- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Share CFDs

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Share CFDs

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & Analysis

- Forex

- FX analysis – JPY , AUD, NZD, CAD, USD

News & AnalysisUSD tracked higher with yields in Tuesday’s session with the Dollar Index (DXY) hitting a high of 103.820, setting a new YTD high and breaking through the key technical levels of the 200-day SMA as well as a 50% Fib resistance level. DXY saw initial weakness in the European morning which emanated from APAC hours amid a firmer post-BoJ Yen but reversed course in the US session as UST yields climbed and earnings disappointments saw US equites struggle.

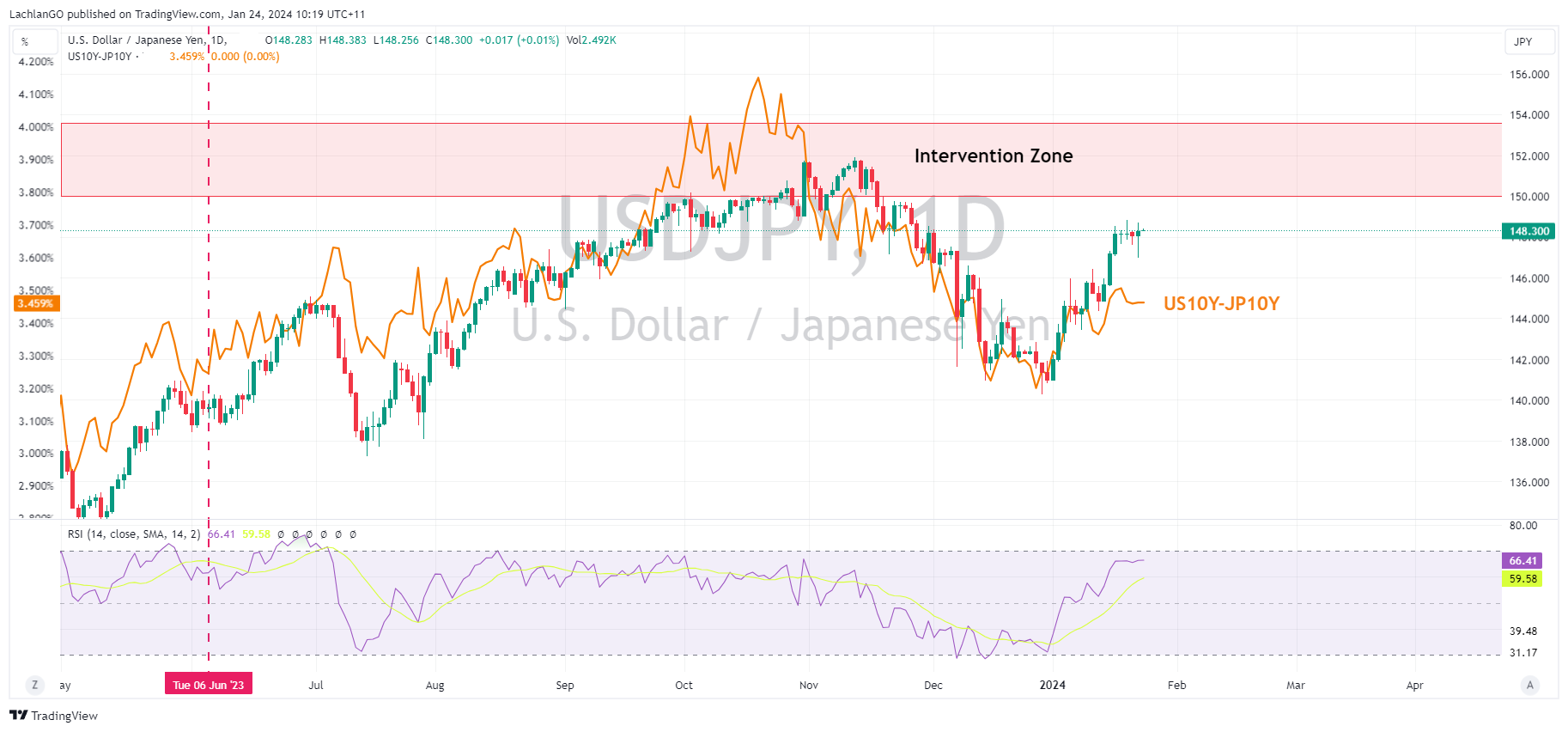

JPY closed the session seeing marginal losses against the USD. USDJPY did drop to a low of 146.97 after BoJ Governor Ueda delivered a hawkish-leaning press conference after the BoJ policy decision where he said he will certainly foresee further rate hikes when exiting negative interest rate policy. JPY gains failed to hold though with the pair retaking the 148 handle coming into the APAC open.

