- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Share CFDs

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Share CFDs

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & Analysis

- Articles

- General Trading Info

- ASX 200: Financial Year in Review

News & AnalysisDespite living through one of the most chaotic political and trade environments in recent history, the ASX 200 delivered its strongest performance since the pandemic rally.

The S&P/ASX 200 Index gained 9.97% in capital growth and 13.81% in total returns, hitting a record high of 8,639.1 points in June.

While Trump’s tariff announcements caused dramatic market swings — including the ASX plunging nearly 500 points on “Liberation Day” — Australian markets weathered the storm and managed to rally before the financial year end.

The rally was driven primarily by heavyweight banks like Commonwealth Bank and Westpac, with CBA alone responsible for nearly half the index’s gains.

However, the performance was not uniform across all sectors — five of the 11 ASX market sectors actually lost value during the financial year.

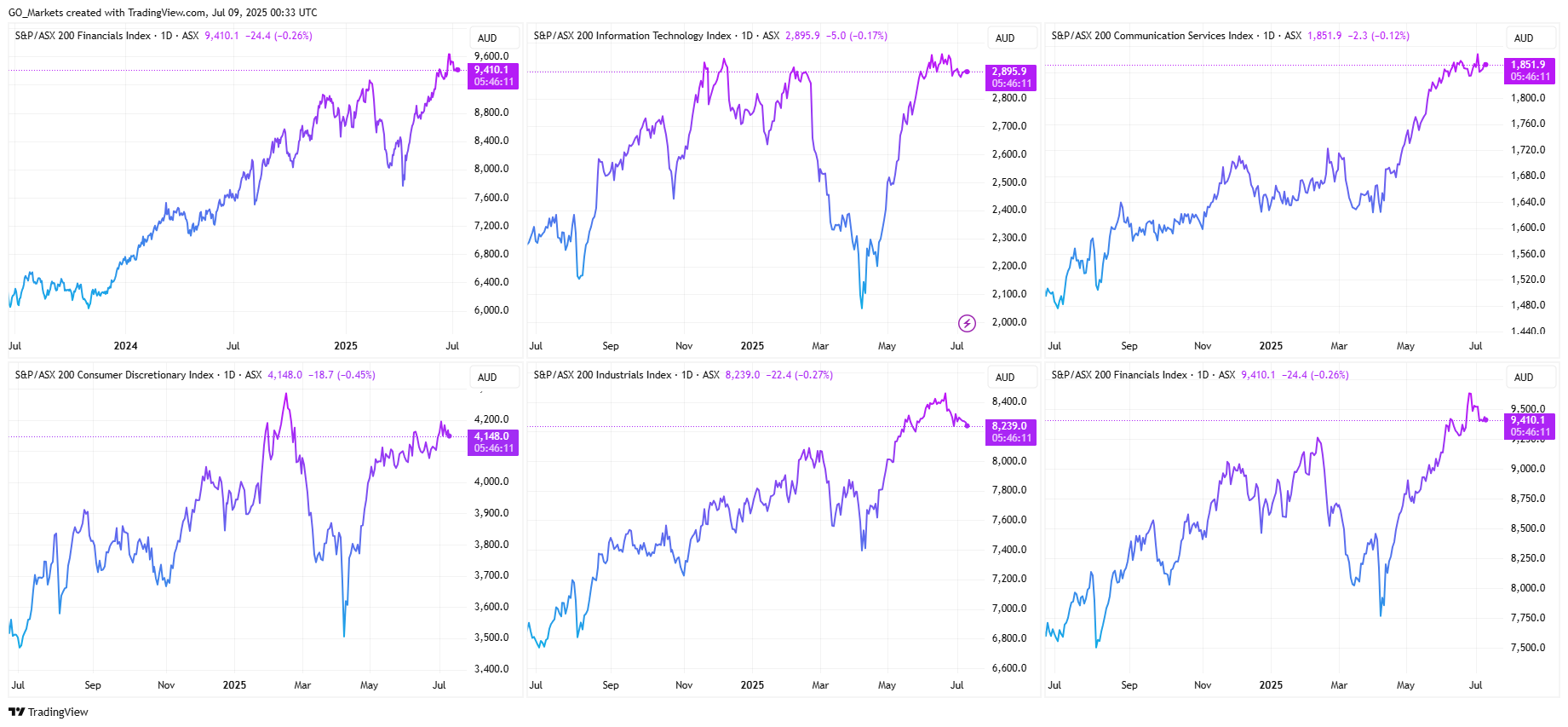

Sector Performance Rankings

Financials

The ASX 200 financials sector was the top-performing market sector of FY25, with the Financials Index rising by 24.45% and delivering total returns including dividends of 29.39%.

