APAC Open – Equites and USD up, Gold down, Oil takes a wild ride.

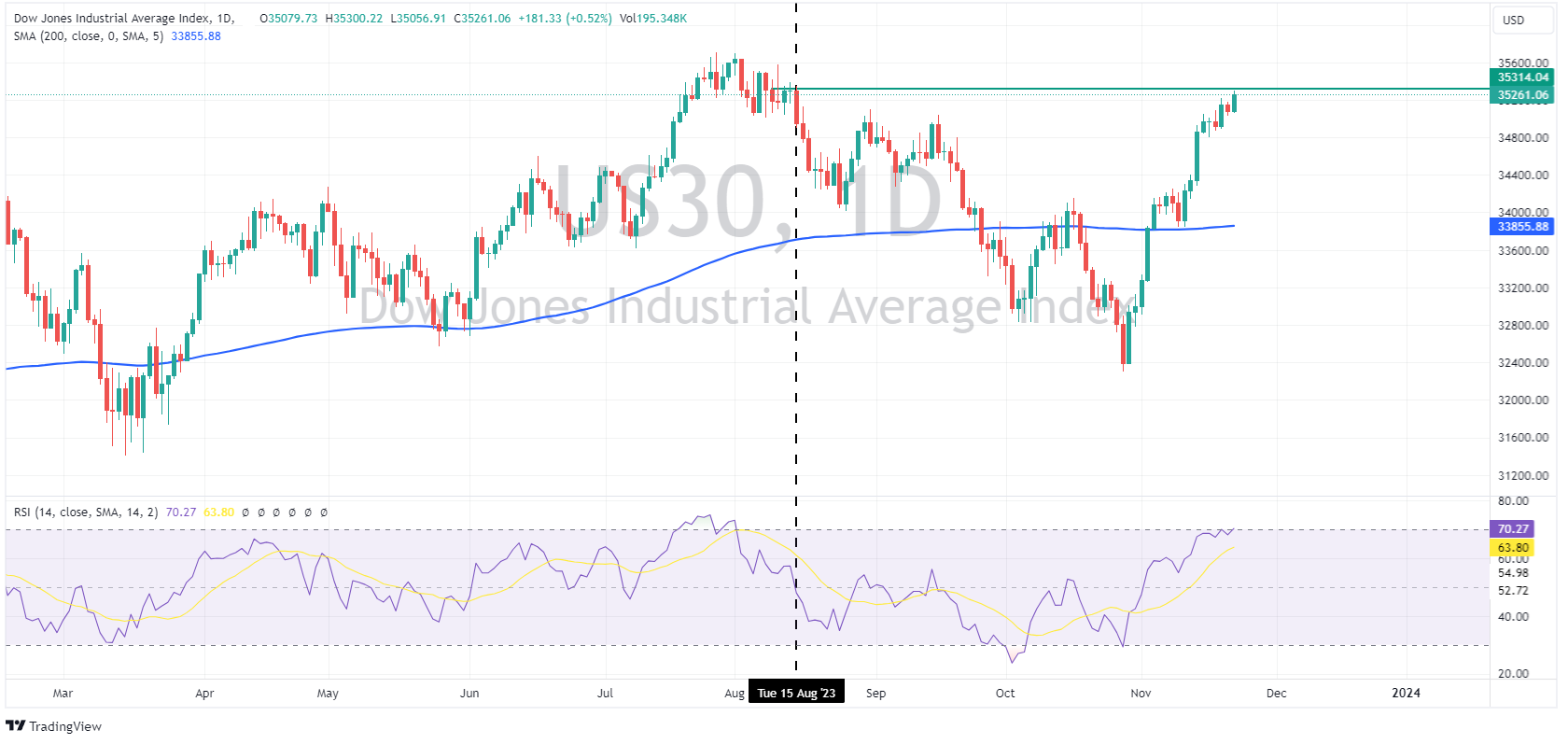

23 November 2023US equities continued to climb in a broad rally ahead of the Thanksgiving break I Wednesdays session with the Dow Jones index up almost 200 points and hitting its highest level since mid-August.

In FX markets, the USD was bid after better than expected employment data saw Jobless claims come in at 209k vs the expected 226k, US consumer sentiment also improved to 61.3 from last month’s reading of 60.4.

This saw the USDJPY resume its upward momentum, back above 149, a further headwind for the yen was commentary from Japanese PM Kishida saying that the BoJ’s monetary policy is not aimed at guiding FX in a certain way.

