FOMC incoming – DXY, Oil analysis

13 December 2023In one of the most anticipated FOMC meetings this year , the Federal Reserve is widely expected to leave the fed funds target range at 5.25-5.5% in today’s FOMC meeting with futures markets pricing in virtually no chance of the December hike the Fed had previously pencilled in via their last “Dot Plot” projections.

What will move markets will be the updated economic projections (with an updated Dot Plot), the accompanying statement and Powells presser, will the Fed push back against the markets dovish expectations at the rate of cuts next year?

A pushback of some kind is expected, especially after US CPI figures yesterday showed a modest though unexpected rise in the m/m figure, so what will move the market is a more or less hawkish than expected Powell.

Charts to Watch:

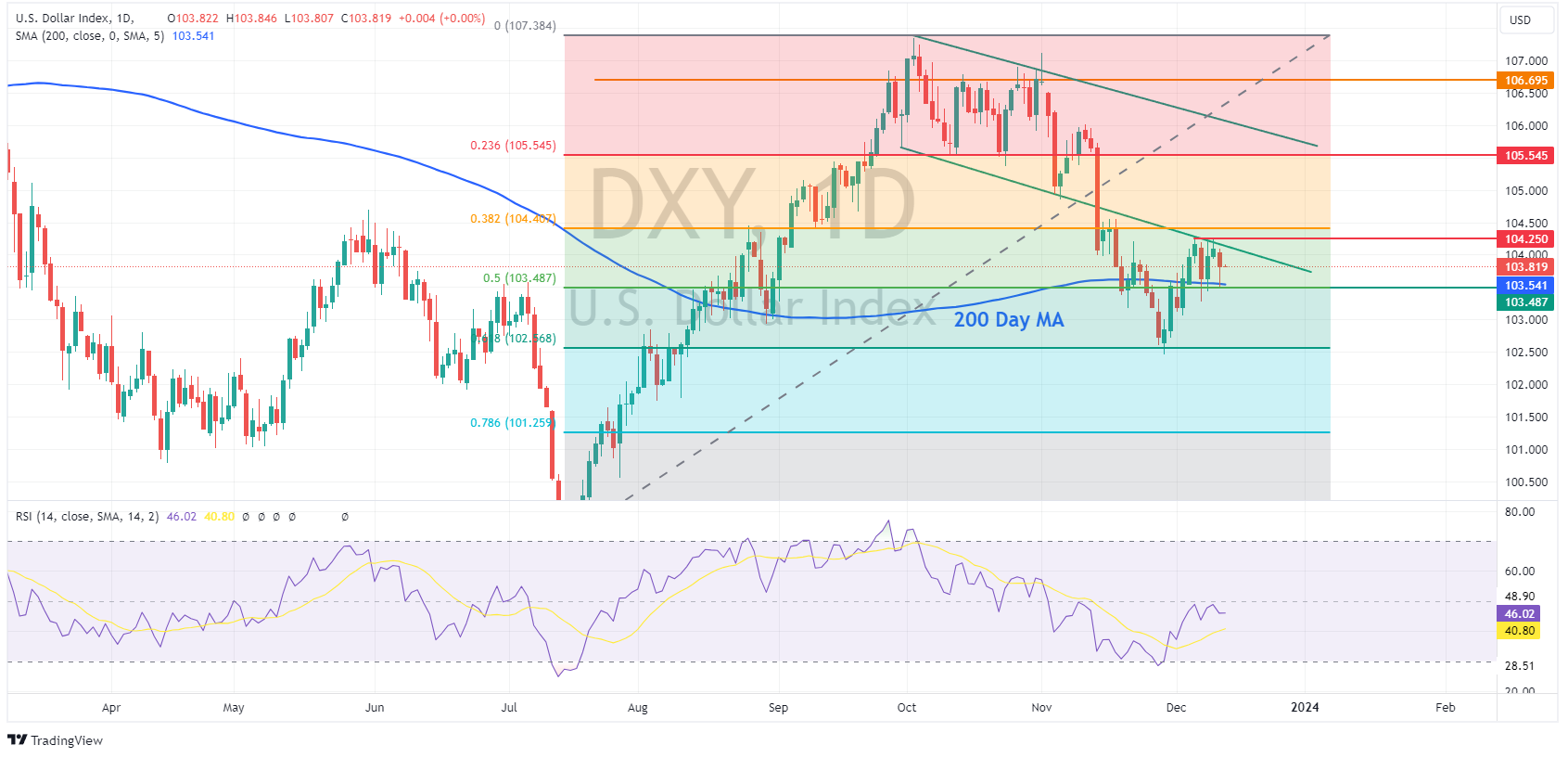

US Dollar Index (DXY)

DXY has been trading in a tight range for the last week, trapped between 104.25 to the upside which is the 7-day high and trendline resistance level, and 103.50 to the downside, the 50% fib and 200-day MA support area. A more hawkish Powell will see yields rally and should push the DXY higher along with them, the 104.25 level will be key to watch if this is the case, a break and hold will be needed to see another leg higher in USD. A “dovish” Powell and the support area at 103.50 could come into play, a fail to hold the support could see the resumption of the November Dollar downtrend.

