- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets.

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets.

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & Analysis

- Forex

- FX analysis – USD drops ahead of FOMC minutes, CAD falls on cool CPI, AUD and NZD supported by PBoC decision

- Home

- News & Analysis

- Forex

- FX analysis – USD drops ahead of FOMC minutes, CAD falls on cool CPI, AUD and NZD supported by PBoC decision

News & AnalysisNews & Analysis

News & AnalysisNews & AnalysisFX analysis – USD drops ahead of FOMC minutes, CAD falls on cool CPI, AUD and NZD supported by PBoC decision

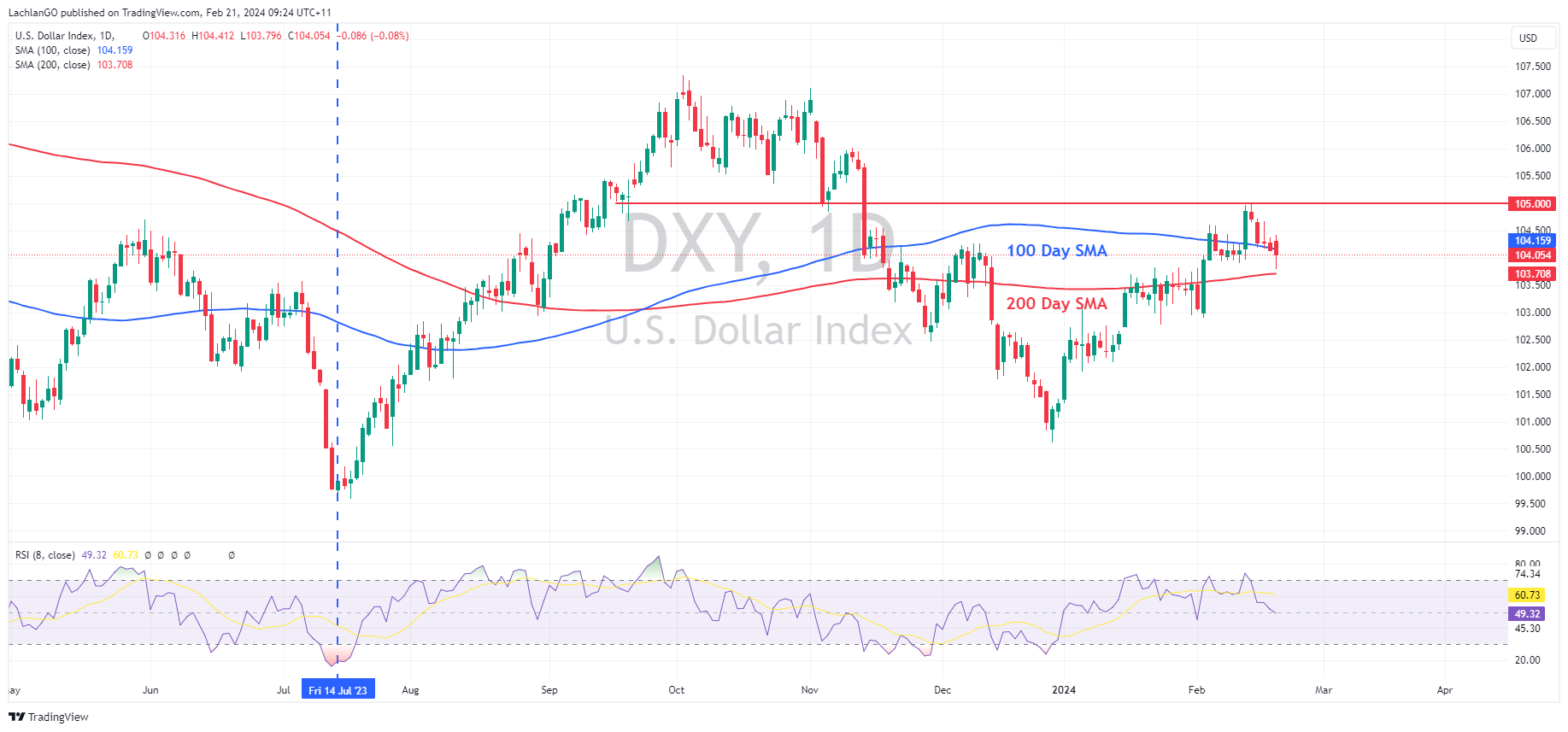

21 February 2024 By Lachlan MeakinUSD sold off in Tuesdays session after US traders returned from holiday. DXY falling for a 5th straight session after finding stiff resistance at the psychological 105 level and breaking below its 100 DMA before finding some support at the 200 DMA before retracing somewhat as market risk sentiment soured during the US equity session. Lower yields as bonds were bid ahead of FOMC minutes later today also weighing on the USD.