Sector Champion: Despite Commonwealth Bank’s headline-grabbing 45% rise that captured most investor attention, it was retirement and general investment solutions provider, Generation Development Group (ASX: GDG), that led the sector with a rise of 114% in FY25.

Technology – AI Boom Continues

The Information Technology Index rose by 23.89% and provided a total return of 24.19%.

Sector Champion: TechnologyOne outperformed both its FY24 and 1H25 earnings expectations — 9.8% and 11.3% on each result respectively. ASX:TNE rose 121% during FY25 to close at $41.01.

Communications

The Communications Index gained 23.4% for the year.

Sector Champion: EVT topped the communication leaderboard in FY25. The stock has largely traded nowhere since 2015, but found some momentum thanks to a bump in earnings from its cinema business, with the stock rising 41%.

Industrials

The Industrials Index gained 22% during FY25.

Sector Champion: Qantas Airways (ASX:QAN) shares rose 84% to close at $10.74. Lower jet fuel prices, strong international and domestic pricing, and capacity growth gave investors renewed confidence in the leading Australian airline.

Consumer Discretionary

The Consumer Discretionary Index rose 18% for the year.

Sector Champion: Temple & Webster Group (ASX:TPW) dominated the sector with a 127% gain to $21.32. Improved consumer sentiment and strong sales saw the e-commerce furniture company capitalise on momentum, especially in its home improvement and B2B categories.

Real Estate & REITs

The Real Estate Index gained 10% despite volatile bond yields throughout the year.

Sector Champion: Charter Hall Group (ASX:CHC) was the sector leader — closing the financial year 72% higher at $19.19 per share.