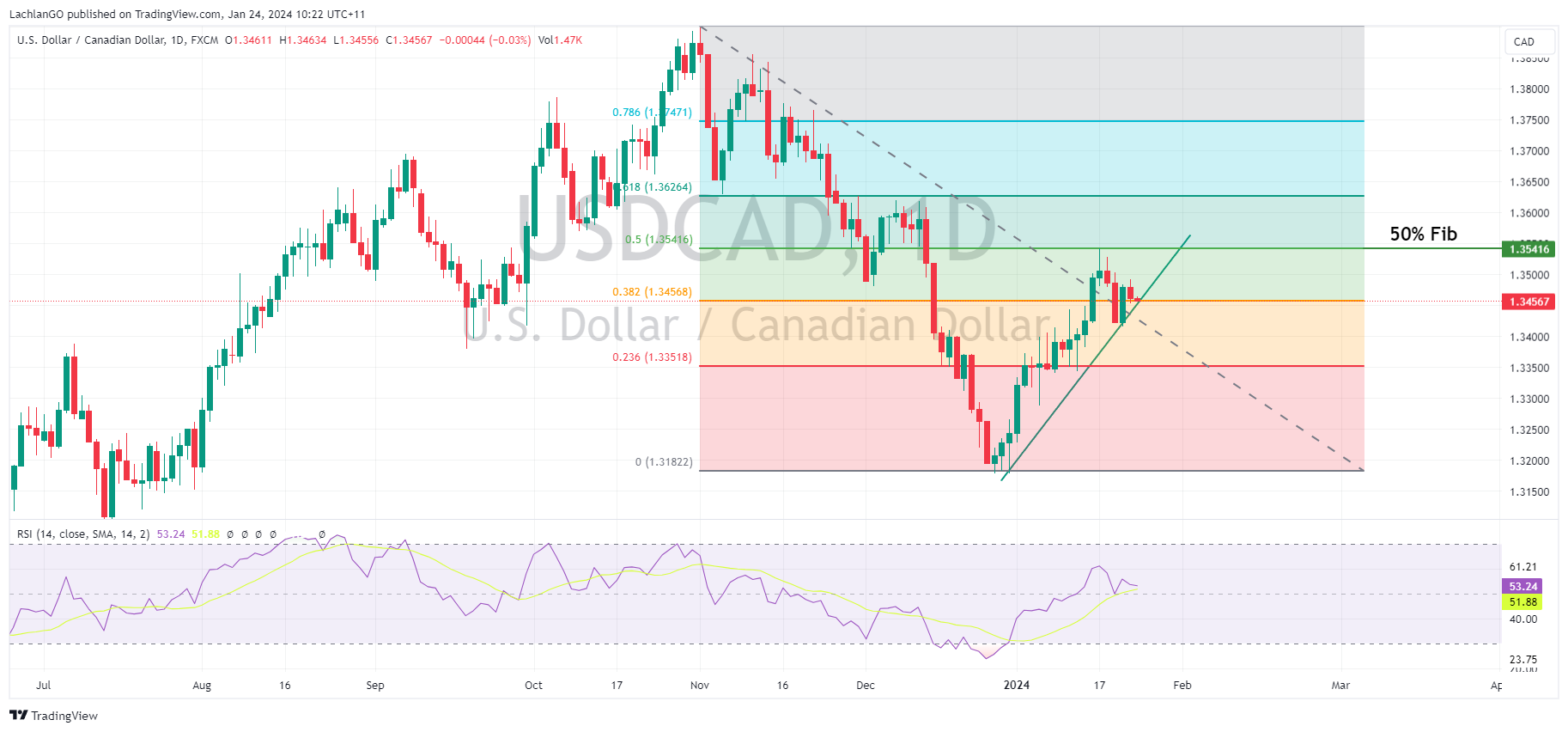

AUD, NZD and CAD were the G10 outperformers, with all making gains against the USD. NZD and AUD were bolstered by overnight Yuan gains and resilience in commodity prices. CAD was bid ahead of todays Bank of Canada policy meeting where the central bank is expected to hold rates steady, and possibly pushback against rate cut predictions after a hotter than expected December inflation reading.

Ready to start trading?

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice.

Next Article

IBM Q4 results exceed expectations – the stock is rising in the after-hours

International Business Machines Corporation (NYSE: IBM) announced Q4 2023 financial results after the closing bell in the US on Wednesday. The American IT and consulting company reported revenue of $17.381 billion for the last quarter of 2023 (up by 4% year-over-year), narrowly beating Wall Street estimate of $17.289 billion. Earnings per sha...

January 25, 2024Read More >Previous Article

Netflix’s total paid subscribers hits an all-time high – the shares are rising

American online streaming service company, Netflix Inc. (NASDAQ: NFLX), released its latest financial results for Q4 of 2023 after the market closed o...

January 24, 2024Read More >Please share your location to continue.

Check our help guide for more info.