Investment Opportunities in the Health Care Sector

24 March 2020It might be difficult to stay optimistic in such plunging markets. Global equities are in a bear market and investors are moving away from riskier assets. Amid the mayhem, there may still be some buying opportunities if investors are selective about certain stocks.

We are facing a global pandemic that is slowly forcing major countries into lockdown and halting global activity. Investors are therefore tapping into sectors that offer bargains or where they see long-term growth opportunities.

The health care sector seems to be on investors’ watchlists. It should be highlighted not all health care stocks are performing the same way. Our attention turns to two stocks that have so far outperformed amid the coronavirus outbreak.

Moderna Inc (NASDAQ: MRNA)

In the US markets, Moderna Inc. is standing out. As several companies are racing against time to create a vaccine for the COVID-19, Moderna Inc. is among the first to develop a vaccine against coronavirus.

For a relatively young and small company, the Massachusetts-based biotechnology firm has performed its first human trial of the coronavirus vaccine on Monday. Ever since they received funding from the CEPI to accelerate the development of messenger RNA Vaccine against the novel coronavirus, the biotech company became popular among investors.

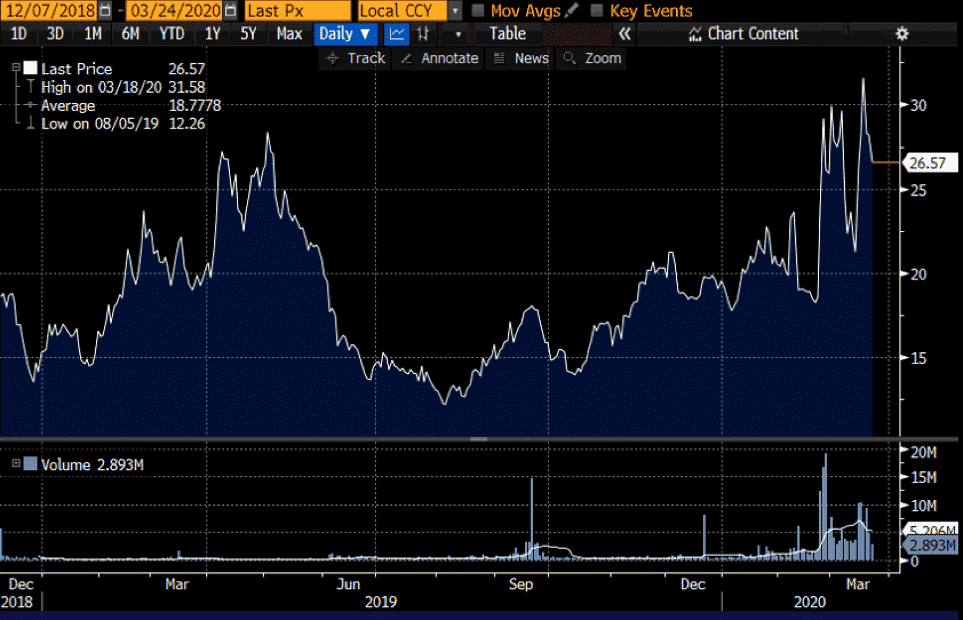

Moderna Inc. is among the best-positioned mRNA company with 16 Phase 1 trial started and five out of their first five modalities demonstrating success in the clinic. As of writing, the company’s share price is currently trading at $26.57 after reaching an all-time high of $31.48 last week.

Source: Bloomberg Terminal

|

For the past month, the company’s share price is currently up by more than 40%! |

The coronavirus vaccine could be a key turning point for the success of Moderna, which is yet to produce a proven product on the market using its mRNA technology.

Share Price & Information |

| Moderna, Inc. is a Cambridge, Massachusetts-based biotechnology company focused on drug discovery and drug development based on messenger RNA (mRNA). In January, Moderna announced the development of a vaccine to inhibit COVID-19 coronavirus. NASDAQ Profile |

| NASDAQ:MRNA |

| Market Cap: 8,741,616,884 |

| Today’s High/Low: $29.81/$26.25 |

Get in touch with your account manager to find out how you can start trading Moderna Inc today. Don’t have an account? Sign up here.