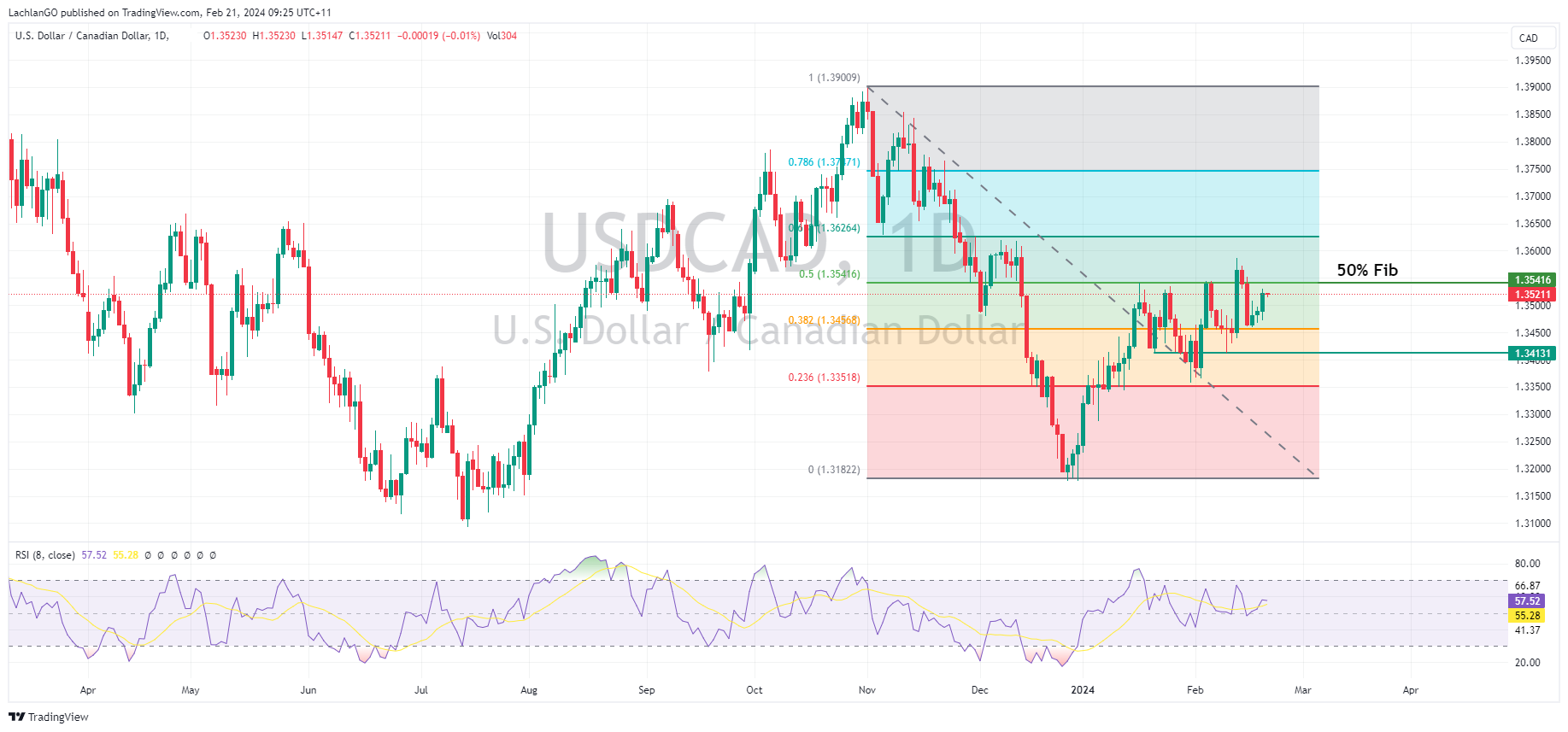

CAD was the G10 underperformer after Canadian CPI came in much softer than expected. USDCAD breaking above 1.3500 and looking to test the 50% Fib level at 1.3541. Futures pricing of BoC rate moves repricing dovishly on the back of the CPI reading, along with a drop in oil prices hitting the CAD.

