- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Share CFDs

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Share CFDs

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & Analysis

- Forex

- Aussie Dollar breaks through two year lows

News & AnalysisThe Aussie dollar has been dropping on the back of global volatility and a lower-than-expected interest rate hike. The AUD has dropped to its two-year lows, and it doesn’t look there is an end in sight. With the AUD already being a risk on currency the fears and pressures from a potential recession are weighing heavily and accelerating the drop.

Chart Analysis

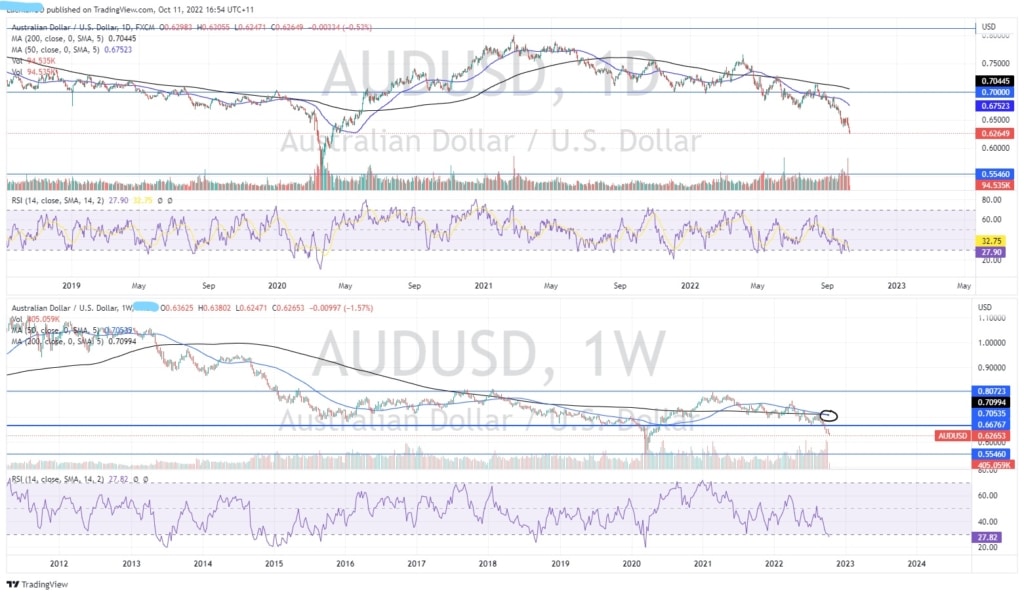

The weekly chart shows just how weak the AUD is particularly concerning and shows that the 50-week moving average has crossed below the 200-week average. This is also known as a death cross and is symbolic of sellers taking control of price. Furthermore, the price is dropping to levels not seen since the height of the Covid 19 pandemic and the GFC before that. The most reasonable short-term target is the Covid lows at 0.55 AUD. It would be difficult to see the price dropping further below that. If the price was to drop further then 0.55 AUD, it would likely need to be on the back of some powerful catalyst. In the short term it doesn’t seem like a powerful catalyst is imminent. Although, with recessionary fears on the horizon a particularly damaging recession may be able to push the AUD lower. The daily chart further enhances just how aggressive the selloff has been. With the 50-day average dropping faster than the 200 days average the price action is worrying. The chart also shows the price in somewhat of a freefall with no immediate support.

Looking forward, with economic data still to come and more rate rises expected by the Reserve bank of Australia, maybe the country’s Central Bank can inject some strength back into the currency. However, at this stage it is fighting a losing battle.

Ready to start trading?

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice.

Next Article

Aussie Dollar breaks through two year price lows

The Aussie dollar has been dropping on the back of global volatility and a lower-than-expected interest rate hike. The AUD has dropped to its two-year lows, and it doesn’t look there is an end in sight. With the AUD already being a risk on currency the fears and pressures from a potential recession are weighing heavily and accelerating the drop. ...

October 11, 2022Read More >Previous Article

Is Ethereum Deflationary? And is it a good thing?

What is a deflationary Cryptocurrency? A Deflationary Cryptocurrency is one that burns, (mints) its supply. This process lessens the number of ...

October 11, 2022Read More >Please share your location to continue.

Check our help guide for more info.