Australian employment figures see a big beat as unemployment hits an historical low

14 July 2022Australian employment figures saw 88,000 new jobs created in June, a huge beat of the expected 30k analysts had forecast. The unemployment rate also dropped to a level not seen since 1974 , coming in at 3.5% , well below the forecasted 3.8%.

With the number of unemployed now almost level with job vacancies the figures today showed how tight the labour market is, with the knock on effect of inevitable wage growth putting pressure on the RBA to speed up their tightening cycle to get inflation under control.

With the RBA stating in their last policy meetings statement that “…The size and timing of future interest rate increases will be guided by the incoming data and the Board’s assessment of the outlook for inflation and the labour market”. This latest labour data suggests 25bp hikes are now off the table now, with 50bp and possibly higher now the most likely in the near future.

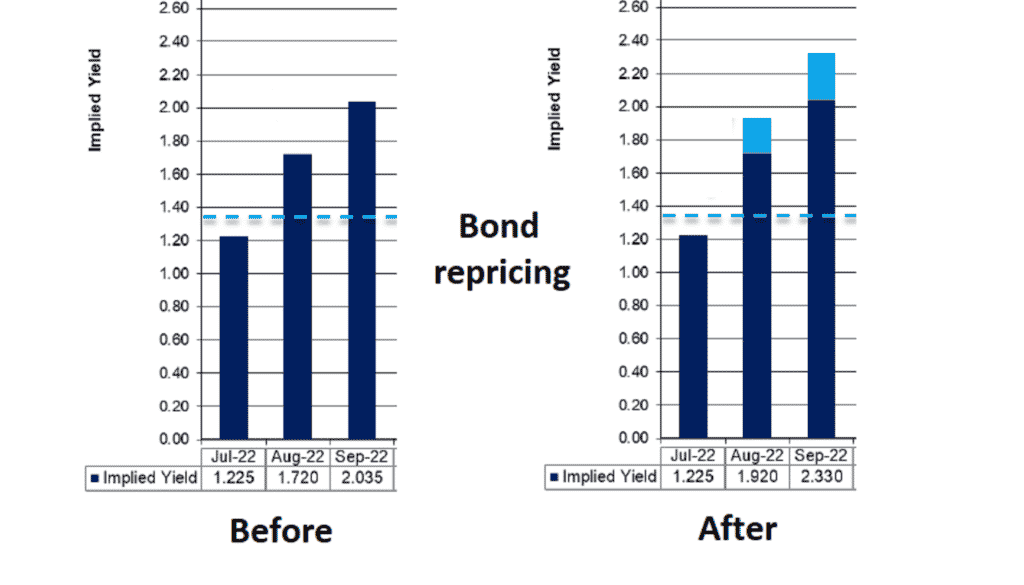

With this in mind, the bond futures market saw a sharp repricing , going into the figures the market was pricing in 79% chance of a 50 bp hike at the next RBA meeting, after a 50bp hike is 100% priced in with now a 20% chance of a 75 bp move on the cards.

Not surprisingly we saw a sharp rally in the AUD on the back of this, though the rally has faded as the afternoon has progressed, with the AUD again tracking equity markets indicating that risk sentiment is still the main driver of AUDUSD price action.

With Q2 inflation data coming out on July 27, the August RBA meeting is certainly going to be one to watch.

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice.

Next Article

JPMorgan falls short in Q2

JPMorgan Chase & Co. (JPM) reported its latest financial results for Q2 before the opening bell on Wall Street on Thursday. World’s largest bank reported revenue of $30.715 billion, falling short of analyst estimate of $31.806 billion. Earnings per share reported at $2.76 per share vs. $2.89 per share expected. CEO of JPMorgan, Jamie...

Previous Article

Oil dips to the bottom of its range as recession fears hit the market.

Oil has seen its first real slip up in price since March. The commodity had been running on the back of high inflation and supply issues stemming from...