- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Home

- News & Analysis

- Economic Updates

- Netflix takes a dip

- 1 Month -8.96%

- 3 Month -31.75%

- Year-to-date -42.13%

- 1 Year -36.57%

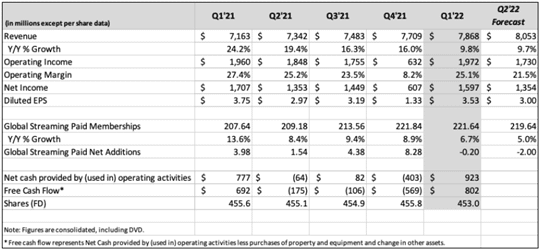

News & AnalysisNetlfix Inc. reported its latest financial results after the closing bell on Wall Street on Tuesday.

The online streaming service company reported revenue just shy of analyst estimates at $7.868 billion in the first quarter vs. $7.929 billion expected.

Earnings per share topped expectations at $3.53 per share vs. $2.90 per share expected.

Netflix lost 200,000 subscribers in the first quarter of 2022 – the first time in over 10 years.

”Our revenue growth has slowed considerably as our results and forecast below show. Streaming is winning over linear, as we predicted, and Netflix titles are very popular globally. However, our relatively high household penetration – when including the large number of households sharing accounts – combined with competition, is creating revenue growth headwinds. The big COVID boost to streaming obscured the picture until recently. While we work to reaccelerate our revenue growth – through improvements to our service and more effective monetization of multi-household sharing – we’ll be holding our operating margin at around 20%. Key to our success has been our ability to create amazing entertainment from all around the world, present it in highly personalized ways, and win more viewing than our competitors. These are Netflix’s core strengths and competitive advantages. Together with our strong profitability, we believe we have the foundation from which we can both significantly improve, and better monetize, our service longer term,” Netflix said in a statement to shareholders following the latest results.

”In the near term though, we’re not growing revenue as fast as we’d like. COVID clouded the picture by significantly increasing our growth in 2020, leading us to believe that most of our slowing growth in 2021 was due to the COVID pull forward.”

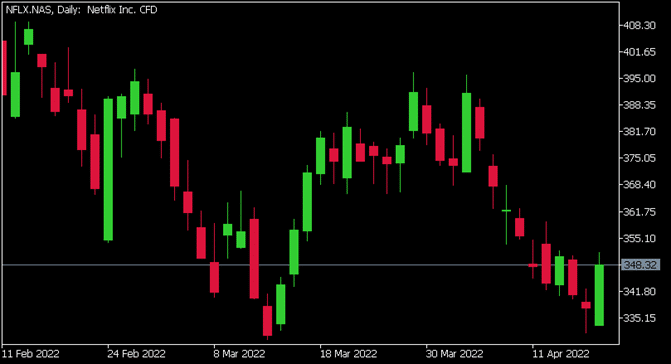

Netflix Inc. chart

Shares of Netflix ended the trading day up by 3.18% on Tuesday at $348.32 per share. However, the stock price fell sharply in the after-market trading hours – down by over 25% due to loss of subscribers and slow growth outlook.

Here is how the stock has performed in the past year:

Netlfix Inc. is the 79th largest company in the world and with a total market cap of $154.87 billion.

You can trade Netflix Inc. (NFLX) and many other stocks from the NYSE, NASDAQ, HKEX and the ASX with GO Markets as a Share CFD.

Sources: Netlfix Inc., TradingView, CompaniesMarketCap

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice.

Next Article

Netflix plumets 25% after hours after hours after disappointing quarterly results.

US streaming giant Netflix (NFLX) has seen its share price fall spectacularly after regular trading hours as the market released poor quarterly results. The concern for the company and the market concern is the first loss of subscribers in a decade. NFLX’s user base dropped by 200,000 and is expected to drop further by 2 million in the next pe...

April 20, 2022Read More >Previous Article

Best-Performing Stocks: April 2022

It's been a volatile stretch for the stock market. From pandemic-induced sell-offs, record highs in 2021 and a bumpy start to 2022, the market has cer...

April 19, 2022Read More >We use a range of cookies to give you the best possible browsing experience. By continuing to use this website, you agree to our use of cookies. You can view our cookie policy here.Manage consentPrivacy Overview

