The Week Ahead – US Mid-terms set stage for another volatile week

7 November 2022Another week done, another roller coaster for equity and risk markets as the bulls and the bears battled to take control of the narrative in a data rich week.

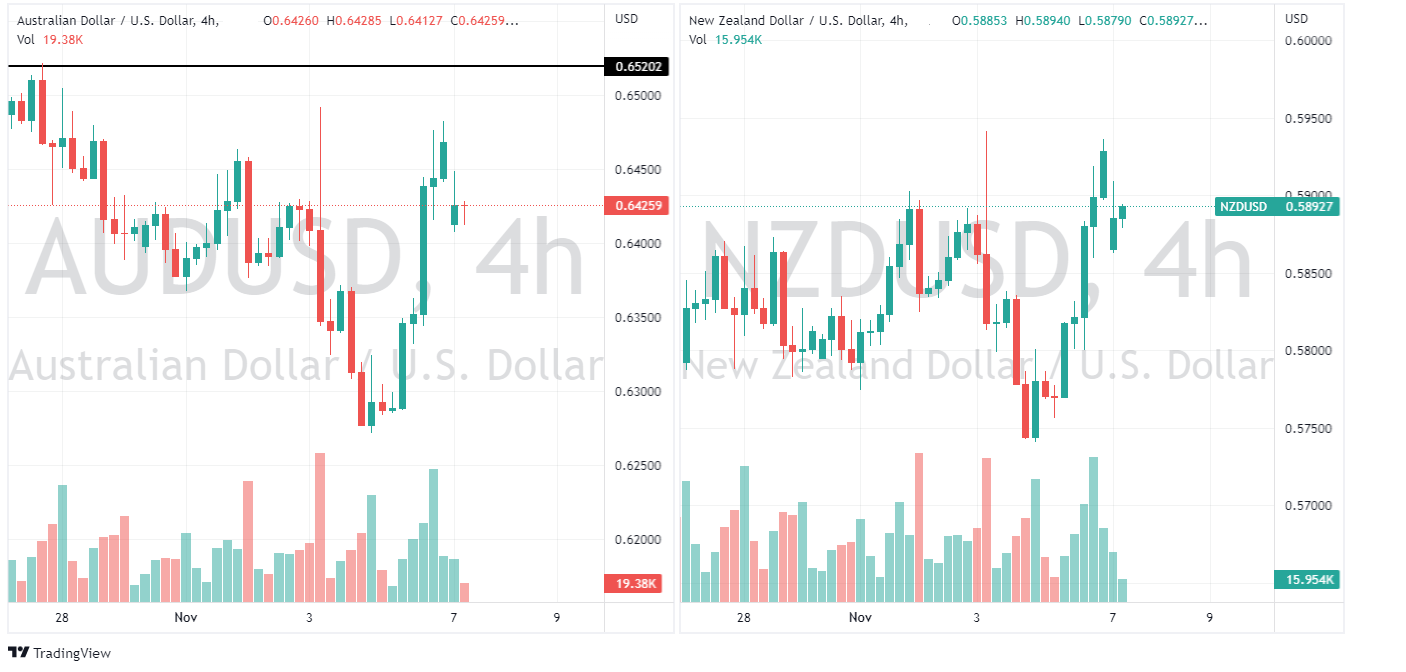

Markets pumped on what was taken initially as a dovish FOMC statement, only to dump as Fed chair Jerome Powell threw cold water on that idea during his presser, then pumped again on Friday as hopes of a China re-opening energised the markets and saw risk assets, especially Oil and Antipodean currencies, soar (Though they have given back some of it with a gap down at today’s open)

Looking ahead, the main risk event this week will be the US midterm elections held on Tuesday in the US.

