- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Share CFDs

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Share CFDs

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & Analysis

- Forex

- The Causes of Today’s Flash Crash

- Caixin Manufacturing PMI fell from 50.2 to 49.7

- German Markit Manufacturing PMI fell from 51.8 to 51.5

- EZ Markit Manufacturing PMI fell from 51.8 to 51.4

- Canadian Markit Manufacturing PMI fell from 54.9 to 53.6

- US Markit Manufacturing PMI fell from 55.3 to 53.8

News & Analysis

Today’s flash crash in the FX markets was surprising to many of us. The triggers behind the slump in the currency’s markets are vague, and everyone was left wondering about a reasonable explanation. First of all, we think it is important to note that we are in a low volume trading environment and any reaction/news can be exacerbated in such thin markets.

Manufacturing Activity

A series of PMI reports released on Monday and Wednesday highlighted the weakness throughout the global manufacturing sector which has increased fears about the outlook for global growth.

The heightened concerns brought additional turbulence in the stock markets when trading resumed on Wednesday, the first trading day of the year 2019.

Apple’s Revenue Forecasts

Apple’s move to downgrade sales on slowing iPhone sales in China fueled the fears about the global economy. Investors fled to safety and sought safe-haven assets like the Japanese Yen which surged through key support levels. Major currencies crashed against the Yen before paring some of the losses. The strong moves in the Yen pairs prompted speculators also to believe that Japanese traders were forced to exit their short yen positions.

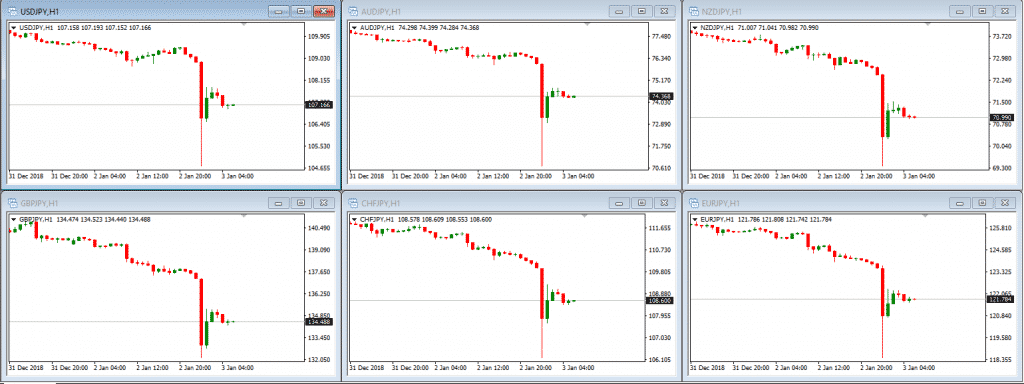

USDJPY, AUDJPY, NZDJPY, GBPJPY, CHFJPY and EURPJY (Hourly Charts)

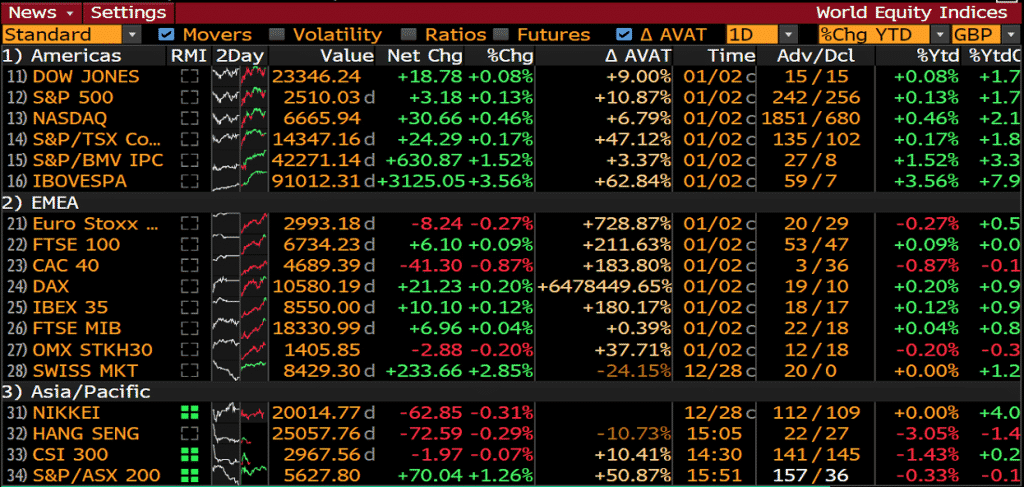

Source: GO MT4In the stock markets, given that Apple is the bellwether for the technology sector, the surprise announcement weighed on the technology stocks in the Asian session. The performance in Asia/Pacific region was mixed, and investors struggled to find a direction.

Source: Bloomberg TerminalWe may see more downgrades in the months to come as slowing global growth and trade tensions will probably remain the key challenges in the financial markets.

For more information on trading Forex, check out our regular free Forex webinars.

Ready to start trading?

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice.

Next Article

Main Macro Themes In 2019

After a stellar year in 2017, investors were taken aback by the massive swings in the markets in 2018. The turmoil in the financial markets has created an environment of panic and fears about a global recession. Even though the risk of a recession is not on the horizon yet, we do expect 2019 to remain volatile. Prudent investors will likely fa...

January 8, 2019Read More >Previous Article

The Dow Jones Industrial Average

Source: Bloomberg Terminal For the traders returning from the Christmas break, the sudden surge in the Dow Jones Industrial Average is probably the ...

December 27, 2018Read More >Please share your location to continue.

Check our help guide for more info.