- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Share CFDs

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Share CFDs

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & Analysis

- Forex

- FX Analysis – Yen surges on BoJ jawboning, Gold sets another ATH, EUR breaks key level

- Home

- News & Analysis

- Forex

- FX Analysis – Yen surges on BoJ jawboning, Gold sets another ATH, EUR breaks key level

News & AnalysisNews & Analysis

News & AnalysisNews & AnalysisFX Analysis – Yen surges on BoJ jawboning, Gold sets another ATH, EUR breaks key level

8 March 2024 By Lachlan MeakinUSD was notably weaker in Thursday’s session ahead of the pivotal NFP report on Friday. The US Dollar index falling for the fifth straight session and breaking below 103 to touch on the Jan 24 lows before finding some support. Risk-on sentiment, a fall in yields and weak jobless claims data being the main drivers of the Greenback decline.

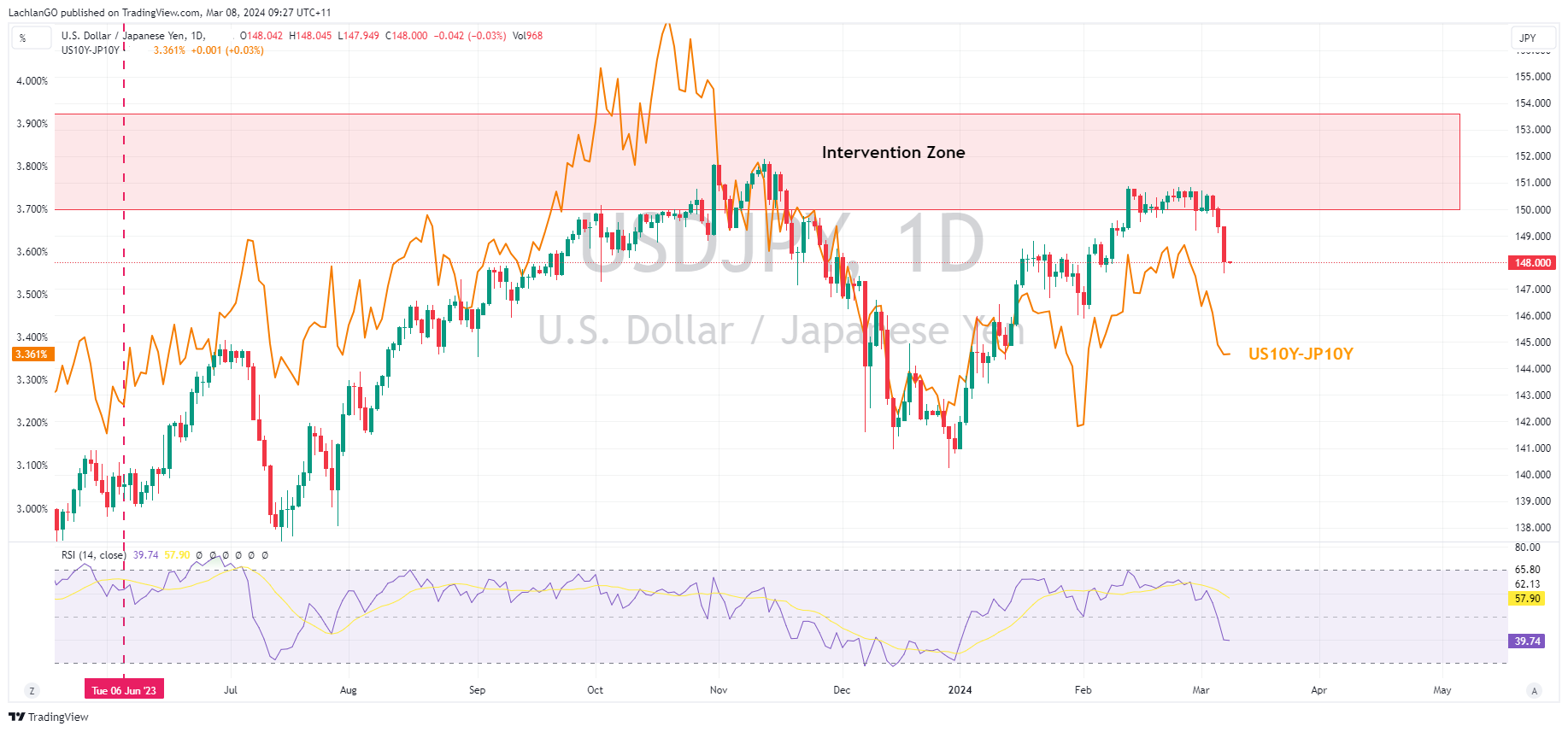

JPY saw strong gains against the USD on the back of hawkish BoJ Speak from Governor Ueda and Board Member Nakagawa, also helped by a tightening in US10Y-JP10Y yield differential. USDJPY continuing its break below the psychological 150 level to hit a low of 147.59.

