Deere & Co. tops estimates

22 May 2022Deere & Co. (DE) reported its financial results on Friday for the second quarter ended May 1, 2022.

The American manufacturer of farm machinery and industrial equipment reported revenue of $13.37 billion in the quarter (up by 11% year-over-year), topping analyst estimate of $13.231 billion.

Earnings per share also coming in above expectations at $6.81 per share vs. $6.69 per share estimate.

”Deere’s second-quarter performance reflected a continuation of strong demand even as we face supply-chain pressures affecting production levels and delivery schedules,” said John C. May, CEO of Deere & Co.

”Deere employees, suppliers, and dealers are working hard to address these challenges. We are proud of their extraordinary efforts to get products to our customers as soon as possible under the challenging circumstances,” May concluded.

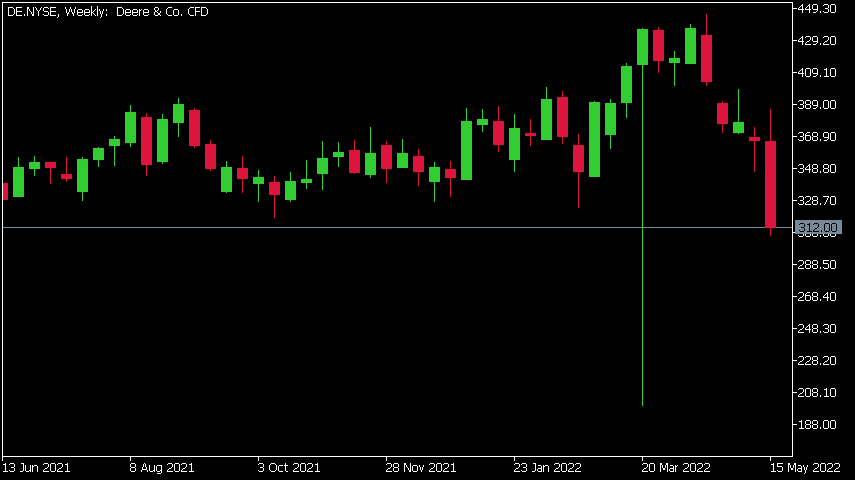

Deere & Co. chart

Shares of Deere & Co. fell by 14.07% on Friday, despite topping Wall Street expectations. The stock was trading at around $312 per share.

Here is how the stock has performed in the past year:

- 1 Month -22.37%

- 3 Month -15.12%

- Year-to-date -8.63%

- 1 Year -12.91%

Deere & Co. price targets

- JP Morgan: $440

- Wells Fargo: $455

- Deutsche Bank: $417

- Barclays: $415

- Credit Suisse: $463

Deere & Co. is the 132nd largest company in the world with a market cap of $96.11 billion.

You can trade Deere & Co. (DE) and many other stocks from the NYSE, NASDAQ, HKEX and the ASX with GO Markets as a Share CFD.

Sources: Deere & Co., TradingView, MarketWatch, Benzinga, CompaniesMarketCap

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice.

Next Article

Xpeng tops first quarter expectations – the stock falls on future outlook

Xpeng tops first quarter expectations – the stock falls on future outlook Xpeng Inc. (XPEV) reported its first quarter financial results before the opening bell on Wall Street on Monday. The Chinese electric vehicle company reported revenue of $1.175 billion in the quarter (up by 152.6% year-over-year) vs. $1.165 billion expected. The co...

Previous Article

China’s dominance of Rare Earths and the West’s opportunity

What are Rare Earths? Neodymium and praseodymium (NdPr) are two resources that you have probably never heard of, but you use every day. They are no...