- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Share CFDs

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Share CFDs

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & Analysis

- Shares and Indices

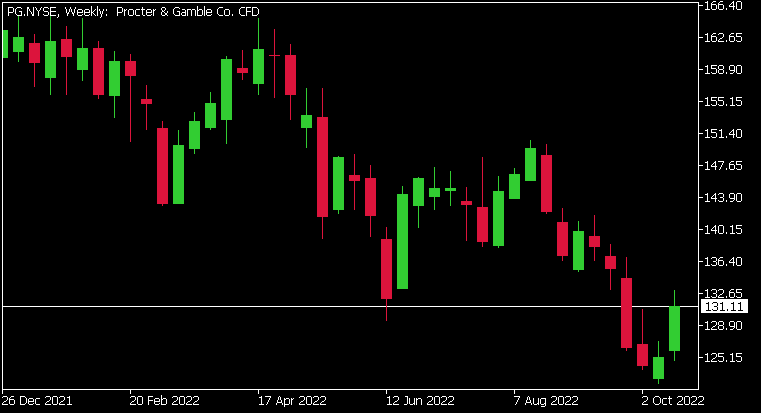

- Procter & Gamble beats estimates – the stock is up

- Home

- News & Analysis

- Shares and Indices

- Procter & Gamble beats estimates – the stock is up

- 1 month: -3.34%

- 3 months: -7.32%

- Year-to-date: -19.80%

- 1 year: -7.10%

- Credit Suisse: $140

- JP Morgan: $140

- Raymond James: $155

- Deutsche Bank: $155

- Morgan Stanley: $160

- Wells Fargo: $150

- Barclays: $154

- Truist Securities: $160

News & AnalysisNews & Analysis

News & AnalysisNews & AnalysisThe Procter & Gamble Company (NYSE:PG) reported its latest financial results before the opening bell on Wednesday.

The largest consumer goods company in the world topped both revenue and earnings per share (EPS) estimates for the quarter – sending the stock price higher at the open.

Revenue reported at $20.612 billion (up by 1% year-over-year) vs. $20.33 billion expected.

EPS at $1.57 per share (down by 2% year-over-year) vs. $1.547 per share estimate.

”We delivered solid results in our first quarter of fiscal 2023 in a very difficult cost and operating environment,” Jon Moeller, CEO of The Procter & Gamble Company said in a press release.

”These results enable us to maintain our guidance ranges for organic sales and EPS growth for the fiscal year despite continued significant headwinds. We remain committed to our integrated strategies of a focused product portfolio, superiority, productivity, constructive disruption and an agile and accountable organization structure. These strategies have enabled us to build and sustain strong momentum. They remain the right strategies to navigate through the near-term challenges we’re facing and continue to deliver balanced growth and value creation,” Moeller concluded.

The stock was up by around 2% following the latest results, trading at $131.11 a share.

Stock performance

Procter & Gamble price targets

The Procter & Gamble Company is the 17th largest company in the world with a market cap of $313.81 billion.

You can trade The Procter & Gamble Company (NYSE:PG) and many other stocks from the NYSE, NASDAQ, HKEX and the ASX with GO Markets as a Share CFD.

Sources: The Procter & Gamble Company, TradingView, MetaTrader 5, Benzinga, CompaniesMarketCap

Ready to start trading?

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice.

Next Article

China’s slow growth a worry for Australia?

China, Australia’s savior during the 2009 Global Financial Crisis may not provide the same security in what may be an impending recession. This does not bode well for the Australian economy which so far has performed relatively well in the recent volatile market conditions. The ASX which has been resilient in the global sell off, on the back of i...

October 21, 2022Read More >Previous Article

Tesla Q3 revenue falls short of Wall Street expectations – price target raised by Bank of America

Tesla Inc. (NASDAQ:TSLA) reported its Q3 financial results after the closing bell on Wednesday. World’s largest automaker exceeded earnings per sha...

October 20, 2022Read More >Please share your location to continue.

Check our help guide for more info.