EUR also outperformed vs. the Greenback with EURUSD breaking through the key 1.09 level and entering APAC at NY session highs at 1.0948. Thursdays ECB policy meeting saw the central bank maintaining rates, as expected, whilst slashing its inflation forecasts which now sees 2025 headline inflation at the 2% target. This “dovish” tone saw EUR initially being the worst performer, before EURUSD benefitted from the accelerating in USD selling during the US session.

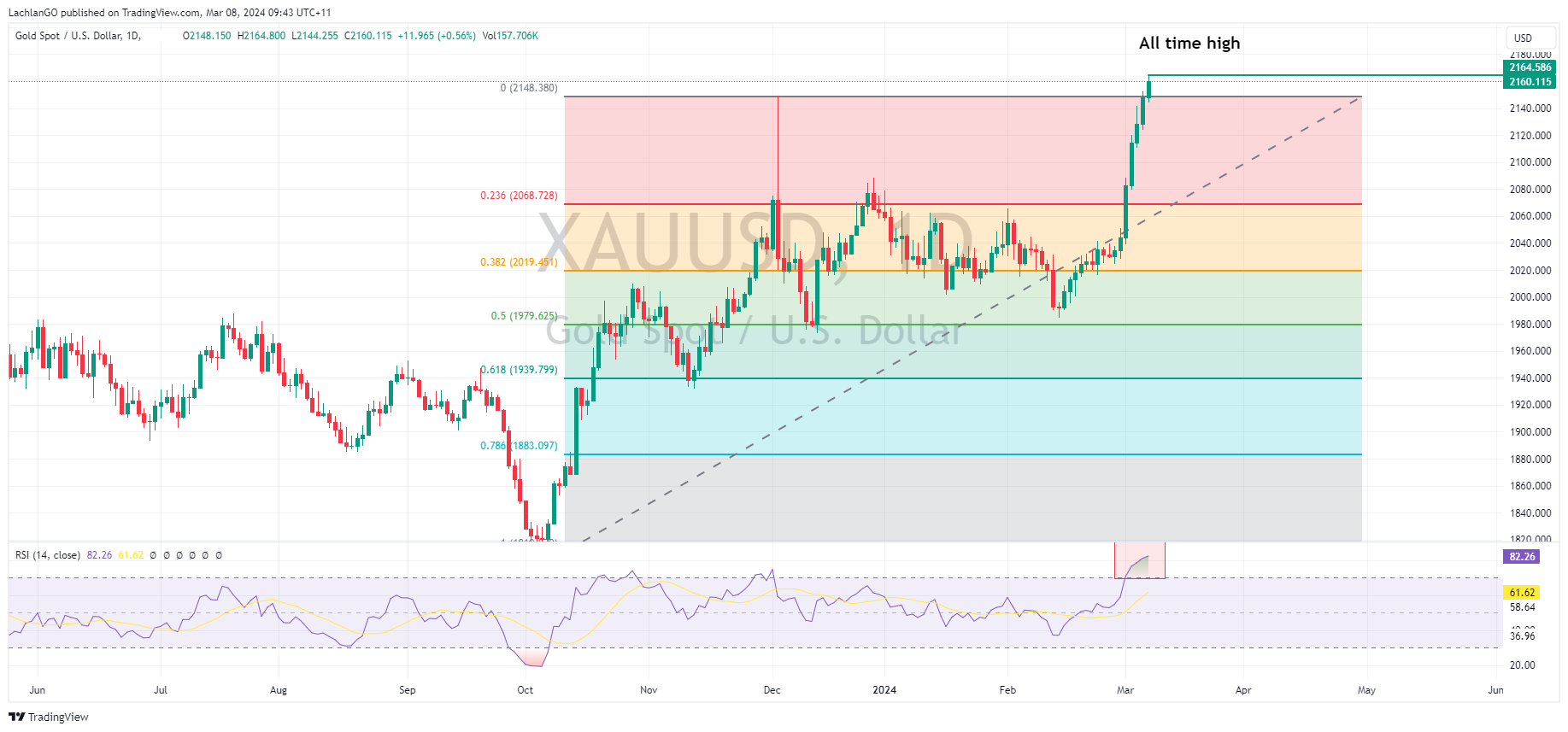

Gold continued its steep rally for a seventh straight session, again setting new all-time highs in doing so. A fall in yields, a weaker USD and a desire for safe havens pushing the precious metal above 2160 USD an ounce.

Ready to start trading?

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice.

Next Article

Oracle stock rises in after-hours as earnings top Wall Street expectations

Oracle Corporation (NYSE: ORCL) announced the latest financial results for Q3 of fiscal 2024 after the market close on Monday. The US software and hardware manufacturer did not disappoint investors as both revenue and earnings per share (EPS) topped estimates. The company achieved revenue of $13.3 billion for the previous quarter vs. $13.286 ...

March 12, 2024Read More >Previous Article

Costco tops EPS but falls short on revenue

Broadcom Inc. (NASDAQ: AVGO) wasn’t the only company releasing the latest earnings report on Thursday. World’s second largest supermarket chain...

March 8, 2024Read More >Please share your location to continue.

Check our help guide for more info.