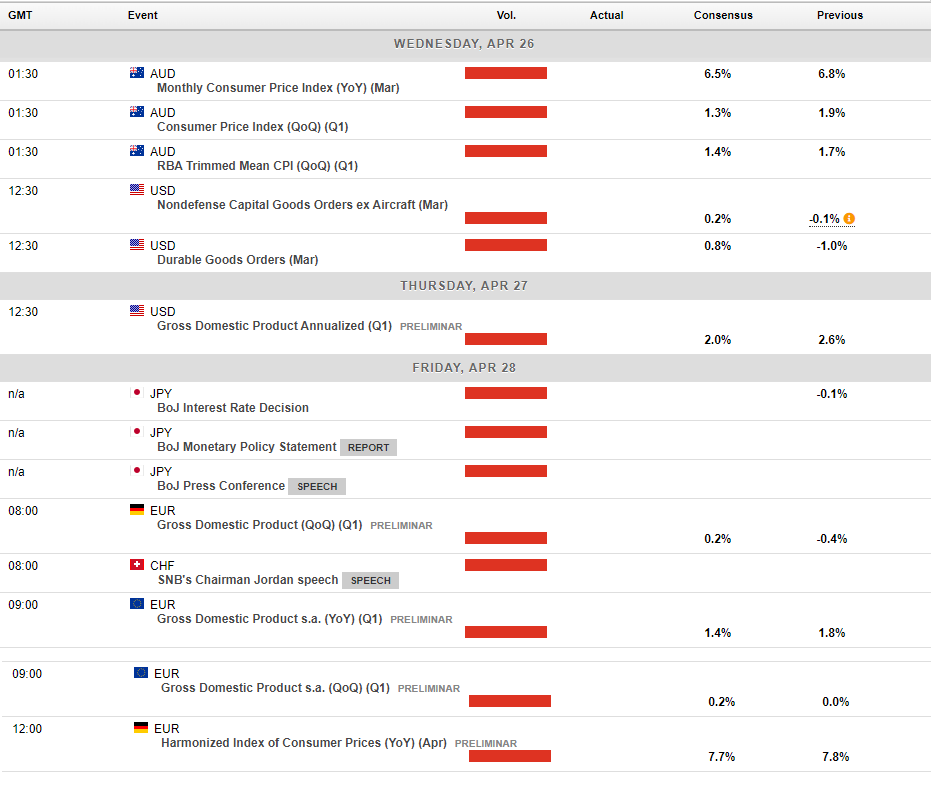

While the economic calendar is light, there are a few risk events that could see some volatility in the markets, starting Wednesday with Australian CPI figures.

Australian CPI (Wednesday)