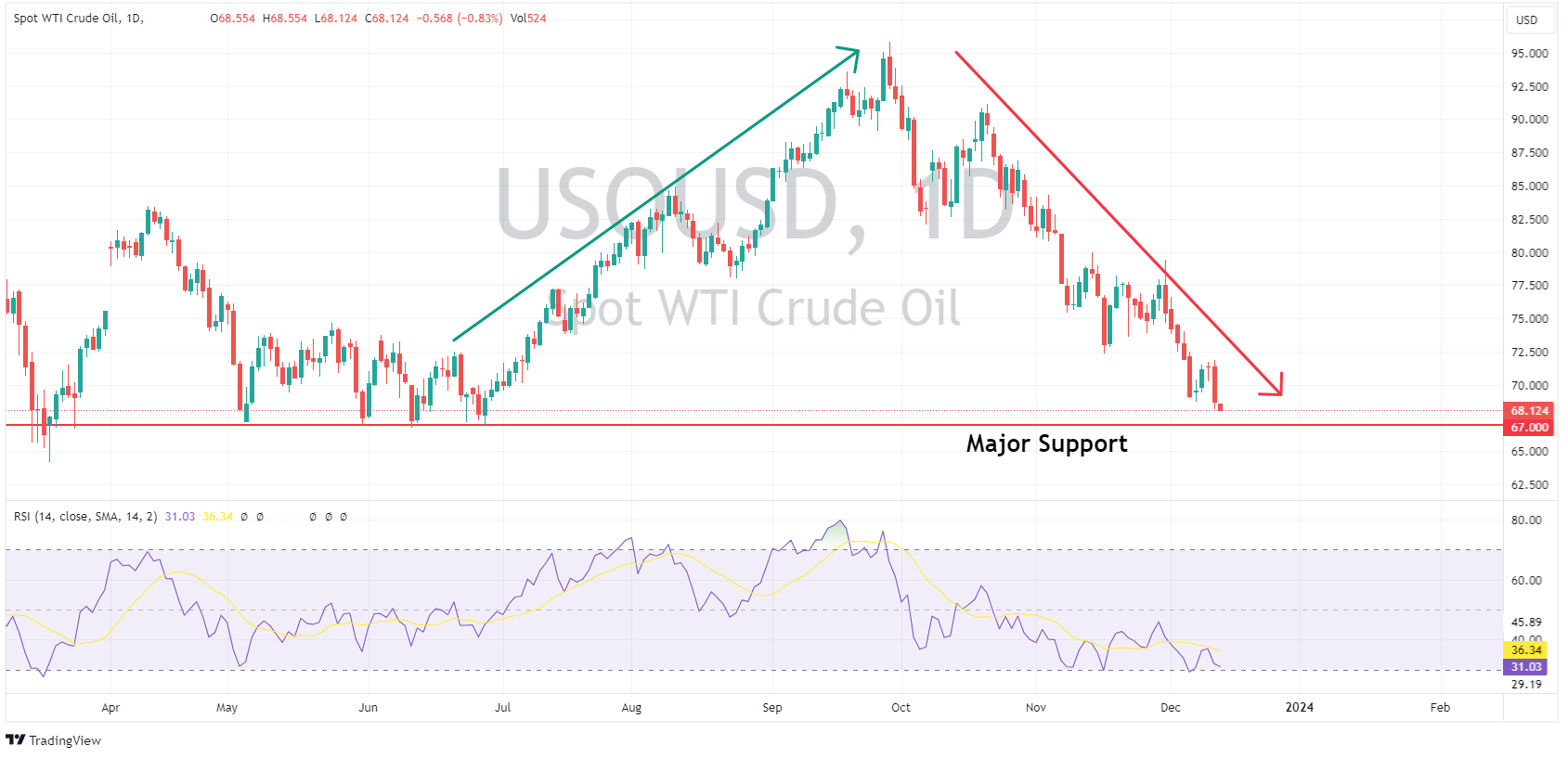

Crude Oil (USOUSD)

Crude Oil has been in a non-stop downtrend since September due to demand concerns as higher rates start to bite on the world economy. USOUSD is approaching a major support level at 67 USD a barrel, a level that held further declines in the earlier part of 2023. A hawkish Powell, where he hints rates will remain higher for longer than the market is pricing in wil add to those demand fears and could see this major support level tested. On the other hand a dovish Powell should give oil a much needed tailwind as demand fears wane, and could see a bounce in price from these oversold levels.

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice.

Next Article

FX Analysis – Dollar dumps, Gold surges on Fed pivot

Wednesdays FOMC meeting was always going to be about whether we’d see a hawkish pushback against market expectations of a dovish Fed in 2024, or a validation of those expectations, from the market reaction to the meeting, traders decided the latter is the conclusion. Rates were kept on hold at 5.35%-5.5% as expected but the updated dot plot an...

Previous Article

Johnson Controls International results announced – the stock is down

On Monday, Citigroup raised its target price for the Irish multinational conglomerate, Johnson Controls International plc (NYSE: JCI), from $58 to $61...