2022 was the worst year ever for Bonds so will 2023 be better?

11 January 20232022 was the worst year ever for Bonds so will 2023 be better?

Government bonds, thought as the safest investment had their worst yearly performance ever in 2022 according to analysis conducted by Edward McQuarrie professor at Santa Clara University. When referring to the performance of bonds it is specifically considering the decrease in price of long-term US government and corporate bonds. According to McQuarrie’s research Bond’s had their worst performance in 250 years.

Why the drop?

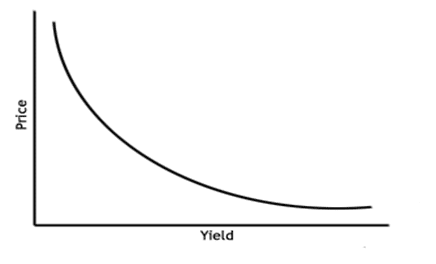

It is important to understand why bonds suffered their biggest losses. This requires an understanding of the relationship between bond prices and interest rates. As interest rates increase, bond prices fall and vice versa. This is because new bonds that get issued will be issued at higher levels of interest forcing the old bonds to have to their prices adjusted to reflect the interest rate shift. Consequently, when inflation is high and central banks need to increase interest rates, the price of bonds suffers as interest on the bonds increase. In 2022 with record high inflation sweeping most established economies, central banks were forced to aggressively raise interest rates to lower inflation levels.

Another complicating factor is that interest rates were already at such a low base to begin with due to the pandemic. After hiking the rates 7 times last year to a current rate of 4.50%. Therefore, the aggressiveness of the hikes sent bond prices plummeting and very quickly. The chart below shows the how aggressive the sell offs in bonds were.

Note that the chart is measured by its yield and there the price drop is just the inverse of the yield. The aggressiveness of the yield jump highlights how weak the bond prices were, especially compared to other years.

The question remains will 2023 be a better or worse year for bonds? Well, this once again depends upon on inflation and the economic data that comes out of the USA. With such aggressive hikes made in 2022 it is unlikely that inflation can keep on going higher and higher at the same rate. Therefore, a shift from the Federal Reserve cannot be faraway. In addition, if a recession threatens to hit the market or occurs it will further pressurise the Fed to lower rates or hikes less aggressively helping the price of bonds.

It is unlikely that Bonds will perform as poorly as they did in 2022 this year. The 0% interest rates that were being bandied around during the early stages of the pandemic are long gone and inflation has for now stabilised. With global volatility still high, bonds can still play an important role in helping build defensive portfolios and trading systems.

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice.

Next Article

Bitcoin showing early signs of another sell off?

Bitcoin had a tumultuous 2022 with the leading cryptocurrency seeing an aggressive sell off. Lead by catalyst such including the collapse of Celsius and exchange FTX, the price of the dropped 65% from 50,000 USD to $17,000. The collapse of the large players within the cryptocurrency sphere sent shockwaves as institutions and retailers pulled their ...

Previous Article

What is going on with Tesla’s share price?

What is going on with Tesla’s share price? Tesla is now one of the world’s most recognisable brands and companies. A leader in technology and pio...