- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Share CFDs

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets.

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Share CFDs

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets.

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & Analysis

- Geopolitical Events

- Brexit and Italy

News & AnalysisAs we head into the Thanksgiving holidays, the continuing factors dominating headlines remain Brexit and Italy.

This Wednesday was an important day for Brexit and Italy, but the events unfolded without any major catalysts or breakthrough.

Theresa May and Jean-Claude Juncker meeting in Brussels:

It appears that some progress has been made. The comments unfolding after the meeting were positive “further progress has been made, very good progress”. However, it looks like both parties still failed to reach a final deal as Theresa May will be flying back to Brussels on Saturday ahead of Sunday EU summit to conclude the progress made.

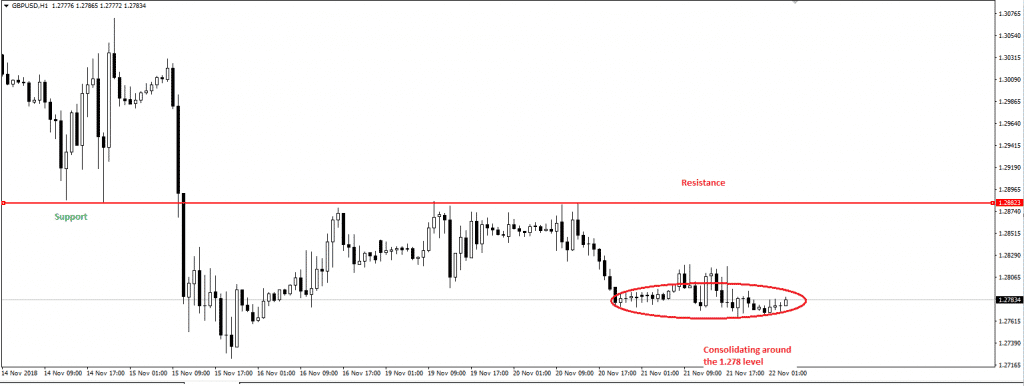

Brexit continues to be the primary driver for the Sterling pairs. After last week’s sharp decline, the GBPUSD pair has been navigating within the 1.27 and 1.28 range finding buyers only at times when the US dollar is weaker. At first glance, on the hourly chart, we can see that the 1.288 mark which acted as a support line before the deep fall is now acting as a resistance line. There were a few attempts to break through and move towards the 1.29 level, but bulls were unable to push beyond that resistance line. The renewed weakness in the US dollar failed to lift the pair as sentiment remained dampened by Brexit uncertainties. The last-minute talks and the race against time are making investors nervous and reluctant to take the local currency in a firm direction unless there is more clarity on the remaining issues.

GBPUSD (Hourly Chart)

Would the exit agreement be signed on Sunday or be postponed?The European Union (EU) decision on Italy:

The EU once again rejected Italy revised draft and is moving closer to placing sanctions on Italy for not submitting a budget proposal that abides by the rules. The Budget included the fulfilment of election promises explaining why Italy is keen to push such a big spending budget.

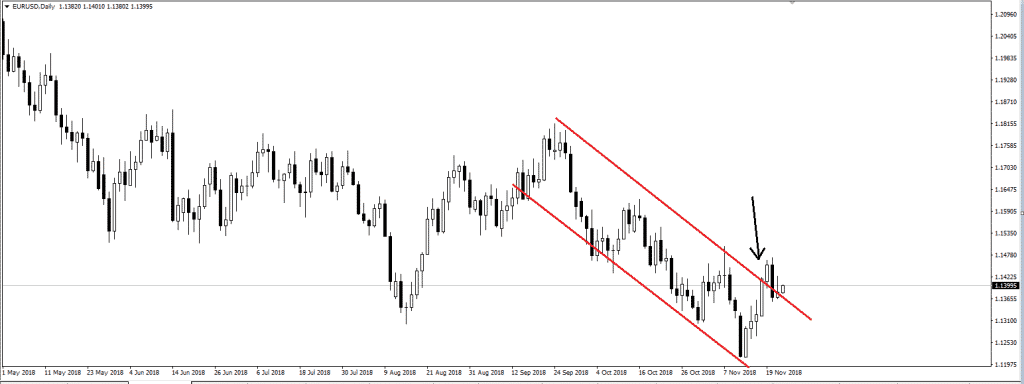

Domestic politics mostly drive the shared currency. At the moment, the EURUSD is finding upside support when the greenback is falling. On Tuesday, the pair broke from the bearish trend, it was trapped in since the end of September, but Brexit and Italian budget jitters are keeping a lid on the gains. So far, the pair is struggling to retest this month high and is currently trading in the 1.13 range.

The current situation is paving the way for an Excessive Deficit Procedure (EDP) against Italy and traders will likely monitor any developments on that matter!

This article is written by a GO Markets Analyst and is based on their independent analysis. They remain fully responsible for the views expressed as well as any remaining error or omissions. Trading Forex and Derivatives carries a high level of risk.Ready to start trading?

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice.

Next Article

ECB Speeches

The week kicked off with a series of ECB speeches, and markets participants were gearing up to have more updates on the Eurozone economy, interest rate and Italy. Investors were keen to see whether the ECB downplays the slowdown in the German economy and the Italian Budget risks. We bring you a summary of the main headlines following the spe...

November 27, 2018Read More >Previous Article

G20 Summit 10th Anniversary

In the wake of the global financial crisis, the G20 summit has become a popular forum of global governance and cooperation. In the heat of the dis...

November 16, 2018Read More >Please share your location to continue.

Check our help guide for more info.