- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets.

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets.

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & Analysis

- Forex

- FX Analysis – Yield spike on hot retail sales fails to lift USD, AUD outperforms, JPY , NZD.

- Home

- News & Analysis

- Forex

- FX Analysis – Yield spike on hot retail sales fails to lift USD, AUD outperforms, JPY , NZD.

News & AnalysisNews & Analysis

News & AnalysisNews & AnalysisFX Analysis – Yield spike on hot retail sales fails to lift USD, AUD outperforms, JPY , NZD.

18 October 2023 By Lachlan MeakinUSD traded in a tight range on Tuesday despite a big move higher in treasury yields after a beat in US retail sales figures, the headline rising 0.7% M/M vs 0.3% expected. DXY whipsawing within a contained range, hitting a high of 106.52 on the initial reaction to the retail sales figure, but quickly paring gains to hit a low of 106.02. Fed member Barkin Fed’s also spoke noting that the FOMC will have a good debate when asked about the chance of a Fed hike at heir November meeting. Looking ahead, Fed speakers are set to continue, ahead of Chair Powell on Thursday, also any further geopolitical updates will be closely watched by USD traders.

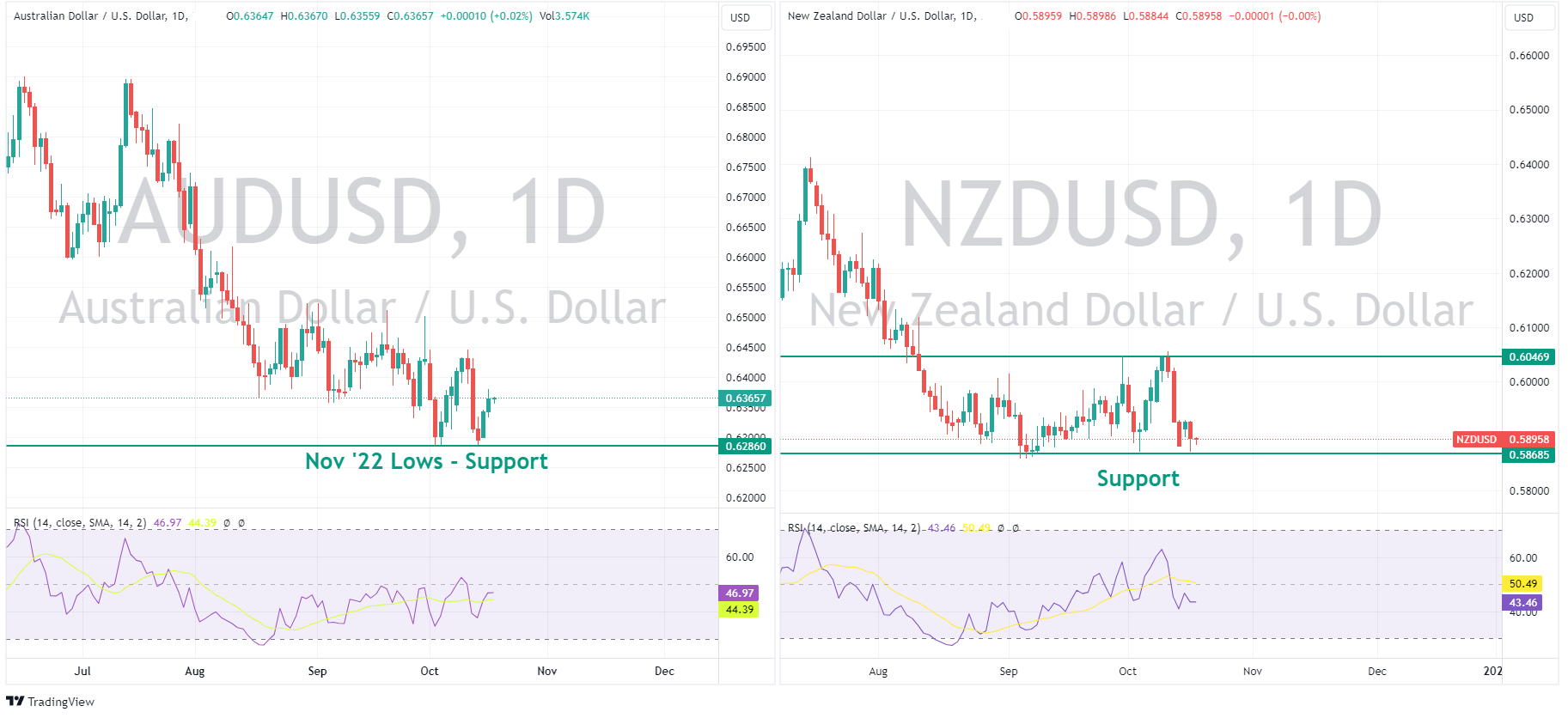

AUD and NZD were divergent on Tuesday, with the Aussie the G10 outperformer and the Kiwi the laggard. AUDUSD continuing its bounce off the major support at 0.6286 to rally to a high of 0.6380, helped along by what was seen as hawkish RBA minutes released during the session. NZDUSD on the other hand struggled after a not as hot as expected NZ CPI, NZDUSD dipping to test the October lows at 0.5871 before finding some support..

