- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Share CFDs

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Share CFDs

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & Analysis

- Geopolitical Events

- Trade Deadline Delayed – “Substantial Progress”

- Home

- News & Analysis

- Geopolitical Events

- Trade Deadline Delayed – “Substantial Progress”

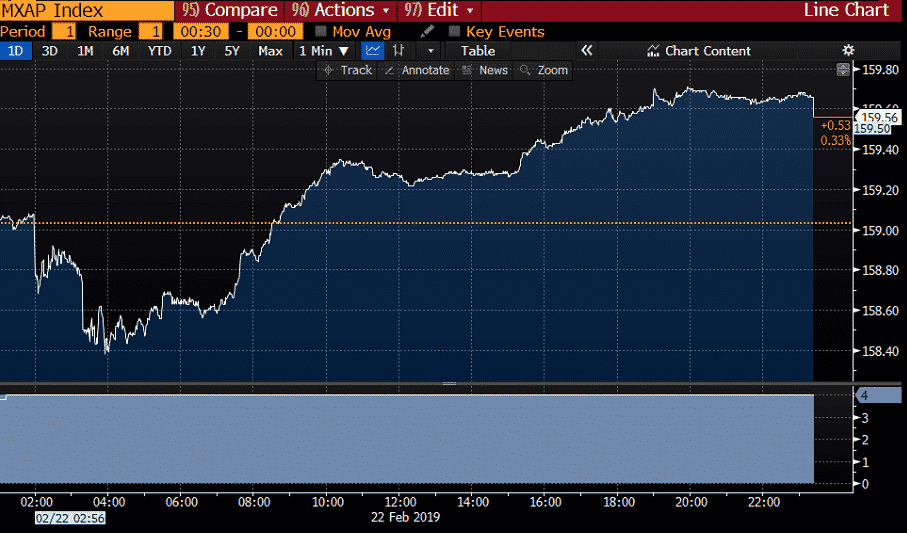

- MSCI Asia Pacific Index rose by 0.5% as of writing. Asian stocks edged higher as investors are cheering up the latest signs of progress.

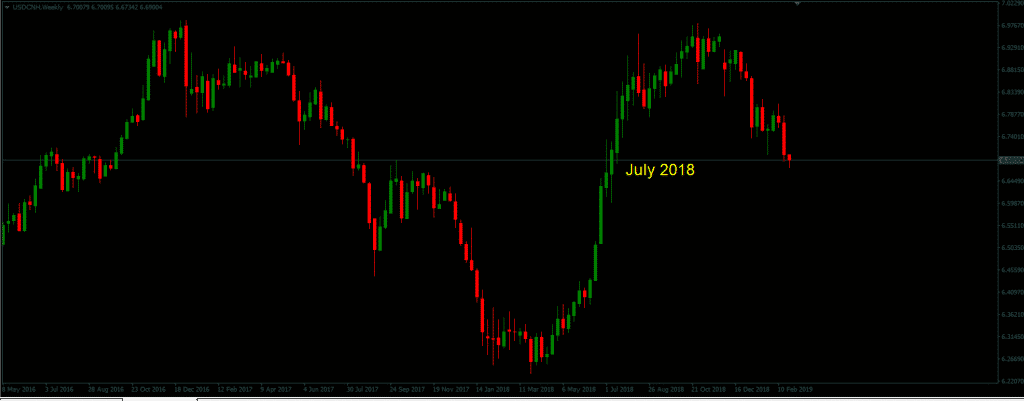

- USDCNH – The Yuan is climbing higher sending the USDCNH pair to its lowest level since July 2018.

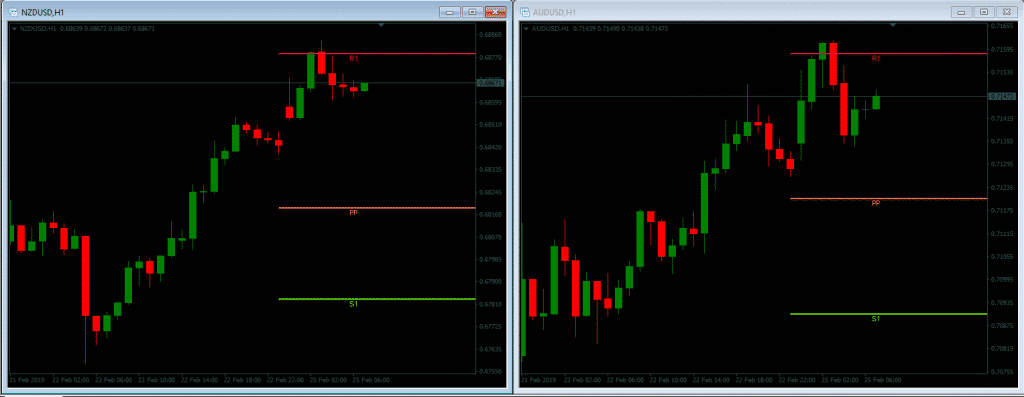

- The Antipodeans being trade-sensitive currencies are finding buyers on trade optimism. However, we can see that AUDUSD and NZDUSD are finding resistance as domestic fundamentals are keeping a lid on the gains. After a strong Retail Sales figures, the NZD pairs gapped higher on the open. However, the pairs are unable to keep the bullish momentum due to the weak fundamentals. On the technical side, the pairs are in the overbought conditions as per the RSI.

News & AnalysisNews & Analysis

News & AnalysisNews & Analysis

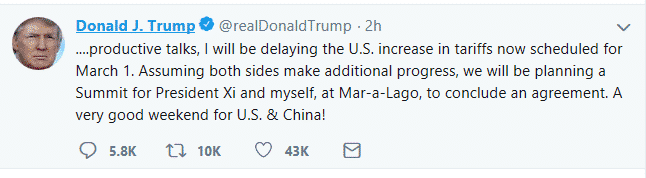

Monday started on a buoyant note as the weekend negotiations between the US and the Chinese officials on structural issues, including intellectual property protection, technology transfer, agriculture among others were productive which encouraged President Trump to extend the 1st March deadline.

Asian stocks and trade-sensitive currencies like the Antipodeans are flashing green. Given that the deadline has been extended, the chances of a trade deal between the two world largest economies also rises which is boding well with investors.

Source: Bloomberg TerminalIn the Australian share market, the real estate sector was the biggest dragger on the ASX today. However, the broad optimism in the market helped the index to close in positive territory despite paring gains in the afternoon trade.

USDCNH (Weekly Chart)

Source: GO MT4NZDUSD and AUDUSD (Hourly Chart)

Source: GO MT4The move in the financial markets in the Asian session following the “delay” announcement has not been huge, but it lifted sentiment and brought relief to the markets!

This article is written by a GO Markets Analyst and is based on their independent analysis. They remain fully responsible for the views expressed as well as any remaining error or omissions. Trading Forex and Derivatives carries a high level of risk.

Ready to start trading?

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice.

Next Article

Trading Opportunities from Japan’s Shock Interest Rate Decision

After looking at the reasons why the Bank of Japan decided to opt for negative interest rates in the first part of this series, we will now see the factors that can help explain why the yen is not going south. When there is nothing out there: As discussed earlier, part of BOJ’s decision to go into negative rates was to push financial institutio...

February 25, 2019Read More >Previous Article

The Dalian Port – “China’s Coal Ban”

Wednesday was the bearer of bad news for Australia. Despite the buoyant employment report which briefly lifted its local currency, the Australian...

February 21, 2019Read More >Please share your location to continue.

Check our help guide for more info.