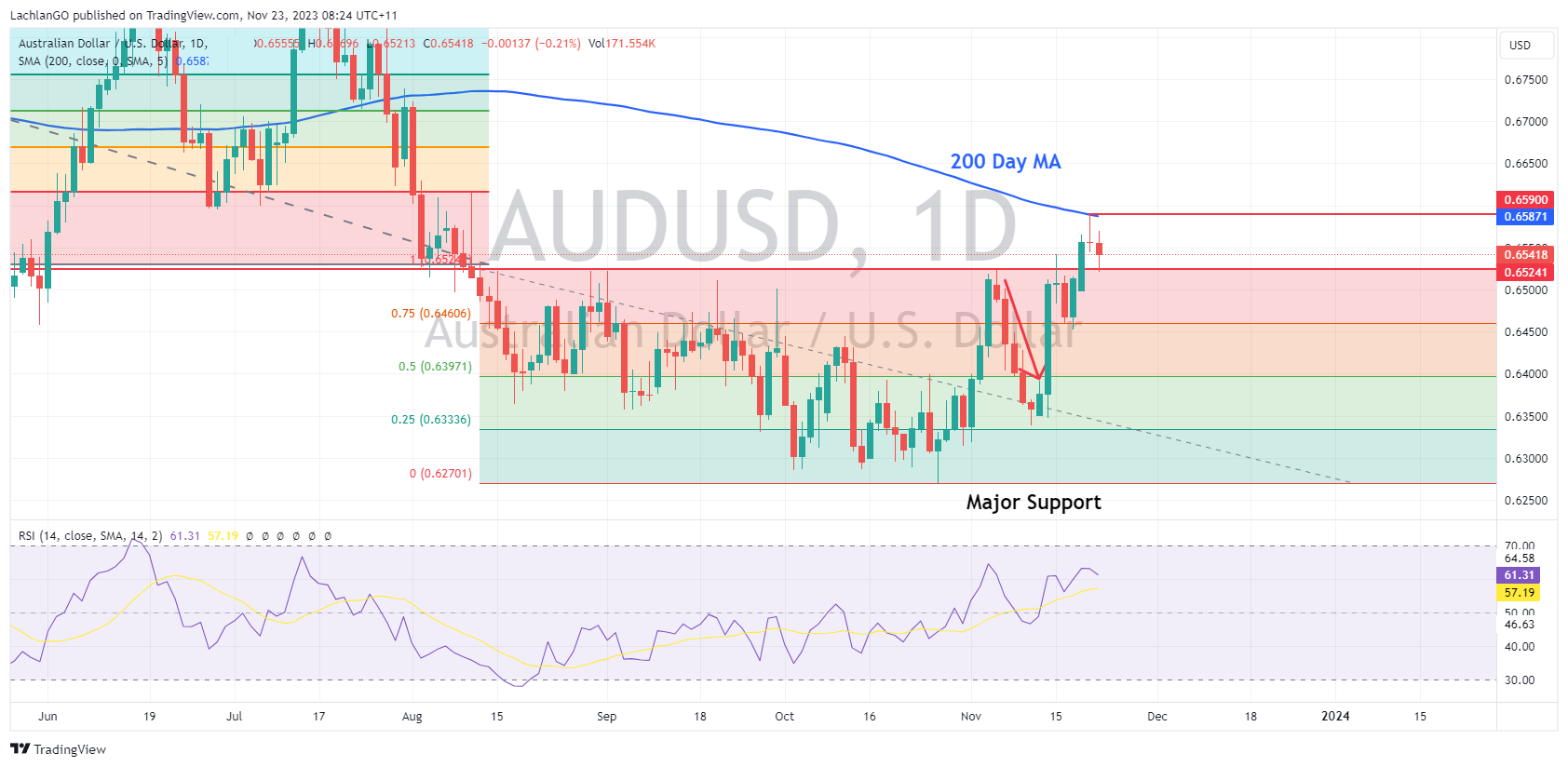

AUDUSD continued to weaken after finding resistance at the 200-day MA on Tuesday at 0.6590, it did find some support at the top of its recent range at 0.6524 and is currently trading in between those levels, both of these key levels to watch in the upcoming session. The Aussie was helped somewhat by some hawkish commentary from RBA governor Bullock in comments about inflation and the strength of the Australian economy.