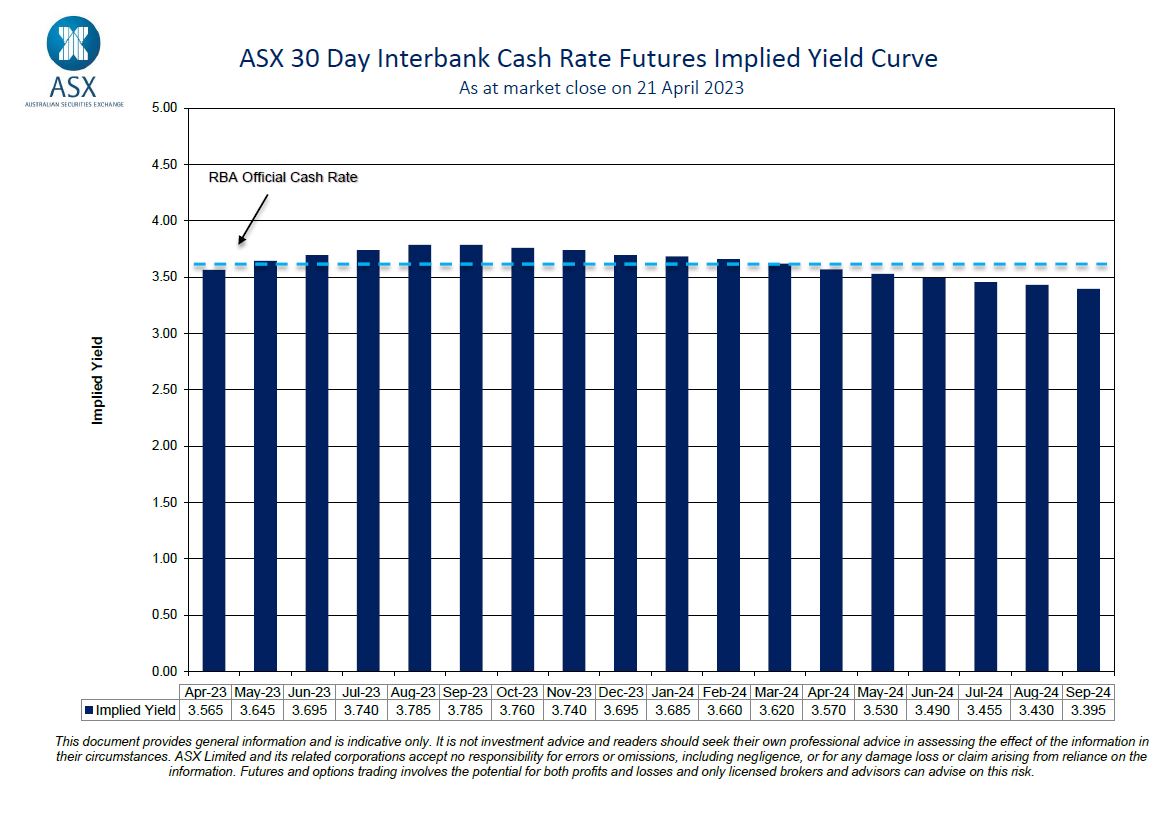

March inflation is expected to fall from the February reading of 6.8% YoY as prices continue to moderate in the face of , up until recently, a relentless hiking cycle from the RBA. The consensus is a drop to 6.5% YoY but there are some major analysts calling a sub 6% figure. With Markets split somewhat on what the RBA will do next week (Futures market pricing in an 80% chance of a hold, 20% of 25bp hike currently) a lower than expected figure would give the RBA all the reason it would need to hold, a big beat would make their decision difficult and see a sharp rally in the AUD you would expect.

USA – GDP, and Core PCE inflation reading

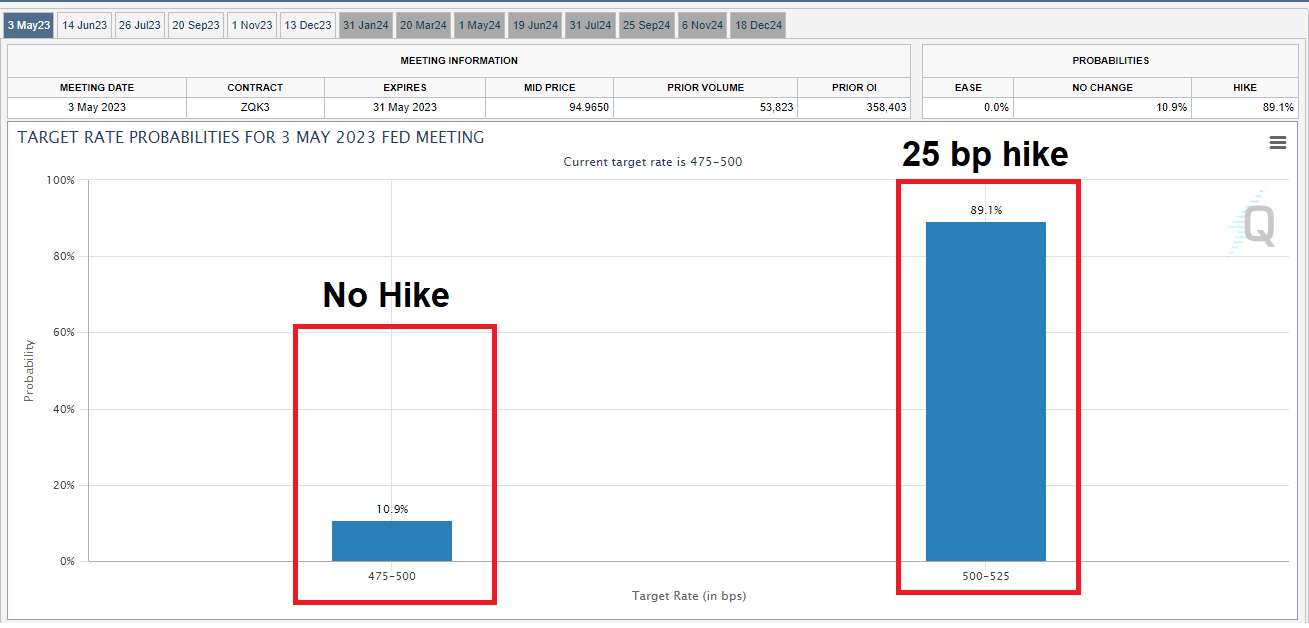

Coming into the Fed blackout window it is hard to see the needle being moved on a FOMC rate hike at their May meeting with this weeks data. Fed Fund futures are currently pricing in a 89% chance of a 25bp hike, and with no shortage of hawkish comments from Fed members last week it would take some very big misses in this weeks data to see the markets reprice that prediction.

First quarter GDP is the highlight of the data releases where a fall to 2% from the previous reading of 2.6% is expected, this will not be enough to dissuade the Fed from hiking rates I would think.

Core PCE inflation will be released on Friday which is expected to show it holding at 0.3% MoM.

Japan – BoJ’s first meeting with new governor

The Bank of Japan will hold its first policy meeting under the leadership of Kazuo Ueda on Thursday, while Ueda has so far been happy to follow the accommodative policies of his predecessor it seems it will be only a matter of time before the Bank makes further adjustments to it’s controversial Yield Curve Control policy. This meeting probably won’t have too much in it to move markets, but the BoJ has surprised in the recent past (December meeting comes to mind) so it’s still a possibility we could see some volatility in the Yen over this meeting.

This weeks full economic calendar below:

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice.

Next Article

The Coca-Cola Company announces Q1 results

The Coca-Cola Company (NYSE: KO) announced the latest financial results for the first three months of 2023 before the market open in the US on Monday. The US Beverage company posted solid results for the quarter, beating both revenue and earnings per share (EPS) estimates. Company overview Founded: January 29, 1892 Headquarters: Atlan...

Previous Article

Procter & Gamble Company exceeds expectations – the stock rises

Procter & Gamble Company (NYSE: PG) announced third quarter fiscal 2023 before the opening bell in the US on Friday. World’s largest consumer...