- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Share CFDs

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Share CFDs

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & Analysis

- Cryptocurrency

- Bitcoin ready for its next leg down?

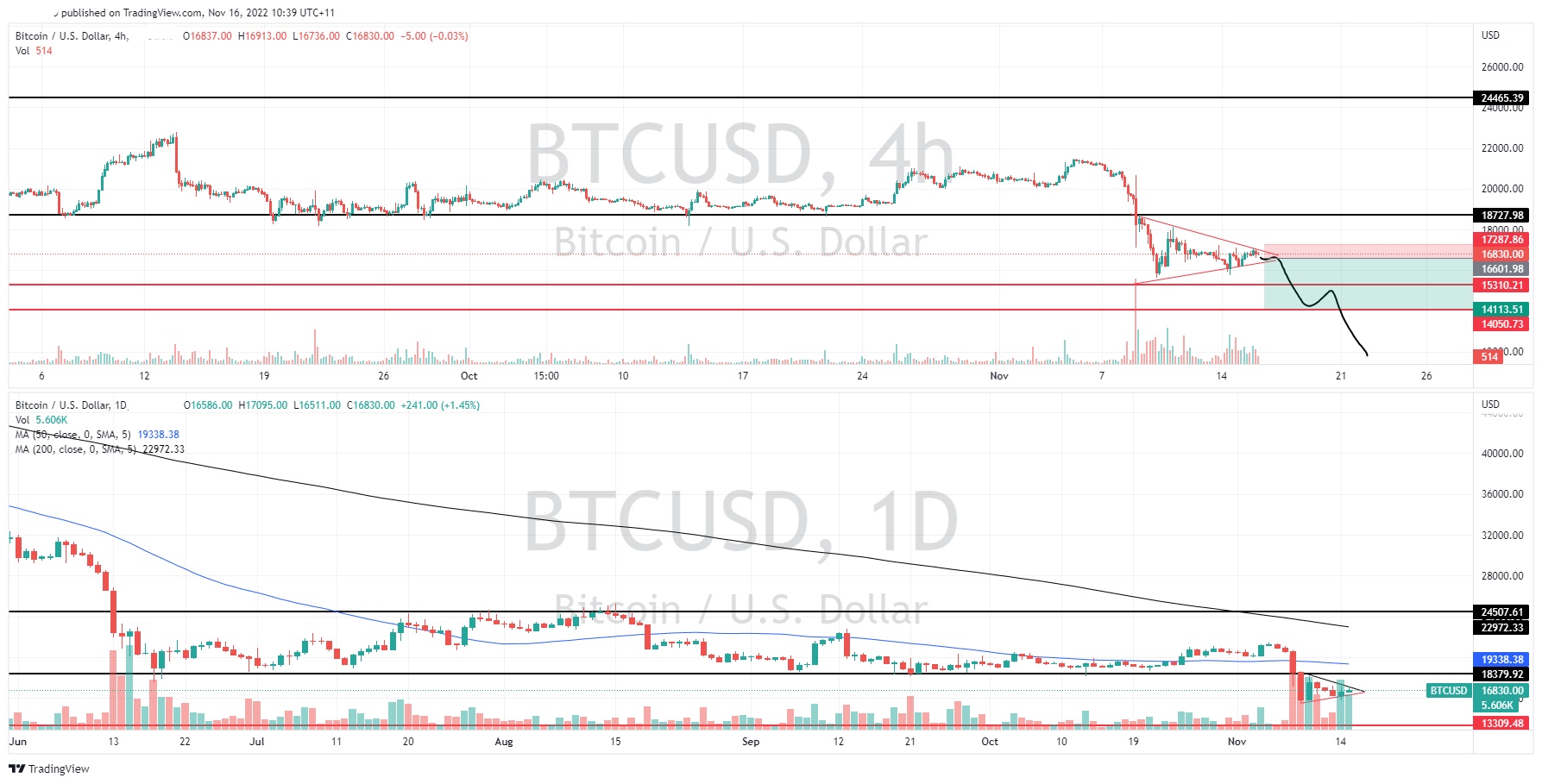

News & AnalysisBitcoin has seen its price plummet after a volatile week largely due to the collapse of Cryptocurrency exchange, FTX. The price of the Bitcoin has fallen to levels not seen since November 2020. The price is now showing signs that it may be in a short-term consolidation before it may sell off again. The downward move may be amplified, especially if it is supported by a news catalyst such as another cryptocurrency exchange going bust or other institutions become entangled in the FTX situation.

After the price of Bitcoin had an initial downward spike in selling where the price broke through the crucial $17,000 support level, the price has been consolidating in a bearish pennant pattern. This pattern is categorised by a tightening of its price range and an overall downward trend in volume. Although, the volume is not perfectly downward sloping, through the duration of the pennant it has been for the most part decreasing. If the pattern plays out correct, the sellers will soon overpower the buyers and push the price through the bottom part of the pennant signaling the next sell down.

If the price can break towards the downside out of the pennant and break through the recent lows, the next major support level is at $13,000 USD and then $10,000 after that. The trade if it follows through also represents relatively good risk reward of almost 3.5:1. However it is important to remember that Bitcoin has been exceptionally oversold and may struggle to move further down so good risk management is essential. With so much attention around cryptocurrency the elevated volatility may continue in the short-term future.

Ready to start trading?

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice.

Next Article

NVIDIA results announced

NVIDIA Corporation (NASDAQ: NVDA) reported its latest financial results after the market close in the US on Wednesday. The US technology giant beat revenue estimates but fell short of earnings per share (EPS) expectations for the quarter. The company reported revenue of $5.931 billion (down by 17% year-over-year) vs. $5.781 billion estimate. ...

November 17, 2022Read More >Previous Article

Walmart posts better-than-expected Q3 results – shares move higher

Walmart Inc. (NYSE: WMT) announced its latest financial results before the market open in the US on Tuesday. World’s largest supermarket chain re...

November 16, 2022Read More >Please share your location to continue.

Check our help guide for more info.