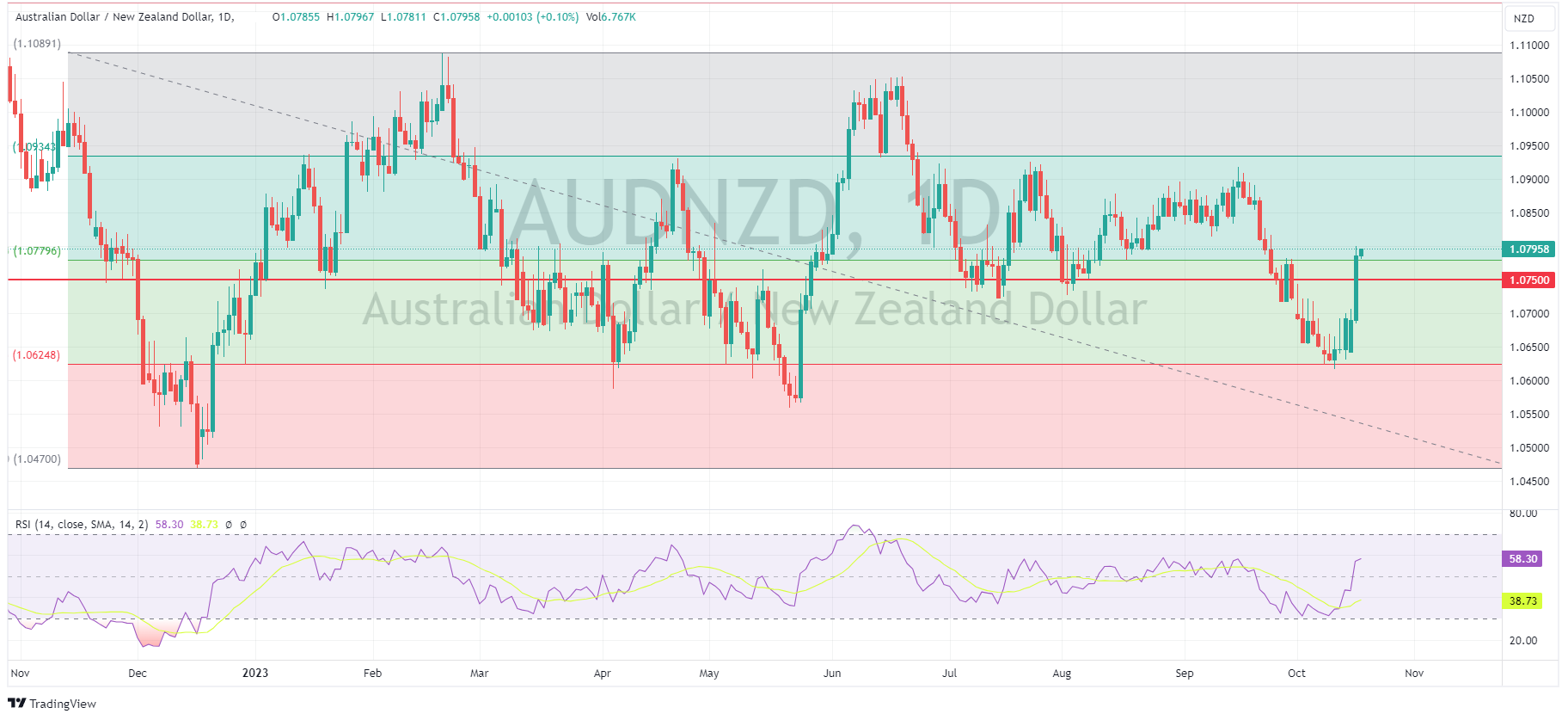

AUDNZD surged higher, retaking the key 1.07 level and within a whisker of also breaching 1.08

JPY faltered against the USD despite seeing strength early in the session after a Bloomberg report that the BoJ was considering revising their inflation forecasts higher. The surge in the Yen swiftly faded with yield differentials pushing USDJPY higher, to hover just below the 150 “intervention zone”

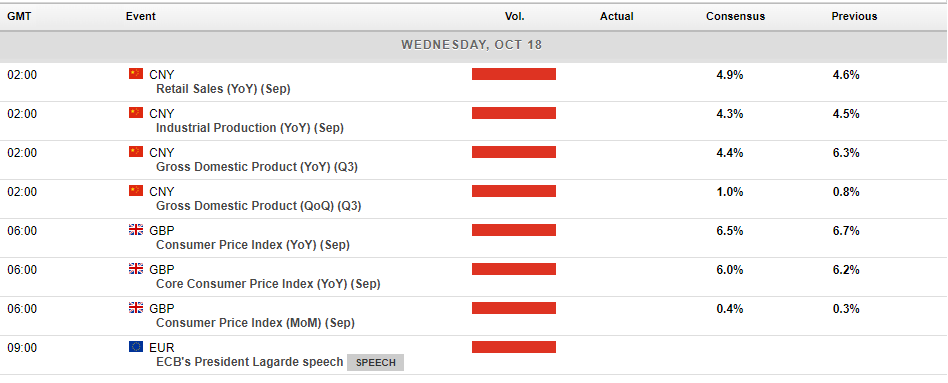

Today’s calendar below:

Ready to start trading?

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice.

Next Article

Is the Gold Run Over?

The recent surge in gold prices, following recent events in the Middle East and the declining US Dollar (DXY), raises the question: Is this the end of the bull run for Gold (XAU/USD)? Gold started rising earlier this month after rejecting the price level of 1815.00. Since then, it has steadily climbed back to its previous peak of 1984.00, a resi...

October 24, 2023Read More >Previous Article

Bitcoin provides traders with some volatility as price continues to trend north.

Bitcoin traders had some excitement in the session overnight, with some false news sending price rising over 7% in a few minutes. A tweet from a we...

October 17, 2023Read More >Please share your location to continue.

Check our help guide for more info.