- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Share CFDs

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Share CFDs

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & Analysis

- Articles

- Forex

- Brent testing critical level again

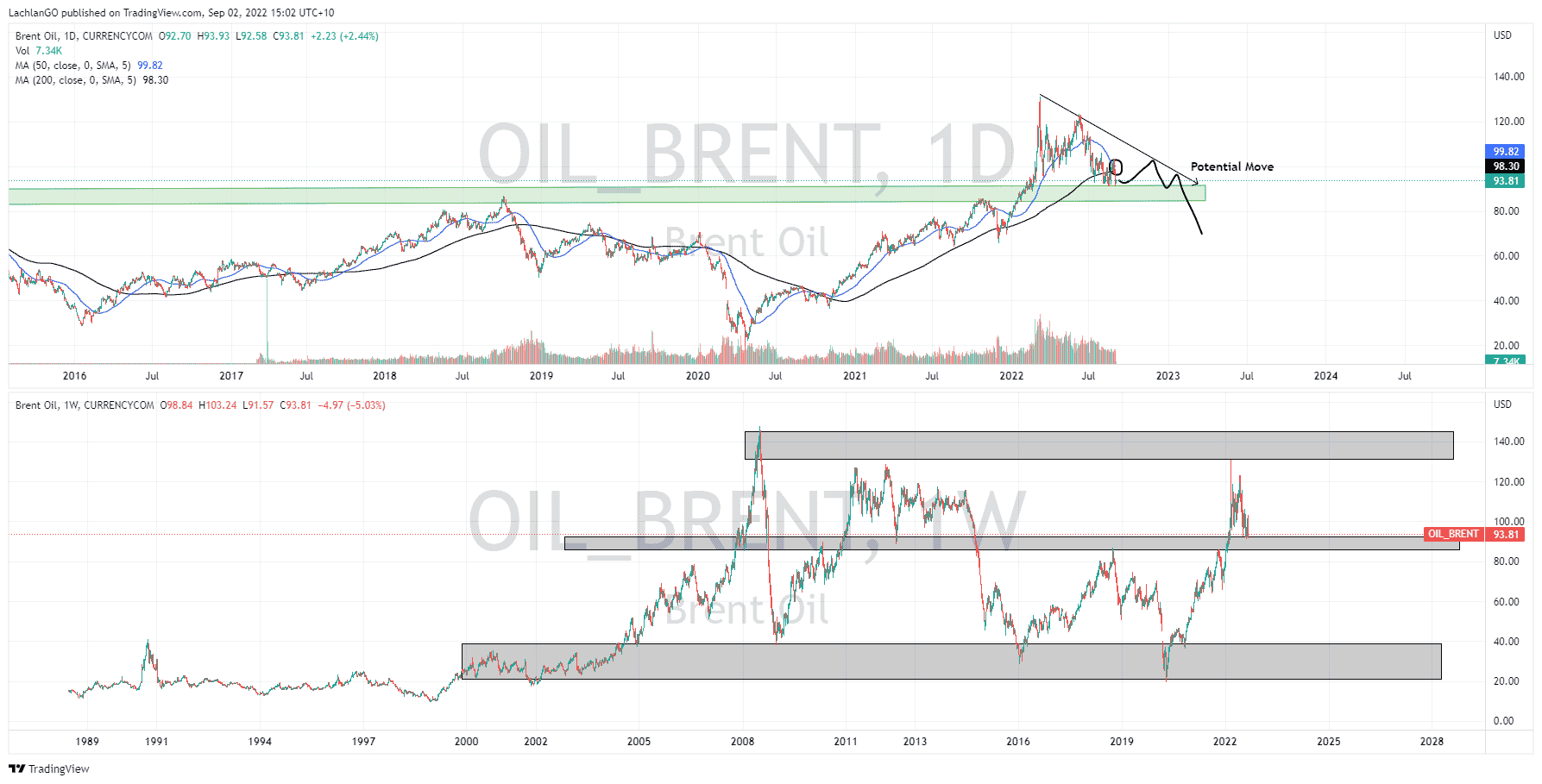

News & AnalysisBrent Crude oil much like many other commodities has seen its value drop on the back of a strong US dollar and weaker demand forecasts. With the tail wind of the Russia and Ukraine crisis fading, Brent has struggled to maintain its highs of $125 a barrel in the last few months. In addition, the price has dropped to the point where it is retesting the critical $85-90 level. With more Covid fears in China and weak global growth, the demand is decreasing even with tight supply from major producer Saudi Arabia. OPEC is also due to meet next week on September 5 to discuss the future demand going ahead and earlier forecast its supply to be higher than the demand for the rest of 2022 before a potential deficit in 2023. The market will eagerly be waiting for the announcement from OPEC before deciding which way the price of Brent will go.

Technical analysis

As stated above, the price has dropped back to the lows of the range and it is retesting the long term support level. The price does look to be forming into a descending triangle pattern with potentially 1-2 more tests of the upper trend line before potentially breaking through the support zone. Whilst it is impossible to say at this stage if the price will hold the $85/90 level it is concerning to see the 50 day moving average inch closer to the 200 Day average. If it does cross through it may signal that a sell off is imminent. In addition, the price was unable to move above the 50 Moving average. The price didn’t just reject the price, it comprehensively sold of the level with an aggressive bearish candlestick highlighting the strength of the sellers.

It should be noted that looking at the longer term chart the strength of the $85-90 support level become more apparent. Not only is it a support but also the mean of the 20-year range for the price. Therefore, to break this support level will require a very powerful sell off.

Ready to start trading?

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice.

Next Article

NIO Q2 results have arrived

NIO Q2 results have arrived NIO Inc. (NIO) reported its unaudited second quarter financial results on Wednesday. The Chinese electric vehicle maker reported revenue of $1.538 billion for the quarter, beating analyst estimate of $1.458 billion. Loss per share reported at -$0.20 per share vs. -$0.16 loss per share expected. William Bin Li...

September 8, 2022Read More >Previous Article

Will gold hold its support or will the USD push it below $1660

Will gold hold its support or will the USD push it below $1660 Gold has dumped again after recession fears and a strong US dollar continue to grip ...

September 1, 2022Read More >Please share your location to continue.

Check our help guide for more info.