This website uses cookies to improve your experience while you navigate through the website. Out of these, the cookies that are categorized as necessary are stored on your browser as they are essential for the working of basic functionalities of the website. We also use third-party cookies that help us analyze and understand how you use this website. These cookies will be stored in your browser only with your consent. You also have the option to opt-out of these cookies. But opting out of some of these cookies may affect your browsing experience.Necessary cookies are absolutely essential for the website to function properly. These cookies ensure basic functionalities and security features of the website, anonymously.Cookie Duration Description AWSALBCORS 7 days This cookie is managed by Amazon Web Services and is used for load balancing. cookielawinfo-checkbox-advertisement 1 month Set by the GDPR Cookie Consent plugin, this cookie is used to record the user consent for the cookies in the "Advertisement" category . cookielawinfo-checkbox-analytics 1 month This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". cookielawinfo-checkbox-functional 1 month The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". cookielawinfo-checkbox-necessary 1 month This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". cookielawinfo-checkbox-others 1 month This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. cookielawinfo-checkbox-performance 1 month This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". elementor never This cookie is used by the website's WordPress theme. It allows the website owner to implement or change the website's content in real-time. PHPSESSID session This cookie is native to PHP applications. The cookie is used to store and identify a users' unique session ID for the purpose of managing user session on the website. The cookie is a session cookies and is deleted when all the browser windows are closed. viewed_cookie_policy 1 month The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. _GRECAPTCHA 5 months 27 days This cookie is set by Google. In addition to certain standard Google cookies, reCAPTCHA sets a necessary cookie (_GRECAPTCHA) when executed for the purpose of providing its risk analysis. __cfruid session Cloudflare sets this cookie to identify trusted web traffic. Functional cookies help to perform certain functionalities like sharing the content of the website on social media platforms, collect feedbacks, and other third-party features.Performance cookies are used to understand and analyze the key performance indexes of the website which helps in delivering a better user experience for the visitors.Analytical cookies are used to understand how visitors interact with the website. These cookies help provide information on metrics the number of visitors, bounce rate, traffic source, etc.Cookie Duration Description CONSENT 16 years 3 months 17 days 20 hours These cookies are set via embedded youtube-videos. They register anonymous statistical data on for example how many times the video is displayed and what settings are used for playback.No sensitive data is collected unless you log in to your google account, in that case your choices are linked with your account, for example if you click “like” on a video. SPSI session This cookie is used for setting a unique ID for the session and it collects user behaviour on the website during the session. This collected information is used for statistical purposes. vuid 2 years Vimeo installs this cookie to collect tracking information by setting a unique ID to embed videos to the website. _ga 2 years The _ga cookie, installed by Google Analytics, calculates visitor, session and campaign data and also keeps track of site usage for the site's analytics report. The cookie stores information anonymously and assigns a randomly generated number to recognize unique visitors. _gat_UA-2467324-17 1 minute This is a pattern type cookie set by Google Analytics, where the pattern element on the name contains the unique identity number of the account or website it relates to. It appears to be a variation of the _gat cookie which is used to limit the amount of data recorded by Google on high traffic volume websites. _ga_9P2FTXTH5P 2 years This cookie is installed by Google Analytics. _gcl_au 3 months Provided by Google Tag Manager to experiment advertisement efficiency of websites using their services. _gid 1 day Installed by Google Analytics, _gid cookie stores information on how visitors use a website, while also creating an analytics report of the website's performance. Some of the data that are collected include the number of visitors, their source, and the pages they visit anonymously. _uetsid 1 day This cookies are used to collect analytical information about how visitors use the website. This information is used to compile report and improve site. Advertisement cookies are used to provide visitors with relevant ads and marketing campaigns. These cookies track visitors across websites and collect information to provide customized ads.Cookie Duration Description IDE 1 year 24 days Google DoubleClick IDE cookies are used to store information about how the user uses the website to present them with relevant ads and according to the user profile. MUID 1 year 24 days Bing sets this cookie to recognize unique web browsers visiting Microsoft sites. This cookie is used for advertising, site analytics, and other operations. NID 6 months NID cookie, set by Google, is used for advertising purposes; to limit the number of times the user sees an ad, to mute unwanted ads, and to measure the effectiveness of ads. test_cookie 15 minutes The test_cookie is set by doubleclick.net and is used to determine if the user's browser supports cookies. VISITOR_INFO1_LIVE 5 months 27 days A cookie set by YouTube to measure bandwidth that determines whether the user gets the new or old player interface. YSC session YSC cookie is set by Youtube and is used to track the views of embedded videos on Youtube pages. yt-remote-connected-devices never YouTube sets this cookie to store the video preferences of the user using embedded YouTube video. yt-remote-device-id never YouTube sets this cookie to store the video preferences of the user using embedded YouTube video. yt.innertube::nextId never These cookies are set via embedded youtube-videos. yt.innertube::requests never These cookies are set via embedded youtube-videos. Other uncategorized cookies are those that are being analyzed and have not been classified into a category as yet.Cookie Duration Description AWSALB 7 days AWSALB is a cookie generated by the Application load balancer in the Amazon Web Services. It works slightly different from AWSELB. DEMO_FORM_PCODE past No description geot_rocket_city session No description available. geot_rocket_country session No description available. geot_rocket_state session No description available. ms-uid 1 year No description available. SPSE session No description available. STYXKEY_geot_country session No description _uc_current_session 1 hour No description available. _uc_initial_landing_page 1 month No description available. _uc_last_referrer 1 month No description available. _uc_referrer 1 month No description available. _uc_visits 1 month No description available. _uetvid 1 year 24 days No description available. Please share your location to continue.

Check our help guide for more info.

- Trading