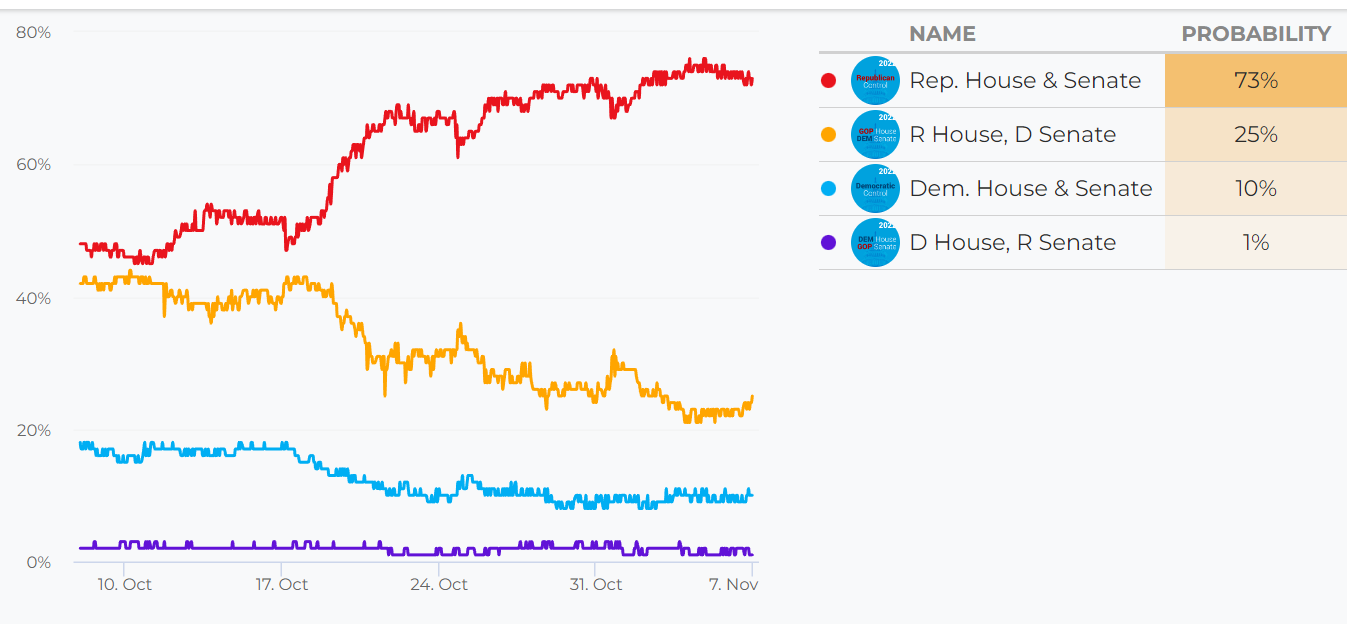

US elections, midterms included normally cause some market turbulence, but this one is set to shake things up more than usual with the backdrop of the US government and the Federal reserve currently battling decades high inflation. Currently the Predictit betting market has the Republicans red hot favourites to take both the House and the Senate, if this holds true it will effectively make Joe Biden a lame duck President with interesting ramifications for financial markets.

One big effect this will have on FX and equity markets is that if the current administration is unable to pass fiscal measures to support the market in a downturn, then the heavy lifting will have to be done by the Federal Reserve. In this scenario it is possible the Fed will have to pivot on their rate hike trajectory sooner than anticipated, as rate cuts may be needed to prop up a struggling economy, whereas before, fiscal policy could have filled that need. This would likely be negative for the USD and a positive for equity and risk markets, for the short term at least. Either way, as the results start coming in on Tuesday night EST volatility in markets is pretty much a given.

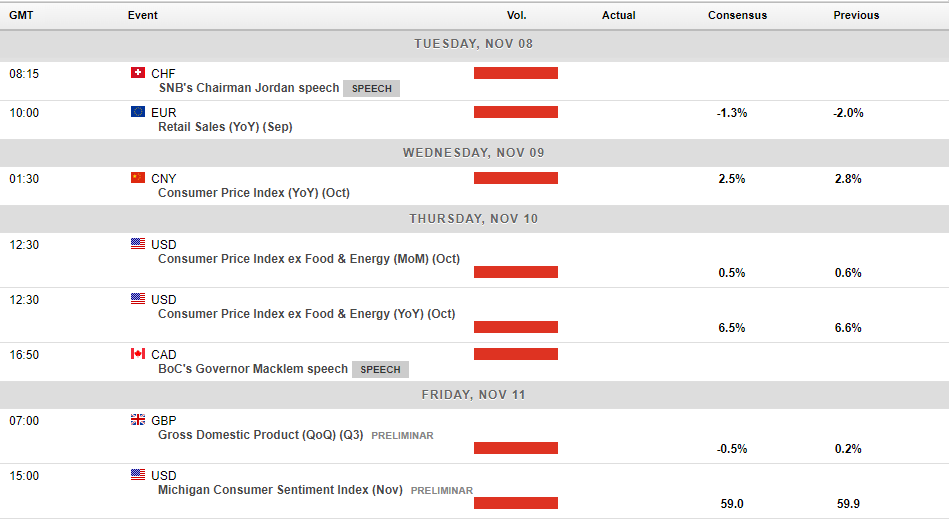

US October CPI figures will also be released this week, which may see some repricing in the markets prediction of the size of the next Fed rate hike on December 14. Though, with November CPI figures released the day before on December 13, this week’s CPI figures may have less an impact than normal.

This weeks scheduled economic announcements

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice.

Next Article

BioNTech tops Q3 expectations – the stock is up

BioNTech SE (NASDAQ:BNTX) reported its third quarter financial results on Monday. The German pharmaceutical company beat both revenue and earnings per share (EPS) estimates for the quarter, sending the stock price higher. The company reported revenue of $3.392 billion vs. $2.024 billion expected. EPS reported at $6.841 per share vs. $3.352...

Previous Article

AUDNZD falls from the top of its range

The AUDNZD pair has seen a large drop in the last few weeks and months as the Reserve Bank of Australia has brought about softer interest rate changes...