Fisher & Paykel Healthcare Corp Ltd (ASX:FPH)

In the Australian share market, Fisher & Paykel Healthcare Corp Ltd is among the best performers. The company is a manufacturer, designer and marketer of products and systems for use in respiratory care, acute care, and the treatment of obstructive sleep apnea.

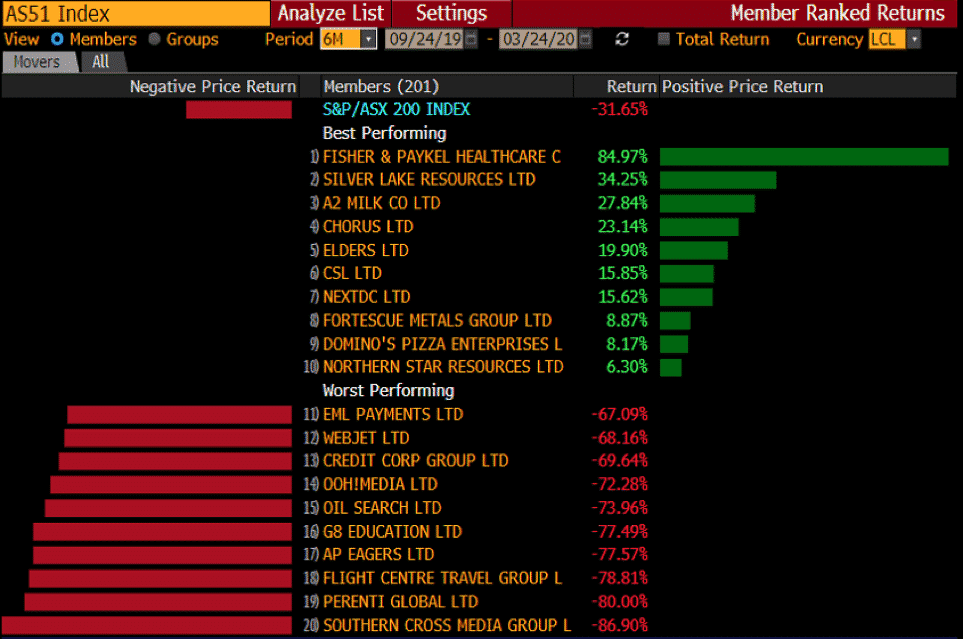

Fisher & Paykel Healthcare’s share price added above 40% since the widespread of the COVID-19 (Year to Date). With a rise of 85% in the last 6 months, the company is currently the best performing stock of the S&P/ASX200.

Back-to-Back Upgrades

While most companies are downgrading forecasts in this bear market environment, the company has issued two upgrades since the beginning of the year.

Vitera, a new full face mask used in the treatment of obstructive sleep apnoea has outperformed in the early stages. The company also received clearance to sell the mask in the US sooner than expected which contributed meaningfully in driving its share price to new record highs.

The company also delivered a strong financial performance for the six months to 30 September 2019:

- Net profit after tax was up by 24% at $121.2million

- Operation revenue rose by 12% at $570.9 million

The COVID-19 outbreak has substantially increased demand for certain products, which has enabled the company to upgrade its revenue and earnings guidance for the financial year ended 31 March 2020 a couple of times since January.

Taking into consideration exchange rate revisions, the company is now expecting:

- Full-year operating revenue to be approximately $1.24 billion instead of $1.19 billion in November’s guidance.

- Net profit after tax to be within the range of approximately $275 million to $280 million instead of approximately $255 million to $265 million back in November.

On the supply side, the fact that the company does not have a manufacturing facility in China, they are not expecting major supply disruptions.

Overall, the company is also making progress with other major initiatives and is establishing a presence in more countries while undertaking numerous other studies.

|

The continuous growth of Fisher and Paykel in the near and medium-term is looking promising. |

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice.

Next Article

The Perfect Storm Brewing in the Oil Market

The Perfect Storm Brewing in the Oil Market The oil and gas industry has been undergoing significant challenges due to the structural shift within the industry. A pandemic-induced economic downturn and an oil price war have now added another layer of uncertainty to the oil markets. Tensions between Saudi Arabia and Russia have disrupted the sta...

Previous Article

Inner Circle Video: Markets in turmoil – Risk and opportunities

At this special Inner Circle session Mike Smith (GO Markets), Cameron Malik and Mark Austin (Magnetic Trading) will be picking apart the events that h...