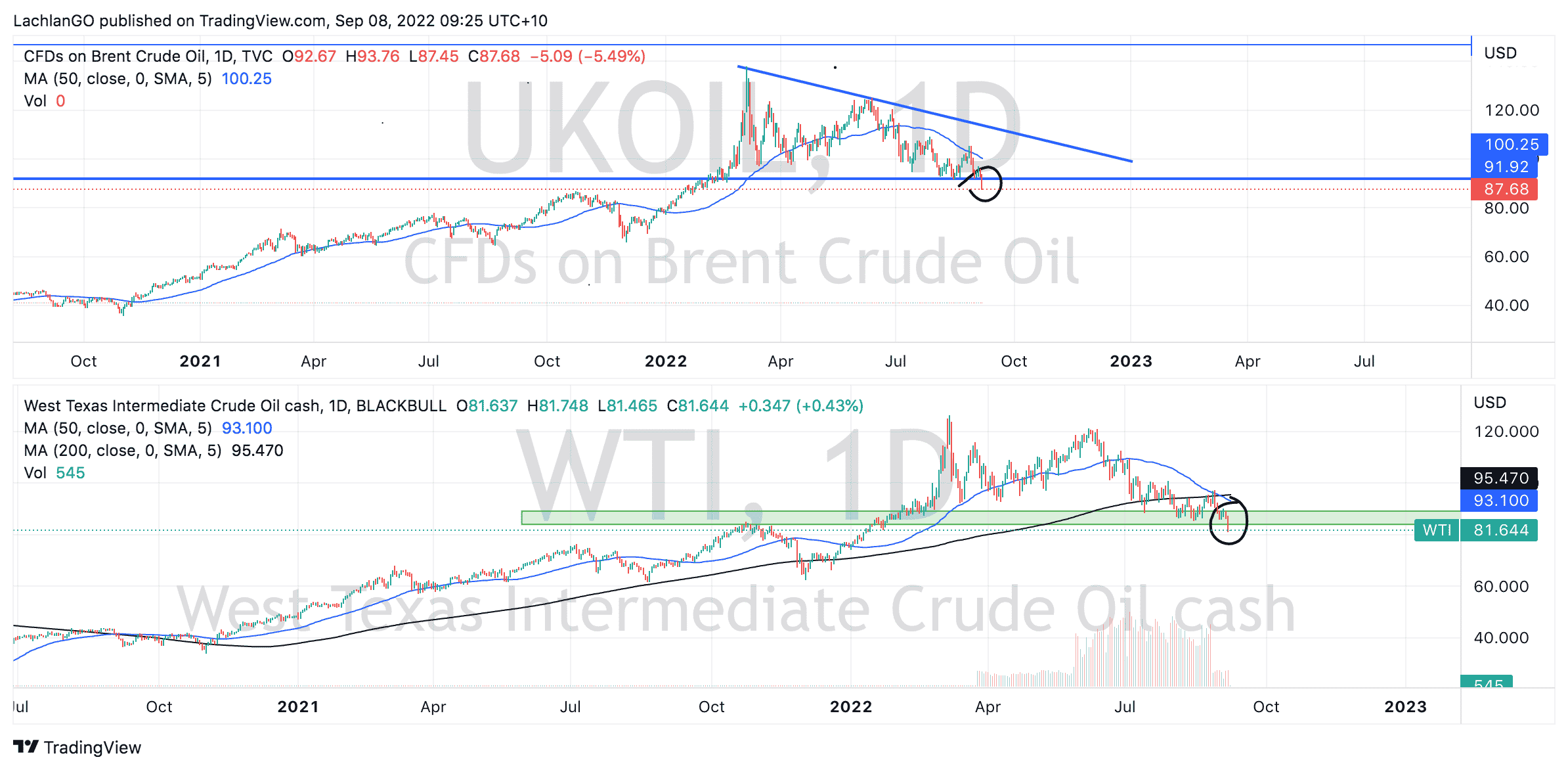

Oil Price tumbles to 7 month lows as recession fears grow

8 September 2022Brent Crude and West Texas Intermediate Oil both fell to their lowest levels since January as fresh recession fears swept the market. Brent dropped to $87 a barrel and WTI to $81. The prices dropped following OPEC’s decision to cut the production by 100,000 barrels a day of supply from October.

In recent months with the Russian and Ukraine conflict raging, OPEC had to lift production as supply dipped. However, with the decreasing health of the global economy and a incredibly strong US dollar demand for overseas oil has dipped. Poor economic data from China and its Covid zero strategy has also pushed concerns of weaker demand. In fact, China’s crude oil important dropped by 9.4% from a year earlier signalling the slowdown in demand.

Furthermore, with the US federal reserve expected to remain hawkish until inflation is back to a sustainable level, in the short term there is little resistance in the way of the US dollar continuing to grind its way higher, further pressuring the price of oil. Whilst the current dip may provide some relief for consumers, with uncertainty from the Kremlin and Putin potentially capping their energy exports, the short term volatility will likely continue.

As it can be seen from the charts below, both WTI and Brent have broken down through their key support levels. The price may struggle to fall lower in the immediate short term and may need to consolidate in the short term before pushing lower again.

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice.

Next Article

NIO Q2 results have arrived

NIO Q2 results have arrived NIO Inc. (NIO) reported its unaudited second quarter financial results on Wednesday. The Chinese electric vehicle maker reported revenue of $1.538 billion for the quarter, beating analyst estimate of $1.458 billion. Loss per share reported at -$0.20 per share vs. -$0.16 loss per share expected. William Bin Li...

Previous Article

Oil Price tumbles to 7 month lows as recession fears grow

Brent Crude and West Texas Intermediate Oil both fell to their lowest levels since January as fresh recession fears swept the market. Brent dropped to...