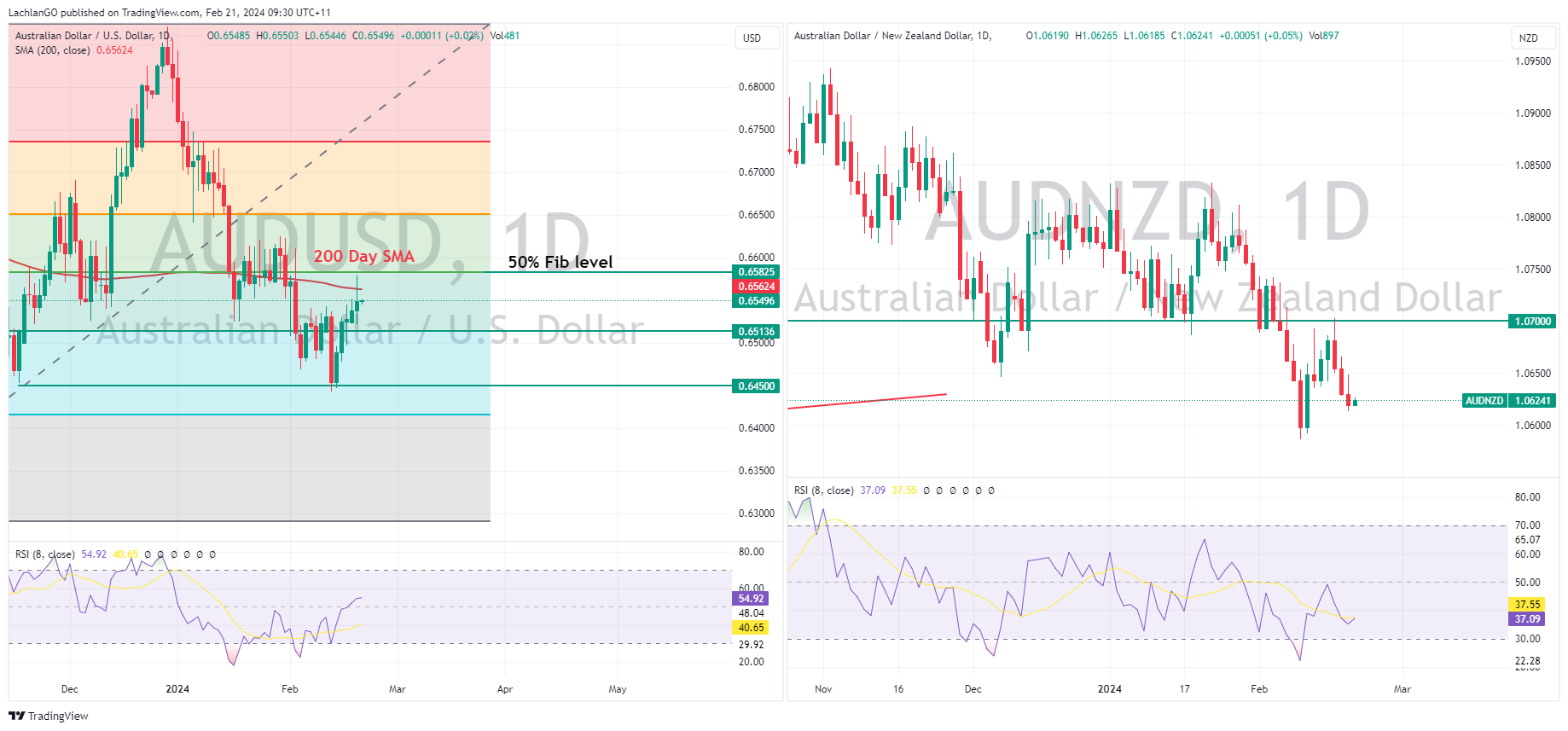

AUD and NZD saw gains against the USD mostly in the APAC session after the larger than expected cut to the 5yr LPR by the PBoC. A stock sell off in the US session saw some of those gains retrace with AUDUSD hitting resistance at the 50% fib level and unable to hold above the 200 DMA. NZD outperforming AUD in the end, seeing the AUDNZD cross rate drop for a 3rd straight session to hit a 1 week low at 1.0613. Today ahead for Aussie watchers will be key wage data released at 12:30 AEDT.

Ready to start trading?

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice.

Next Article

NVDA earnings preview – AI mania put to the test

The most anticipated US earnings announcement is coming up with NVDA due to report fiscal Quarter ending Jan 2024 earnings after the Wednesday US market close. NVDA has seen a meteoric rise, quintupling in 2023 and up more than 40% so far in 2024, being the number one stock riding AI mania, making this earnings report one that all investors will be...

February 21, 2024Read More >Previous Article

Walmart stock gains after better-than-expected earnings report

Walmart Inc. (NYSE: WMT) announced the latest financial results before the US market open on Tuesday. World’s largest supermarket chain achieved ...

February 21, 2024Read More >Please share your location to continue.

Check our help guide for more info.