- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Share CFDs

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Share CFDs

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & Analysis

- Oil, Metals, Soft Commodities

- Is the price of wheat ready to bounce?

- Home

- News & Analysis

- Oil, Metals, Soft Commodities

- Is the price of wheat ready to bounce?

News & AnalysisNews & Analysis

News & AnalysisNews & AnalysisThe price of wheat is finally starting to show positive signs after an aggressive sell off that has been ongoing since May 2022. There is hope that the price of the commodity may begin to climb again with the price finally finding some support. The price has been impacted by growing fears that production may slip may increasing volatility and increasing in price. Pressure from Global Warming has effected the production/farming of the grain reducing supply. India in particular which is the second largest producer of wheat, has suffered from rising heat levels with its production dropping by 3% in 2021/22. Furthermore, the constant ambiguity surrounding the Russian and Ukraine crisis still has the potential move the price even higher adding to a potential supply crunch.

Technical Analysis

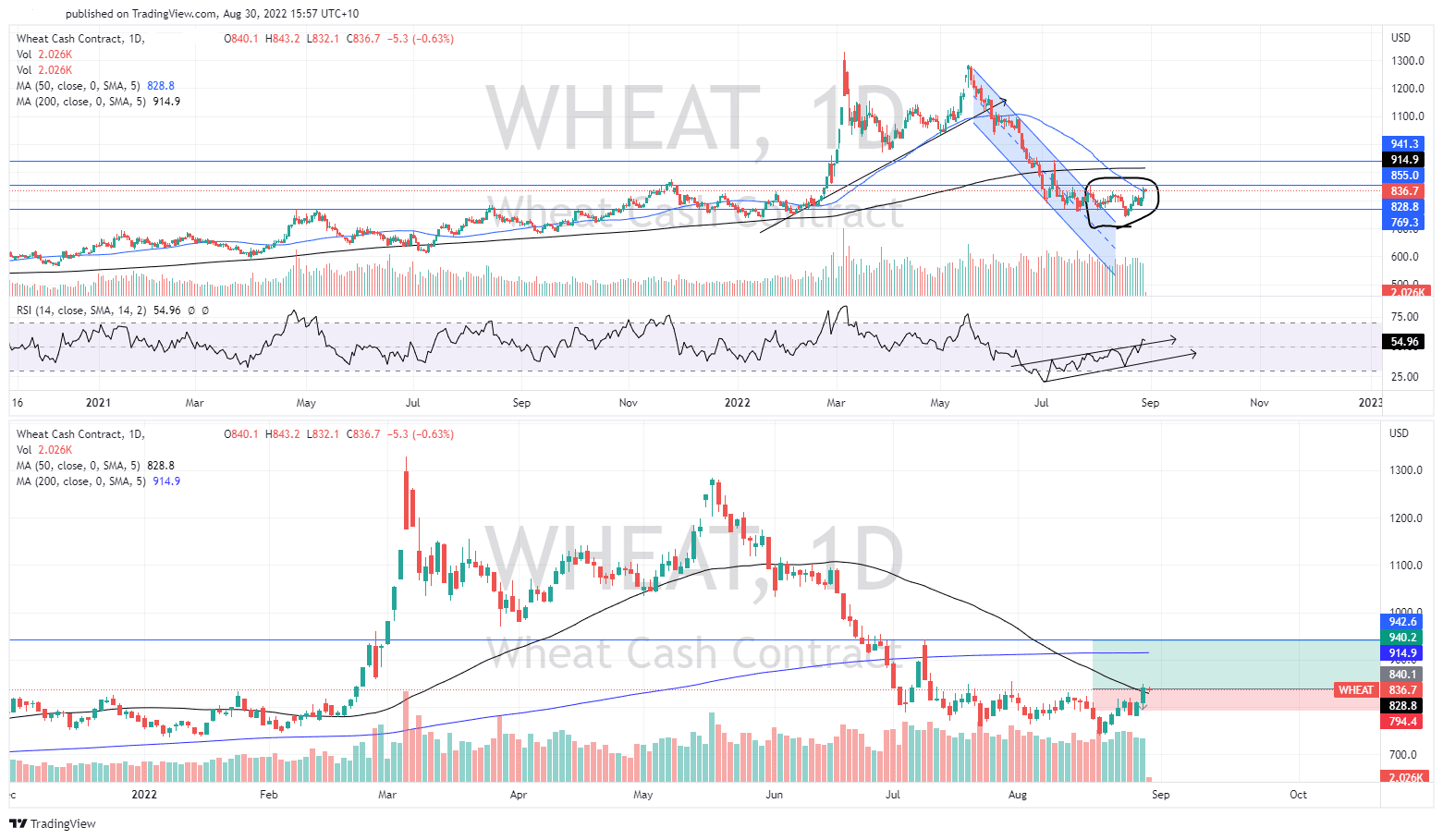

The Price chart for wheat shows how the price ran during the initial stages of the Russian and Ukraine crisis, before failing to breakout and entering an aggressive downtrend. This shift is essentially a long-term reversion to the mean moving back towards the 200-day average and prior long term supports. The price action is a common follow on from sharp and fast rises in prices. The price has now settled and consolidating between $770-$850 and importantly broken out of the downtrend.

Adding to the evidence for a potential reversal is that there is a divergence between the RSI and the current price. As it can be seen, the RSI is itself in an upward channel and has crossed through the 50 level. This can be compared to the actual price which is still consolidating. Divergences can be an early indicator that a reversal is about to occur.

This current price action is showing the potential for a bounce based on the factors discussed above and presents a potential long trade with a risk reward of around 2.5:1. For this trade, the recent resistance point of $940 can be the first target. If the price can pass through this level, it may be able to reach $970. Placing a stop loss below the recent low wick at 830 provides solid risk management in case the price goes in a different direction.

Ready to start trading?

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice.

Next Article

Baidu beats Q2 estimates

Baidu Inc. (BIDU) reported its unaudited Q2 results on Tuesday. The Chinese technology company topped both revenue and earnings per share estimates for the quarter. Revenue reported at $4.424 billion for Q2 (down by 5% year-over-year) vs. $4.395 billion expected. Earnings per share at $2.36 per share for the quarter vs. $1.59 per share estima...

August 31, 2022Read More >Previous Article

Jackson Hole Symposium set to get underway today

The Kansas City Federal Reserve is set to host the 45th Annual Symposium at Jackson Hole Lodge in Wyoming’s Grand Teton National Park. Som...

August 26, 2022Read More >Please share your location to continue.

Check our help guide for more info.