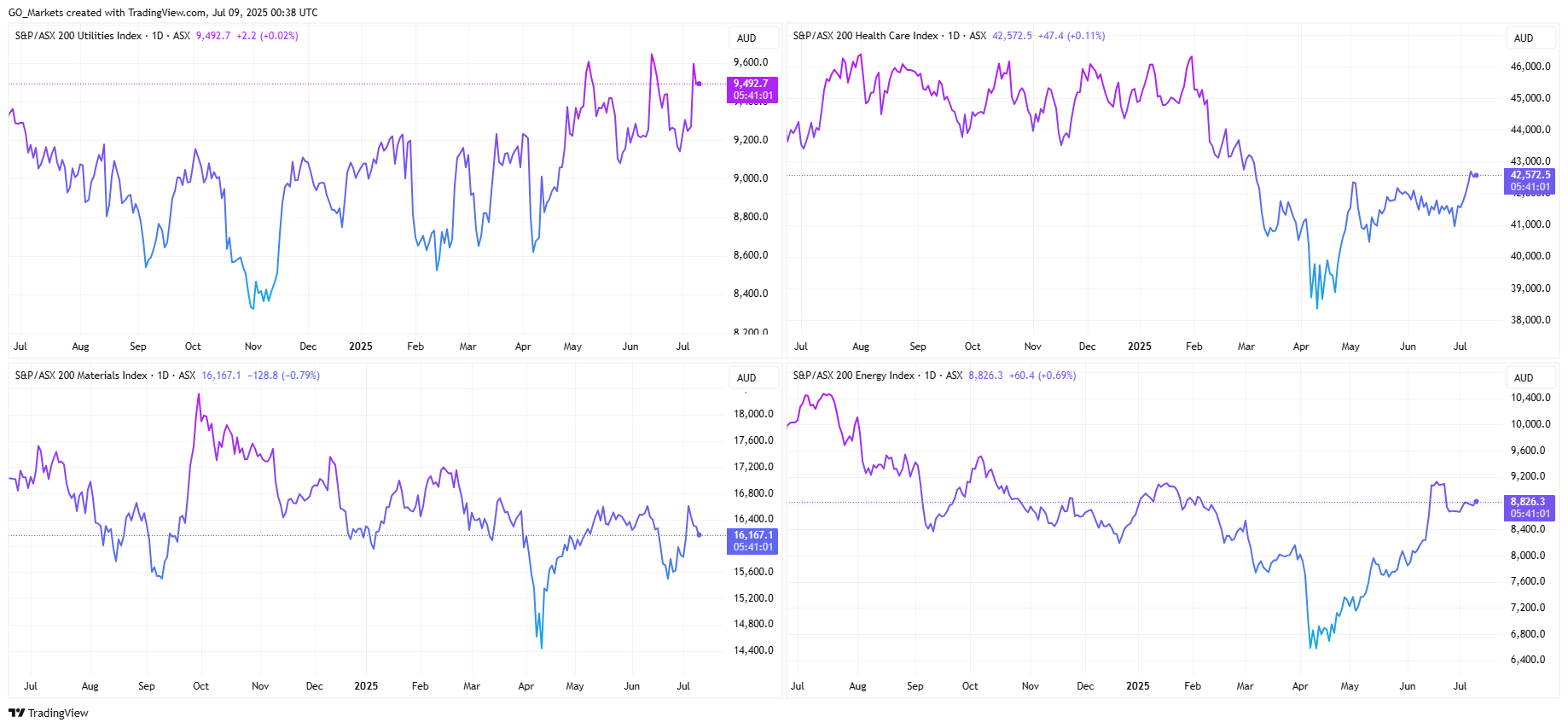

Top-performing sectors in FY25 Utilities

The Utilities Index fell 1.6%.

Sector Champion: APA Group (ASX:APA) managed a modest 2.3% gain in FY25, but managed to come out above its peers as the sector’s best performer.

Consumer Staples

The Consumer Staples Index declined 2.1%.

Sector Champion: Bega Cheese (ASX:BGA) led the sector with a 28% gain, backing up its strong FY24 results.

Healthcare

The Healthcare Index fell 5.99% despite some individual standouts.

Sector Champion: Sigma Healthcare’s merger with Chemist Warehouse created one of the biggest rallies of the year. As the merger gained clarity, the stock’s potential inclusion in the S&P/ASX 200 drove strong buying from investors. Sigma (ASX:SIG) gained 135% to close at $2.99.

Materials

The second-worst sector was materials, with the Materials Index dropping 6.04%.

Sector Champion: Despite sector struggles, gold miner Regis Resources (ASX:RRL) ascended 150% to close at $4.39, benefiting from rising gold prices.

Energy – The Year’s Biggest Loser

The worst-performing ASX sector was energy, with the Energy Index falling 13.52%. Influences largely by the sector’s largest stock — Woodside Energy Group — crumbling by 16%, closing at $23.66.

Sector Champion: Uranium explorer Deep Yellow (ASX:DYL) stood out in the struggling sector with a 25% gain.

Worst-performing sectors in FY25 Looking Ahead

The results of FY25 tell a simple story: execution matters more than sector. Technology and financials thrived because the best companies in these sectors did what they said they would do.

Energy and materials struggled because many companies in these sectors are fighting structural headwinds, not just cyclical ones. The market is becoming more about which companies to back, rather than which sectors to back.

Looking forward to FY26, this pattern could become even more pronounced as geopolitical tensions and trade wars see market uncertainty become the norm rather than the exception.

Ready to start trading?

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice.

Next Article

How to Spot When the Trend May be Truly Turning

There are few trades as appealing, or as risky, as trying to catch a market reversal. The idea of entering at the turning point and riding the new trend is exciting. However, most traders fail to consistently produce good trading outcomes on this potential, often entering too early without confirmation, and thus get caught at a pause point of ...

July 14, 2025Read More >Previous Article

Where to for FY26 and beyond?

The ASX 200 closed out the 2025 financial year on a high, reaching a new intra-month peak of 8,592 in June and within touching distance of the all-tim...

July 8, 2025Read More >Please share your location to continue.

Check our help guide for more info.