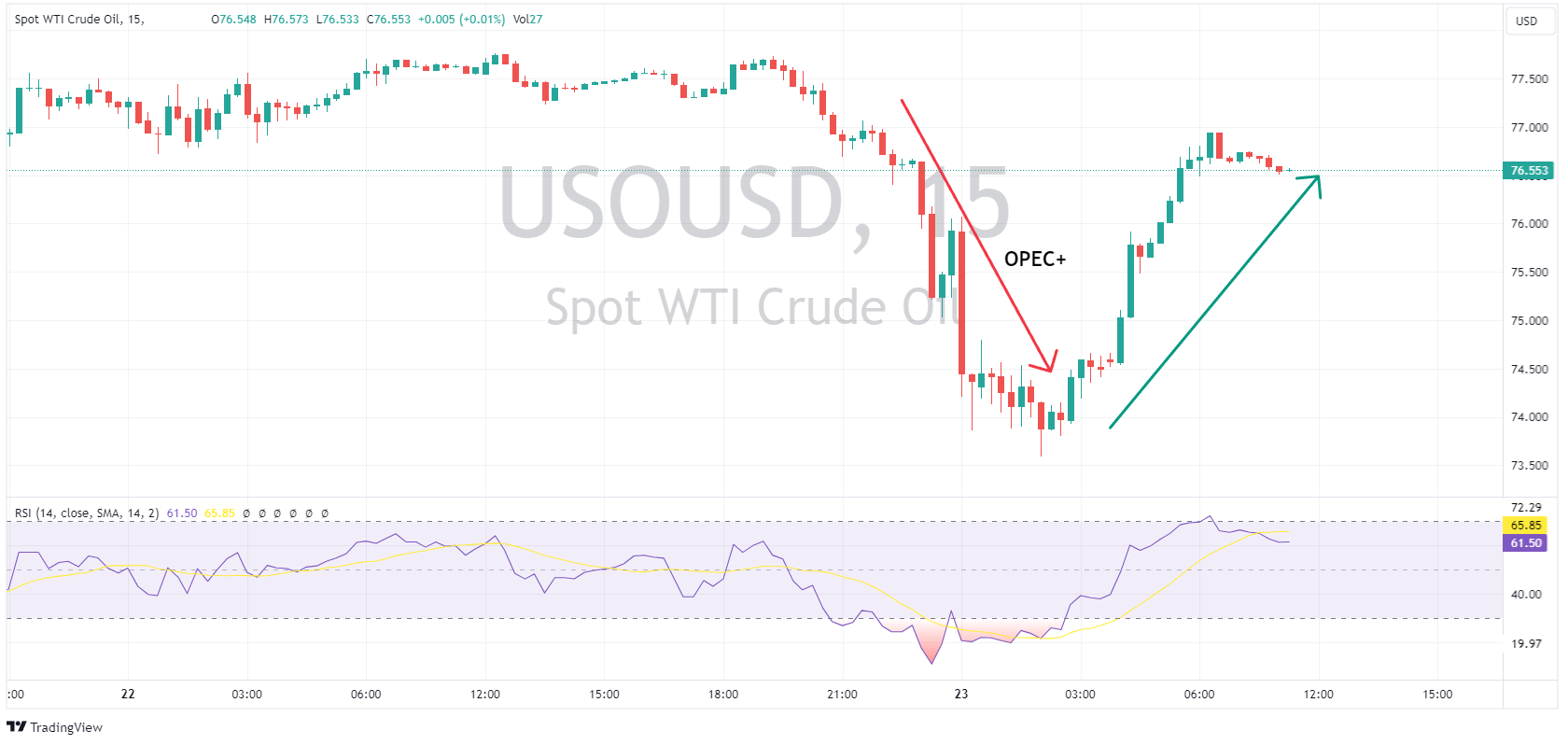

In commodities, Crude oil had a rollercoaster session, first dumping 4% on news that OPEC+ had postponed their November meeting, then retracing the move lower after analysts suggested that the meeting delay will help create “cohesion around collective cuts”

Gold dipped after again testing the resistance at the and being rejected at October highs, XAUUSD dropping below 2000 USD an ounce, giving up almost half of Tuesdays gains.

Ahead today French, German and UK PMI readings will headline.

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice.

Next Article

FX Analysis – EUR and GBP rally on PMIs, USDJPY tests key level.

Markets were predictably quite due to holidays in the US and Japan on Thursday. USD was marginally softer overall with DXY dropping to test the support at the 200-day MA before recovering modestly amid the holiday lull for Thanksgiving. Source:TradingView.com EURUSD managed mild gains with price action choppy around the 1.0900 level but ev...

Previous Article

Deere & Company results top estimates but the stock is falling

Deere & Company (NYSE: DE) reported the latest results for the fourth-quarter ending October 29, 2023 and full fiscal 2023 before the market opens...